Salary arrears of the previous financial year's received from an employer or concerned enhance your taxes and are reflected in the year of receipt. To less the extra burden, you can reduce your tax burden by U/s 89(1) as per the Income Tax Act.

An employee must meet certain

conditions in order to claim relief under this section. To begin with, Section

89(1) can be claimed in any of the following years in a given year:

Salary arrears or advance receipt

Premature withdrawal from ProvidentFund

gratuity

Pension The modified value of the

pension

Family arrears of family pension

Compensation for termination of

employment

Relief Claim under Section 89(1)

An employee is eligible to claim

relief under section 89(1) and must submit Form 10E. It has to be submitted

online in the e-filing portal of the Income Tax Department.

Note: Form 10E must be submitted

before filing an income tax return.

Features of Form 10E:

Form 10E includes details of an

employee's total income and arrears received.

10 10E Forms are easy to submit and

are fully digital, available on the Income Tax Department e-portal. One must

visit the portal and login to your account or create an account if you are a

new user

You may also, like-

Automated Income Tax Preparation Excel Based Software for the Non-Govt(Private)Employees for the F.Y.2021-22

in the Income Tax Form 10 E Fill out the form carefully and be aware of

the add-ons provided when filling out the form.

You must select the relevant

attachment and fill it out (paragraph I for arrears, paragraph

2 for gratuity, and paragraph III

for post-employment compensation).

Obligation to claim relief under 89

- When claiming relief under 89 online, your pay slips serve as proof of

receipt of arrears.

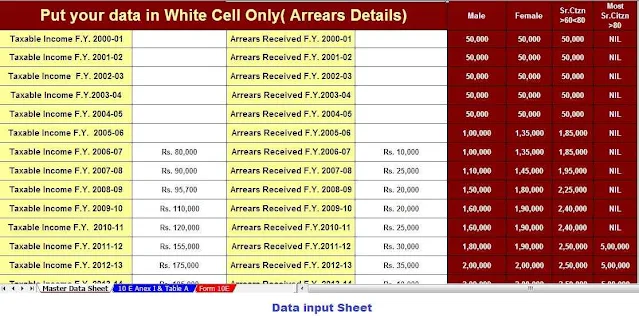

How is 89 / relief calculated?

1) Calculate the tax payable on

total income, including excess income, arrears or compensation, in the year it

is received.

2) Calculate the tax payable on the

total income, excluding any additional salary, in the year in which it is

received.

3) Subtract the calculation from

step 2 from the calculation of total salary from step 1.

4) Calculate the tax payable on the

total income excluding the arrears, the year which is related to the arrears.

5) Calculate the tax payable on the

total income including the arrears, the year relating to the arrears.

6) calculate the minus between step

4 and step 5.

An additional amount of step-over

on step-at is a tax deduction that will be granted to you, while no relief will

be allowed if the amount of step-in exceeds the amount of step-in.

Things to keep in mind when

claiming relief in arrears:

Form 10E must be submitted online.

Taxpayers who claimed relief in the last financial year but did not submit Form

10E will receive a notice of non-compliance from the Income Tax Department, but

your return process will not be compleated until form 10 E is submitted.

Usually, the salary is usually taxable

when it is due or when it is received, but in case of arrears, they are usually

declared from a later date, due to which when their arrears cannot be paid.

IT Submit Form 10E before filing

your ITR. When it comes to choosing the year of arrears assessment, you must

choose the year of assessment where the arrears were received. For example, if

arrears are found in F.Y 2021-22, the assessment year would be A.Y 2022-23.

However, you must submit and keep

all documents in your archive.

Your employer may ask you to confirm the submission of Form 10E, but the employer is not required to submit this form.