Rates

of old and new tax regimes for A.Y 2022-23, Comparison of rates of old and new

tax systems for A.Y 2022-23

The

new income tax slab rates introduced in Budget 2020 after AY 2021-22 are

reserved for taxpayers, where they are free to choose from the old regime's tax

slab (F.Y 2021-22). The new tax slab has been made common for taxpayers of all

ages to reduce the income tax rate to Rs 15,00,000. But, it denies 70 tax

exemptions and deductions that are available as relief with the old regime tax

rates.

The new tax system and the old tax system have the following income tax rates: -

|

Income tax rate slabs (Rs) |

Old Regime |

New Regime |

Surcharge |

|

Up to 2.50 lakh |

nil |

nil |

Nil |

|

2.50 lakh to 5.00 lakh |

5% |

5% |

Nil |

|

5.00 lakh to 7.50 lakh |

20% |

10% |

Nil |

|

7.50 lakh to 10.00 lakh |

20% |

15% |

Nil |

|

10.00 lakh to 12.50 lakh |

30% |

20% |

Nil |

|

12.50 lakh to 15.00 lakh |

30% |

25% |

Nil |

|

15.00 lakh to 50.00 lakh |

30% |

30% |

Nil |

|

50.00 lakh to 1.00 Cr |

30% |

30% |

10% |

|

1.00 Cr to 2.00 Cr |

30% |

30% |

15% |

|

2.00 Cr to 5.00 Cr |

30% |

30% |

25% |

|

5.00 Cr & above |

30% |

30% |

37% |

You may also, like- Automated Income Tax Preparation Excel Based Software for the West Bengal Govt Employees for the F.Y.2021-22[This

Excel Utility can prepare at a time your Tax Computed Sheet as per Budget 2021

+ Individual Salary Structure as per the W.B.Govt Employee’s Salary Pattern +

Automated Income Tax H.R.A. Exemption Calculation + Automated Income Tax Form

16 Part A&B and Form 16 Part B]

4%

Health and Education Benefit is applicable on all the above taxes

Money

discount 12,500 u / s 87A is applicable for the tax slab of both old and new

regimes, Rs. 5.00 lakhs.

Below additional surcharges are imposed on the very rich with the following income:

To

show how the new tax slab rates can reduce your tax liability, we present the comparative study below, if you are prepared to avoid the authorized deductions

of the old tax system:

When

choosing a new tax slab: -

Option

to use ITR for F.Y 2021-2022 (A.Y 2022-2023) on or before 31st July 2022

Business people / HUFs who do not have business income can choose between old and new

rule tax slabs every year.

Business

Those who have a business income, they get a chance to choose their

options. Once done, they have to follow the rules every year unless they stop

this source of income.

Note:

- General tax deduction for salaried taxpayers approved at the old tax slab

rate (removed to the new tax system)

You may also, like- Automated Income Tax Preparation Excel Based Software for the Assam State Govt Employees for the F.Y.2021-22[This

Excel Utility can prepare at a time your Tax Computed Sheet as per Budget 2021

+ Individual Salary Structure as per the Assam State Govt Employee’s Salary

Pattern + Automated Income Tax H.R.A. Exemption Calculation + Automated Income

Tax Form 16 Part A&B and Form 16 Part B]

The

new tax slab denies 70 tax exemptions and deductions, e.g.

Travel

Discount, tax-free once claimed in two-year block

Standard

Deduction 50000 / -

•

Depending on the house rent allowance (HRA), salary structure and payment of

rent

Housing

interest on the loan (Section 24) Rs 3.5 lakh for affordable housing, Rs 2 lakh

for others

CC

80CCD (2) Reducing employer contribution to NPS of RS 50000 / -

Chapter

VI-A 80C, 80CCC, 80CCD, RS 150,000 / -

80D, RS 25000 / - (Rs. 50,000 for parents and senior citizens)

80 TTA reduction (Savings Bank interest: Rs. 10,000)

•

80 TTB Interest Income (for Senior Citizens): Rs. 50,000

•

80 E deduction (pay interest for eight consecutive years)

80 DD deduction: (Rs. 75,000 to Rs. 1.25 lakhs depending on disability)

80 DDB discount: Rs. 40,000 (Rs. 1 lakh for senior citizens)

80EE,

80EEA, 80EEB,

80G (50-100%) reduction of donated money

80GG, 80GGA, 80GGC, 80IA, 80IAB, 80IAC, 80IB, 80IBA,

MPs

/ MLAs, and other allowances that used the tax slab of the old regime.

