Deduction under Chapter VI of the Income Tax Act. Do you have to pay income tax? Well, if you earn

more than INR

2,50,000 per financial year and are a resident of

Fortunately, tax laws in the country do not work that way. Although you are eligible to pay taxes, there

are many other calculations that can help you avoid paying any taxes legally.

Chapter VI-A of the Income-tax Act has the different sub-sections under section 80 which allow a deductor to claim a deduction from the total income and reduce tax payable amount.

Established tax slabs help you reach the total financial year that you may have to pay in a fiscal year. But before you start calculating your taxes, it is important to know the final income that is calculated as income tax. And it’s not the same amount you earn.

Deductions allowed under income tax law help you reduce your taxable income. You can get these discounts only if you have made a tax-saving investment or made a reasonable expense. There are many discounts available under different categories which will reduce your taxable income. One of the most popular is Section 80C of the VIA. Other preferred cuts under Chapter VIA are 80D, 80E, 80G, 80DDB etc. In this article, let’s discuss some important deductions under VIA that a taxpayer can claim

Given below the Sub-Sections under Chapter VI-A as per the Income Tax Act

80C, 80CCD(1),80CCD(1B), 80CCD(2) and 80 CCC and maximum limit of Rs. 1.50 Lakh.

80CCC: Contribution to the employee's pension fund. With Section 80C and Section 80CCD (1), the exemption limit is Rs 1.5 lakh.

80CCD (1): Exemption to the contribution to Central Government Pension Scheme - In the case of an employee, 14% of salary (Basic + DA) maximum limit is Rs 1.5 lakh.

80CCD (1B): In additional amount Rs.50,000/- can be availed against new pension fund except deduction of U/s 80 C limit Rs.1.5 Lakh.

80CCD (2): 14% Employers

Contribution to the

80D: For medical insurance Premium for below 60 Years Rs. twenty-five thousand and above 60 Years Rs. Fifty Thousand

80E: For higher education and there has no limit for deduction as an educational Loan interest.

80EE: Deduction in case of interest paid up to Rupees fifty thousand on loan taken for residential house property.

80EEA: Deduction can be allowed Rs.1.5 Lakh for the Newly Constructed Building loan interest. additional deduction U.s 24(B)

80G: Donations to specific charitable funds, 100% or 50 % as per slab by the CBDT.

80GG: Those who do not get House Rent from their employer, can get House Rent Exemption @ Rs. 5000/- p.m. or Rs. 60, 000/- Per annum.

80TTA: Deduction up to Ten Thousand in case of interest on Savings Bank Account in case of Assessors other than Resident Senior Citizen.

80TTB: Deduction in interest on deposits up to Fifty Thousand in the case of resident senior citizens.

80U: For physically disable person can get Rs. 75,000/- Discount and for senior citizens above 60 years of age Rs.1,25,000/-

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

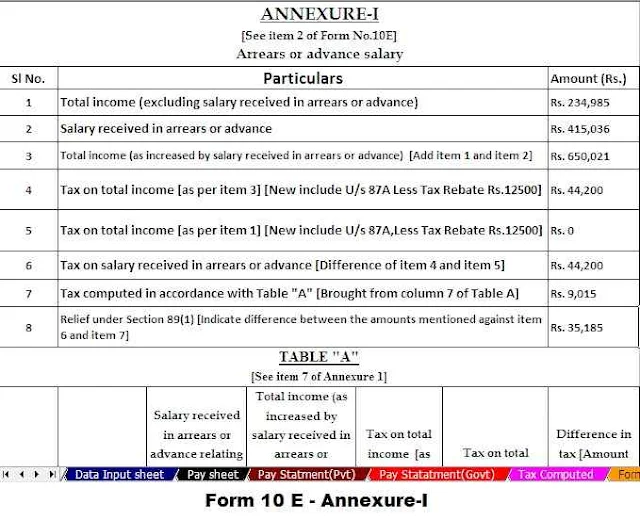

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated

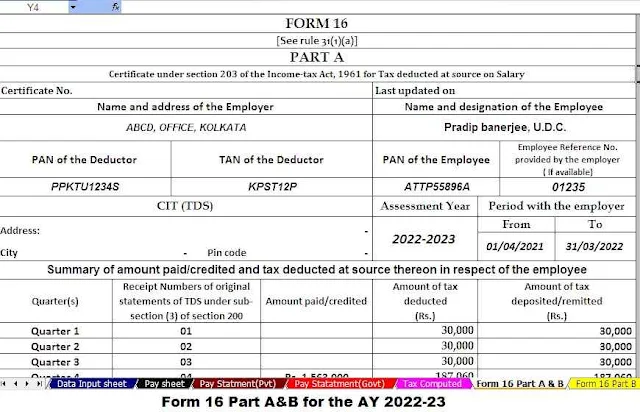

Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2021-22