A permanent Account Number (PAN) is a 10-digit alphanumeric number provided by the Income Tax Department to any "person" who are wanting for it or department assigns a number without an application.

A PAN helps to link all transactions of "individuals" to the department. These transactions include filing of income tax returns, payment of taxes, TDS / TCS, correspondence, etc. It has been noticed that the Income Tax Department has been inactivating all income tax assessment panes with more than one pan at any time in the past.

PAN card de-activation can, unfortunately, cause some obstacles. As the Income Tax Department deactivates the PAN which it uses for the purpose of filing its income tax return, the assessment will no longer be able to file its return.

PAN blocks e-filing login once deactivated by the Income Tax Department and therefore will not be able to respond electronically to the online communication/information/notices by the Income Tax Department.

The steps you can take if your PAN is disabled by the Income Tax Department are as follows:

If your PAN is activated by the department, you need to contact your AO by letter in order to activate your PAN.

You may also, like-

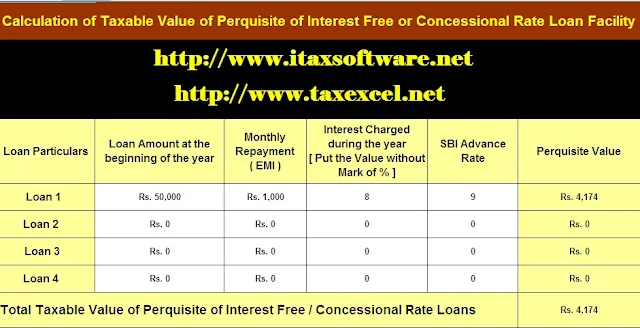

Automated All in One Value of Perquisite U/s 17(1) in Excel

Submission of relevant documents in AO

After the letter indicates the activation of your PAN, you will need to attach relevant documents related to PAN activation. The following documents are attached

Copy of PAN card which the assessment uses to file regular income tax returns

2. A copy of ITRV is a copy of the PAN filed with the Income Tax Department for the last three years

3. Compensation bond on behalf of the Income Tax Department. An indemnity bond acts as a security bond to ensure that the contract will be fulfilled.

Deadline to reactivate the pan by category

The time is taken by the Income Tax Department to reactivate the PAN after sending a letter to the office is about 15 working days.

Response to the department's online information/correspondence if the e-login is blocked:

Where the re-login has been blocked and the assessment has to be held accountable for the online information/correspondence executed by the Income-tax department, the jurisdiction under which the jurisdiction is to be approached and its concerns addressed and the need to re-apply for a PAN card.

You may also, like- Automated Income Tax House Rent Exemption Calculator U/s 10(13A)

In addition, the assessment department may submit a manual against the investigation/correspondence until the PAN reactivation process. File Note that once the PAN reactivates, the evaluation obligation to respond online and account for the department's investigation is effective and must be met.

Penalty for keeping multiple pans

One person cannot hold more than one PAN card at a time. If you have more than one PAN card at any one time, you will have to hand over the extra PAN. Holding more than one PAN card at a time is a legal offence and the Income Tax Department can issue laws, so it can be penalized.

According to Section 2227B of the Income Tax Act, 19191, a person may be asked to pay a fine of Rs. 4,000 / -. 10000 / -if Multiple PAN registered in the name of one person.

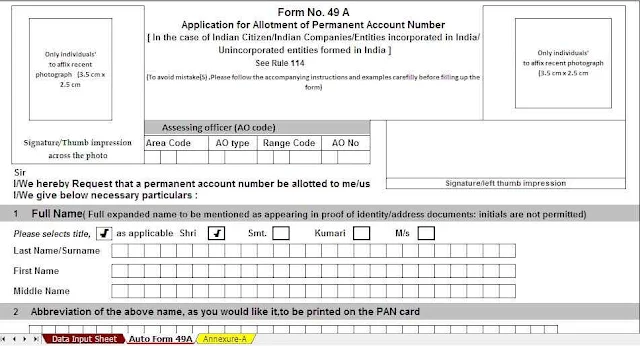

Download Automated Excel Based New Pan Card Application Form 49 A in Revised Format