Salary Arrears Relief Calculator

U/s 89(1) with Form 10E. Have you received any advance salary or arrears of

salary? If so, you may be concerned about its tariff provisions. Do I have to

pay tax on the total amount? What about the previous year's tax calculations?

Taxpayers have this kind of question in mind, here’s what you need to know

By this time, you have already realized that income tax is calculated on the taxpayer's total income for a given year. Income can be in the form of either salary or family pension or other sources of income.

However, there may be situations where you have received arrears of family pension or arrears of salary in the current financial year. It can happen that an income taxpayer receives a portion of his profit or salary in arrears in advance or in any financial year, which increases his total income which in turn increases the tax payable.

In such cases, an application can be made and the Assessing Officer may grant relief to the taxpayer. In summary, income tax law ensures that there is equality in the income tax slab rate, and thus, when a portion of the income received is not related to the current year, relief is provided so as not to increase the amount of taxable income.

You may also, like- Automatic Income TaxRevised Form 16 Part B for the F.Y.2020-21 which can prepare at a time of 50Employees Form 16 Part B)

To ensure that you are not burdened with paying additional duties, the Income Tax Department provides Relief U / S 89 (1). If you receive a pension or payment for the previous year, you will not be charged the total amount for the current year. Basically keep you away from paying extra taxes, because there was a delay in paying.

You must submit Form 10E to receive benefits under Section 89 (1). What would be the most obvious question in Form 10E?

Details of Form 10E with details on how and why to submit are provided below.

What is relief under Section 89 (1)?

When the taxpayer receives:

1. arrears of salary or

2. Advance pay or

3. Family pension arrears

Then such amount is taxable out of the amount received.

However, relief is provided undSalary Arrears Relief Calculator U/s 89(1) with Form 10E. Have you received any advance salary or arrears of salary? If so, you may be concerned about its tariff provisions. Do I have to pay tax on the total amount? What about the previous year's tax calculations? Taxpayers have this kind of question in mind, here’s what you need to know

By this time, you have already realized that income tax is calculated on the taxpayer's total income for a given year. Income can be in the form of either salary or family pension or other sources of income.

However, there may be situations where you have received arrears of family pension or arrears of salary in the current financial year. It can happen that an income taxpayer receives a portion of his profit or salary in arrears in advance or in any financial year, which increases his total income which in turn increases the tax payable.

In such cases, an application can be made and the Assessing Officer may grant relief to the taxpayer. In summary, income tax law ensures that there is equality in the income tax slab rate, and thus, when a portion of the income received is not related to the current year, relief is provided so as not to increase the amount of taxable income.

To ensure that you are not burdened with paying additional duties, the Income Tax Department provides Relief U / S 89 (1). If you receive a pension or payment for the previous year, you will not be charged the total amount for the current year. Basically keep you away from paying extra taxes, because there was a delay in paying.

You may also, like- Automatic Income Tax RevisedForm 16 Part B for the F.Y.2020-21 which can prepare at a time 100 EmployeesForm 16 Part B)

You must submit Form 10E to receive benefits under Section 89 (1). What would be the most obvious question in Form 10E? Details of Form 10E with details on how and why to submit are provided below.

What is relief under Article 89 (1)?

When the taxpayer receives:

1. arrears of salary or

2. Advance pay or salary Arrears Relief Calculator U/s 89(1) with Form 10E. Have you received any advance salary or arrears of salary? If so, you may be concerned about its tariff provisions. Do I have to pay tax on the total amount? What about the previous year's tax calculations? Taxpayers have this kind of question in mind, here’s what you need to know

By this time, you have already realized that income tax is calculated on the taxpayer's total income for a given year. Income can be in the form of either salary or family pension or other sources of income.

However, there may be situations where you have received arrears of family pension or arrears of salary in the current financial year. It can happen that an income taxpayer receives a portion of his profit or salary in arrears in advance or in any financial year, which increases his total income which in turn increases the tax payable.

In such cases, an application can be made and the Assessing Officer may grant relief to the taxpayer. In summary, income tax law ensures that there is equality in the income tax slab rate, and thus, when a portion of the income received is not related to the current year, relief is provided so as not to increase the amount of taxable income.

