How to reduce tax for F|Y2022-23 under the new budget 2021, there were several legitimate ways for

taxpayers to file tax returns under the old regime to claim tax exemption under 1919 Income Tax Act.

1961 Act.

Download Automated Income Arrears Relief Calculator U/s 89 (1) with Form 10 E for the F.Y.2020-21

Section 80C of the 1961 Income-tax Act is among the most known deductions. Only a person can claim an exemption under this section if he prefers the old/existing tax discipline in the given financial year. People who prefer the current tax exemption, on the other hand, will not be able to claim the exemption under this section.

So, you can reduce your taxable income at the bottom of the bottom.

Exemption under section 80C

This is one of the most popular discounts available under the tax law. Section 80C of the Income-tax Act, 1961 allows individuals to claim a tax benefit of Rs 1.5 lakh.

If you can disclose Rs 1.5 lakh of your annual investment, you can deduct Rs 1.5 lakh from your total taxable income.

A) Tax savings fixed deposits,

B) Public Provident Fund (PPF),

C) Certificate of National Conservation (NSC),

Salary,

D) Life insurance premiums,

E) National Pension Scheme (NPS),

F) Home loan repayment

G) EPF,

H) The Senior Citizens Savings Scheme and Sukanya Samridhi Yojana are some of the initiatives that are eligible for discounts.

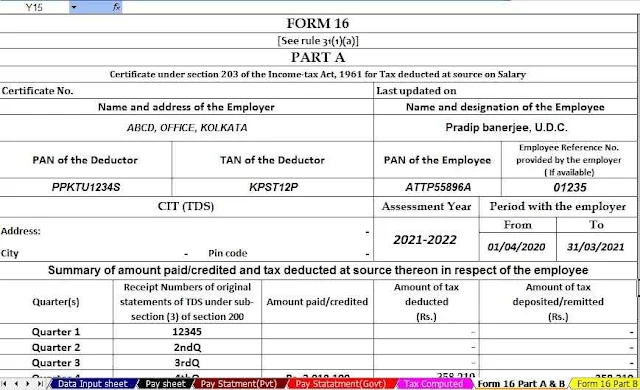

Download Automated Income Tax Form 16 Part B which can prepare One by One Form 16 Part B for the F.Y.2020-21

I) Additional Exemptions under Section 80CCD (1B) An additional Rs. 50,000 / - can be deducted for contribution to the National Pension System under Section 80CCD (1B) in addition to Rs.

J) 80C. (NPS) Individuals can invest in both equity and debt funds under this scheme, which allows them to build a retirement portfolio. At age 60, the full amount can be withdrawn.

K) Exemption under section 80E

Under this section, you can claim a tax deduction for the interest paid on a loan for yourself, your spouse, legal guardian for you or any of your students.

There is no limit to the amount of discount that can be claimed in a given year. The loan that you have started repaying and lasts for the next seven years or until full interest is paid, whichever comes first, you can get the discount.

In addition, this tax deduction is only possible if the loan is borrowed by an approved financial institution instead of a family member or friend.

L) Exemption under section 80D

An individual or HUF can claim a discount of Rs 25,000 for the medical insurance premium paid in a calendar year. Health insurance premiums paid for you, your spouse, your children and your parents may be exempt. Keep in mind that if your parents are not senior citizens, you can take an additional discount of up to Rs 25,000 for their insurance. (Over 60 years)

The amount of exemption is extended to Rs. 50,000 if the parents are more than 100 years of age. The total exemption for both taxpayers and parents above the age of 60 years is Rs.1,00,000 1, in addition, Section 80 (d) allows a rebate of Rs.5000 for preventive check-ups conducted on taxpayers, spouses, minors and parents in subsequent years. You can see some sections such as Section 80 (DD), Section 80 (DDB) and Section 80 (U) for additional discounts.

M) Exemption under section 24(B)

If you have an existing home loan, you can claim interest payable as a tax deduction under Section 24 of the Income Tax Act. As a deduction, it can be claimed that the total amount is Rs 2 lakh per annum.

N) Apart from this, under Section 80 (EE) of the IT Act, you can claim an additional rebate of Rs 50,000 in addition to Rs 200,000.

There are certain requirements that must be met in order to deduct this additional discount. If the property is leased, and you do not own it, there is no ceiling above and you can deduct the full interest rate as a tax break.

O) The home stamp duty value of the house must be less than Rs 45 lakh to be eligible for this discount. Also, home loans must be issued between April 1-2019 and March 31, 2020.

Download Automated Income Tax 50 Employees Form 16 Part B for the F.Y.2020-21

P) Exemption against interest earned on savings accounts

An individual or HUF can claim a total rebate of Rs 10,000 for interest income from a savings account of a bank, co-operative society or post office.

To be clear, under the 80TTTA of the Income Tax Act, interest on savings accounts is tax-free up to Rs 10,000 per annum.

Q) And Section 80 (TTB), which enables senior citizens to claim a rebate of up to Rs 50,000 from interest income. Discounts against grants You can also contribute or donate to charities to increase your tax benefits.

R) 80G- The various contributions listed under 80 (g) of the Tax Code are 100% or 50 liable for the operation. Individuals must be aware, however, that cash contributions above Rs 2,000 are not liable for tax deductions. As a result, contributions through digital forms are more effective as they will be liable for tax deduction under section 80. (G)

S) 80GG- Exemption under Section 80GG You can claim this Exemption if you do not receive Home Rent Allowance (HRA) as part of your salary or if you are self-employed. You will need to fill out Form 10BA to take advantage of this discount. This clause enables you to claim a deduction of up to Rs 60,000.