New

Section 80JJAA approved for new employees.

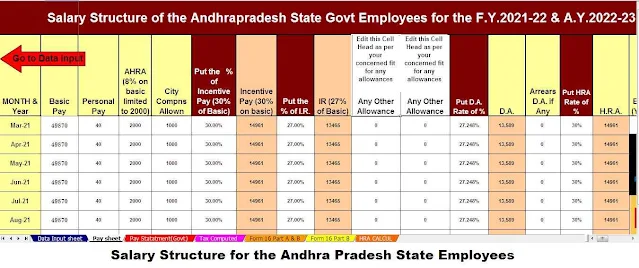

You may also, like- Automated Income Tax Preparation Excel Based Software for the Andhra Pradesh State GovtEmployees for the F.Y.2021-22[This Excel Utility can prepare at a time your Tax Computed Sheet as per Budget 2021 + Individual Salary Structure as per the Andhra Pradesh State Govt Employee’s Salary Pattern + Automated Income Tax H.R.A. Exemption Calculation + Automated Income Tax Form 16 Part A&B and Form 16 Part B]

We

offer simple schemes so that you can switch between old and new tax slab rates

when you want to invest for a tax deduction:

1.

Taxpayers earn up to Rs. 5 lakhs, fall

under the exemption of INR 12,500 available under Section 87A and have zero tax

liability. So, they are not coming under any available tax exemption.

2.

For income up to Rs. 7.5 lakhs, if your

investment amount of INR 1,25,000 or more is eligible for a tax deduction, opt

for the old tax regime. But, if your investment is less than that, go for a new

tax regime.

|

Particulars |

Old Regime (In INR) |

New Regime (In INR) |

|

Taxable Income |

7,50,000 |

7,50,000 |

|

Less Deduction Amount |

(1,25,000) |

- |

|

Taxable Amount |

6,25,000 |

7,50,000 |

|

Tax Calculation |

(@20%) 37,500 |

(@10%)37,500 |

Note:

The calculation is shown by subtracting the amount of CESS.

|

Particulars |

Old Regime (In INR) |

New Regime (In INR) |

|

Taxable Income |

10,00,000 |

10,00,000 |

|

Less Deduction Amount |

(1,87,500) |

- |

|

Taxable Amount |

8,12,500 |

10,00,000 |

|

Tax Calculation |

(@20%) 75,000 |

(@15%) 75,000 |

3.

If your income is up to Rs. 10 lacks, or if your investment amount of

Rs.1,87,500 or large is entitled to a tax exemption, choose Old Tax

Regime. But, if your investment is less than

that, go for a new tax regime.

Note:

The calculation is shown by subtracting the CESS amount.

4.

For an income of Rs. 12.5 lakhs, if your

investment amount is eligible for a tax deduction of Rs. 2,10,000 or more, opt for the old tax regime.

But, if your investment is less than that, go for a new tax regime.

For

an income of Rs. 15 lakhs, if the amount of your investment is eligible for a

tax deduction of Rs. 2,50,000 or more,

opt for the old tax regime. But, if your investment is less than that, go for a

new tax regime. Income above Rs. 15

lakhs is taxable at both tax slab rates of 30% and can be changed depending on

your investment plan.

Main feature of this Excel Utility-

#This Excel

Utility can prepare at a time your Tax Computed Sheet as per Budget 2021

# Individual

Salary Structure as per the Govt & Non-Govt Employee’s Salary Pattern

# Automated

Income Tax H.R.A. Exemption Calculation U/s 10(13A)

# Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E For the

F.Y.2021-22

# Automated

Income Tax Form 16 Part A&B and Form 16 Part B]