To ensure that you are not burdened with paying additional duties, the Income Tax Department provides Relief U / S 89 (1). If you receive a pension or payment for the previous year, you will not be charged the total amount for the current year. Basically keep you away from paying extra taxes, because there was a delay in paying.

You may also, like- Automatic Income Tax Revised Form 16 Part A&B for the F.Y.2020-21 which can prepare at a time 100 Employees Form 16 Part A&B)

You must submit Form 10E to receive benefits under Section 89 (1). What would be the most obvious question in Form 10E? Details of Form 10E with details on how and why to submit are provided below.

What is relief under Section 89 (1)?

When the taxpayer receives:

1. arrears of salary or

2. Advance pay or

3. Family pension arrears

Then such amount is taxable out of the amount received.

However, relief is provided, and salary Arrears Relief Calculator U/s 89(1) with Form 10E. Have you received any advance salary or arrears of salary? If so, you may be

concerned about its tariff provisions. Do I have to pay tax on the total amount? What about the previous year's tax calculations? Taxpayers have this kind of question in mind, here’s what you need to know

By this time, you have already realized that income tax is calculated on the taxpayer's total income for a given year. Income can be in the form of either salary or family pension or other sources of income.

You may also, like- Automatic Income Tax Revised Form 16 Part A&B for the F.Y.2020-21 which can prepare at a time 50 Employees Form 16 Part A&B)

However, there may be situations where you have received arrears of family pension or arrears of salary in the current financial year. It can happen that an income taxpayer receives a portion of his profit or salary in arrears in advance or in any financial year, which increases his total income which in turn increases the tax payable.

In such cases, an application can be made and the Assessing Officer may grant relief to the taxpayer. In summary, income tax law ensures that there is equality in the income tax slab rate, and thus, when a portion of the income received is not related to the current year, relief is provided so as not to increase the amount of taxable income.

To ensure that you are not burdened with paying additional duties, the Income Tax Department provides Relief U / S 89 (1). If you receive a pension or payment for the previous year, you will not be charged the total amount for the current year. Basically keep you away from paying extra taxes, because there was a delay in paying.

You must submit Form 10E to receive benefits under Section 89 (1). What would be the most obvious question in Form 10E? Details of Form 10E with details on how and why to submit are provided below.

What is relief under Article 89 (1)?

Then such amount is taxable

section 89 (1) to reduce the additional tax burden due to delays in receiving such income.

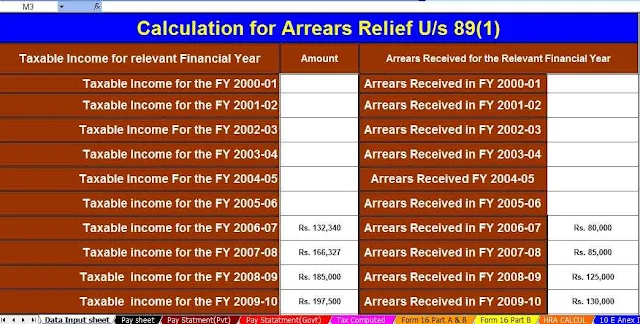

How to calculate relief under section 89 (1)?

The steps for calculating relief under section 89 (1) of the Income-tax Act, 1961 are as follows:

1. Calculate the tax payable on the total income including the arrears in the year received.

2. Calculate the tax payable on total income excluding arrears in the year received.

3. Calculate the difference between (1) and (2).

4. Calculate the tax payable on the total income of the year related to the arrears-salary including arrears.

5. Calculate the tax payable on the total income of the year by deducting the arrears

6. Calculate the difference between (4) and (5).

Relief. The amount of relief is the excess amount (3) over (6). If the amount of ()) is more than (3) no relief will be allowed.

In order to claim relief under Section 89 (1) of the Arrears Arrested, it is mandatory to file Form 10E with the Income Tax Department. If Form 10E is not filed and relief is claimed, the taxpayer will receive a notice from the Income Tax Department for not filing Form 10E.

When do I need to submit Form 10E?

Form 10E must be submitted before filing the income tax return.