Exemptions under section VI-A Look for short articles for each deduction, such as deduction under section 80C, deduction U/s 80CC, etc. "Taxes are better than taxes!" Let's provide a special article on. Now you can scroll down and check out all the discount list section VIA in more detail at a glance

At a glance deduction under chapter VI-A

In this article we provide a list of all exemptions available under the Income Tax Chapter VIA. In this article, we provide a list of all deduction according to the section covered by Chapter VIA. Now check the list of all discounts at a glance at the bottom of the table for chapter VIA

Departments are allowed the amount of the deductions as follows:

80C deduction on life insurance premium, contribution to provident fund etc.

deduction in the case of contributions to specific pension funds and individual and HUF maximum. 1,50,000

In case of contribution of fixed pension fund, 80 CC exemption is maximum for individual only. 1,50,000

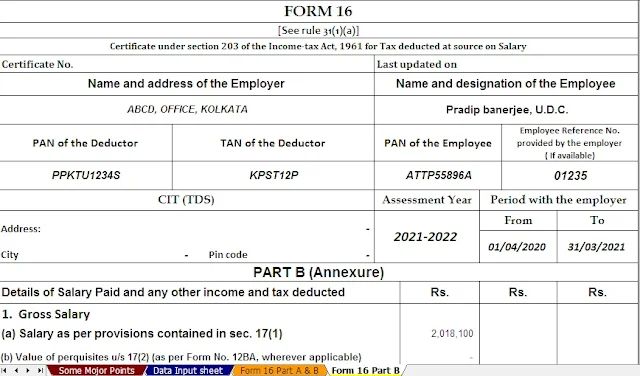

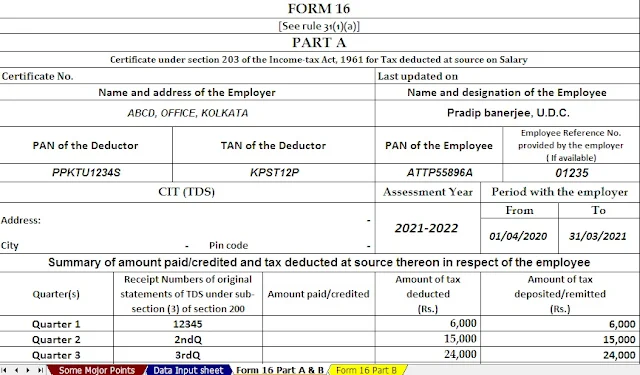

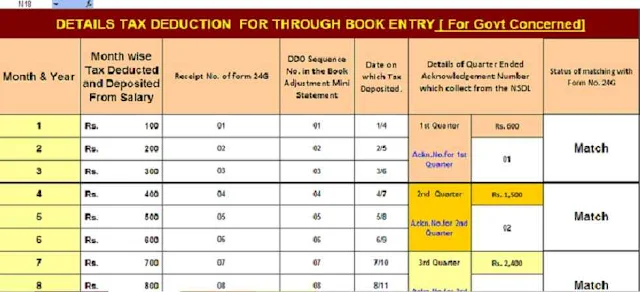

Download Automated Income

Tax Form 16 Part A&B and Part B for the F.Y.2020-21 as per new and old tax

regime U/s 115 BAC [This Excel Utility Can prepare One by

One Form 16 Part A&B and Part B]

80CCD Exemption for Contribution in case of Contribution of Central Government Salary Employee or Self-Employed Individual Employer and Employee not exceeding 10% of salary in each case Maximum Exemption for an Employee or Self-Employed Person

80 C deduction

on investment in equity savings scheme is less than 50% of the resident

investment in

80 D deduction in case of Medical Insurance Premium Individual or HUF, Resident or Non-Resident, Individual case - Maximum Rs. 25,000 for the below 60 years of age and Rs. 30,000/- above the age of 60 years.

80 DD deduction

on maintenance including treatment of a dependent person with disability of

senior citizen. Private or HUF resident in

In case of

medical treatment etc., 80 DDB deduction is the highest in

80E deduction for interest in senior citizens

Individual whether residential or not. 20,000

Actual amount paid

80EE deduction of Rs. 50,000 / - in case of interest on the loan approved in FY 2013-13

80G Exemption in case of grants to some funds, charities etc. All assessments (a) 100% or 50% of eligible grants without imposing eligibility limit in certain cases

80GG deduction in case of rent payment is only individual (b) 100% or 50% of eligible grant, after application - 10% eligibility limit of Adjusted GTI, maximum Rs.2,000 p.m.

80 TTA deduction Max Rs.10,000/- deduction in case of interest on savings account

Download Automated IncomeTax Form 16 Part B for the F.Y.2020-21 as per new and old tax regime U/s 115BAC [This Excel Utility Can prepare One by One Form 16 Part B]