Provision and explanation of Section 115 BAC and Options Form 10-IE. In this article, we will mainly understand Article 115BAC and Form 10-IE. Finance Budget, 2020 introduces a new tax regime. The F.M. has declared a new tax slab for individuals, HUFs.

However, the Government has proposed two sections for the new tax slab:

115BAC: Section has modified the tax slab for individual and HUF income

This Section 115BAC: New tax rate on income of cooperative society.

In this article, we will discuss Sec 115BAC. These sections are implemented from. F.Y 2020-21.

Some key points in this section: -

Provision and explanation of Section 115 BAC and Options Form 10-IE. The new tax system continues from A.Y. after 2021-22.

The new income tax method implements to each and every person as per their age, meaning the tax slab also applies to senior citizens and super senior citizens.

The new tax system is in place.

The discount is available for those whose total income is less than 5 lakh rupees.

The exemption is not allowed when choosing a new tax regime: -

Standard deductions for salaried taxpayers;

Discount Travel Allowance (LTA);

• House Rent Allowance (HRA);

Children's education allowance;

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Andhra Pradesh State Employees for the F.Y.2021-22

Other special allowances [Article 10 (14)];

Family Depreciation from family pension income;

Interest on housing loan in self-occupied property or vacant property (Article 24);

Chapter VI-A deductions;

Other Discounts or discounts for any other grant or allowance;

Carried forward without any loss or uncovered devaluation of the previous year;

32 Not permitted except in section (iia) of sub-section (1);

Deduction for SEZ u / s 10AA;

Reduction between 32 32AD, 33AB, 33ABA, 35, 35AD, 35CCC;

You are not entitled In the case of self-occupied property deduction U/s 24 B,

If you choose the new tax regime some Deductions are allowed as given below

Deduction under CC 80CCD (2) (employer's contribution to your pension account);

J 80JJAA (Additional Staff Cost)

Transport allowance (Dibang) for various eligible employees;

Transport allowance for government duties;

Any allowance for travel/travel/transfer costs;

The daily allowance is given to employees under certain conditions.

you can change your option and back to your suitable tax regime :

Personal business income: - People who have business income have the option of moving to a new regime once in a lifetime. If any person chooses a new tax system and after that is willing to revert to the old system, such a person cannot choose a new tax slab without having any business income.

Who are salaried person and has no business income: - A person who has only salary income other than personal income can choose an option to choose within the old tax regime and the new tax regime every year,

You may also, like- AutomatedIncome Tax Preparation Excel Based Software All in One for the Jharkhand StateEmployees for the F.Y.2021-22

It is mandatory of the Taxpayers give 'Form 10-IE' electronically from the Income Tax e-filing portal. You can submit the form under digital signature or through Electronic Verification Code (EVC).

Last date for submission of Form 10IE

If you have any business income: then submit of IRR Before the due date.

Form 10IE Submission Frequency: -

A person who is salaried and has no business income: - Every year, he has the option to file a 10IE form every year.

Form 10-IE Content: -

Given below are the common details required for the newly introduced Form 10IE:

Person Name / HUF

Confirmation of whether there is any income or profit from the person or business and profession under the HUF.

• PAN number

• Address

Date of birth/date of inclusion

Type of Business / Occupation (Mandatory in case of business income)

Confirmation in 'Yes / No' of

whether the taxpayer referred to in sub-section (1A) of LA 80LA has any unit in

IFSC (

Details of any previous Form 10IE filed.

• Announcement

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has all amended Income Tax Section as per Budget 2020

3)

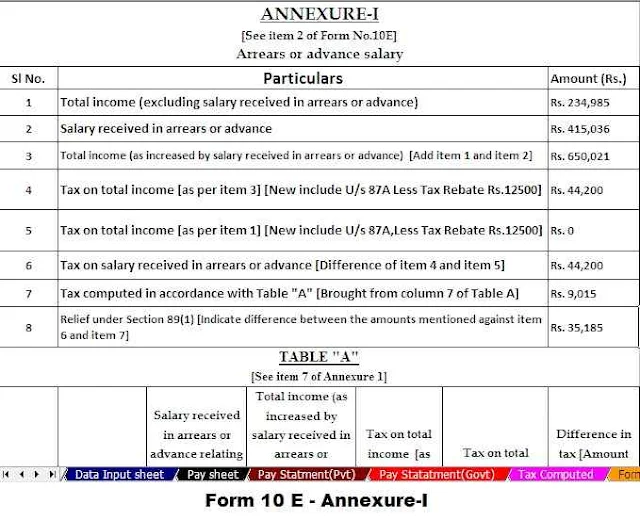

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Updated Version)

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Govt and Private Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet