Automatic Income Tax Preparation Software in Excel All in One for the F.Y.2021-22.It is known that

the House Rent Allowances is not treated as the salary income As per the Income Tax Act,

For most employees, the house rent allowance (HRA) is part of their salary income. However, some small, and medium-sized companies can pay employees a single amount without any break-up. For a hired employee to claim a deduction, the HRA should be part of his or her salary income. However, In the Income Tax Act, 1961 needed exemption against the rent paid to employees, Indeed if the House Rent Allowances is not a Salary Income. Such employees may claim a rebate against the house rent paid under Section 80GG of the Income-tax Act. The rules also apply to self-employed individuals. Now make out the eligibility of amount and conditions under which anyone can claim tax exemption under section 80GG.

You may also, like- Automatic House Rent Exemption Calculator U/s 10(13A)

Terms & Conditions

To claim deduction under section 80GG, you should not have received HRA in any part of the financial year. "Both exemption H.R.A. U/s 10(13A) and U/s 80 GG can not claim HRA, who are not get HRA from their employer, they can claim U/s 80 GG. They can not be entitled as well as claim the HRA Exemption U/s 10(13A)

Under section 80GG, a person claiming deduction should not own any home in the city of residence. In fact, there should be no house in the name of wife, minor child or Hindu Undivided Family (HUF) in which the person is a member, in which town the office is located or business is conducted. So, if you have a family home in your town where you work, you cannot claim this discount.

The taxpayer must submit 10 BA forms; Only then can he claim this discount. It is a declaration made by the person that all the conditions of the section have been fulfilled.

The taxpayer who has chosen the alternative, or the new tax system, cannot claim this exemption.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Non-Government (Private) Employees for the F.Y.2021-22 and A.Y.2022-23

This is how it is calculated

The deduction has to be calculated on the basis of a formula. The amount cut under this section shall be less than three:

(a) rent paid in over 10% of the total income,

(b) 25% of the total income,

(c) a maximum of Rs. 5,000 per month.

However, the maximum deduction or exemption allowed in a year is Rs 60,000/- After claiming all deductions from the total income of the taxpayer, the total income has to be considered for the purpose of calculation.

So, for example, if a person's total income is Rs 15 lakh for one year and the person claims to deduct about Rs 2 lakh under various other sections including 80C, then Rs 13 lakh will be considered as total income. Thus, if a person pays a rent of Rs.325,000 Therefore, the minimum amount is Rs.60,000 which an individual can claim under section 80GG.

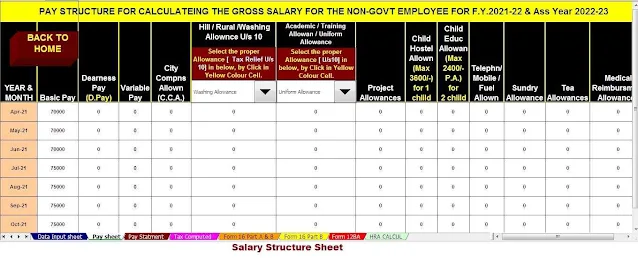

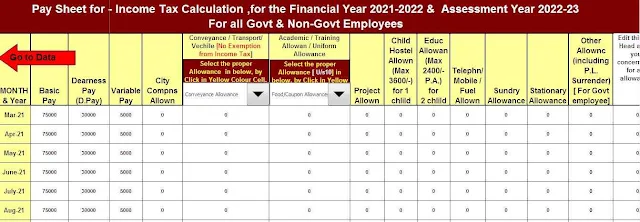

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

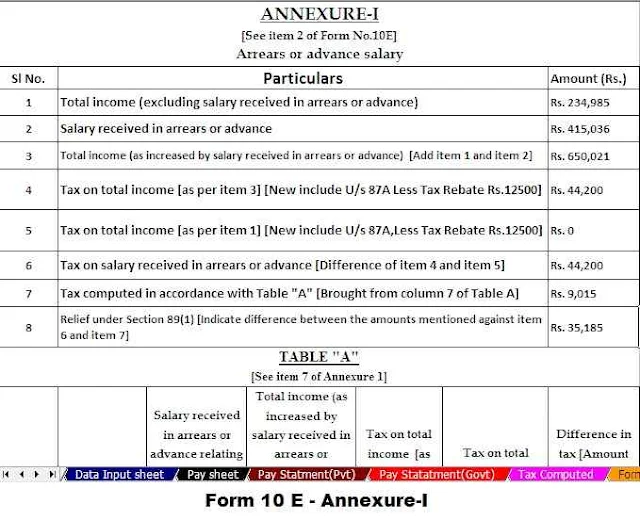

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01

to F.Y.2021-22 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2021-22