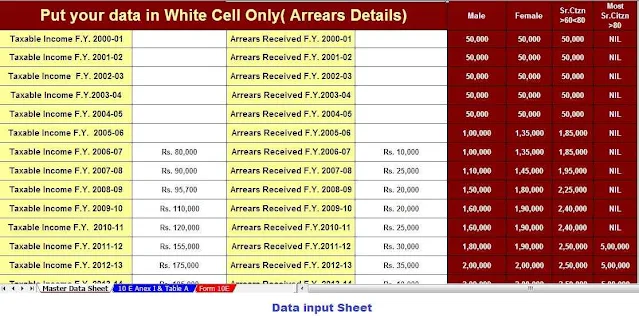

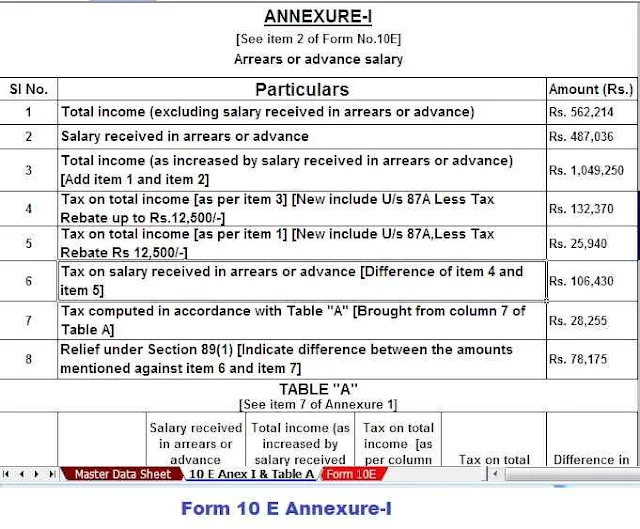

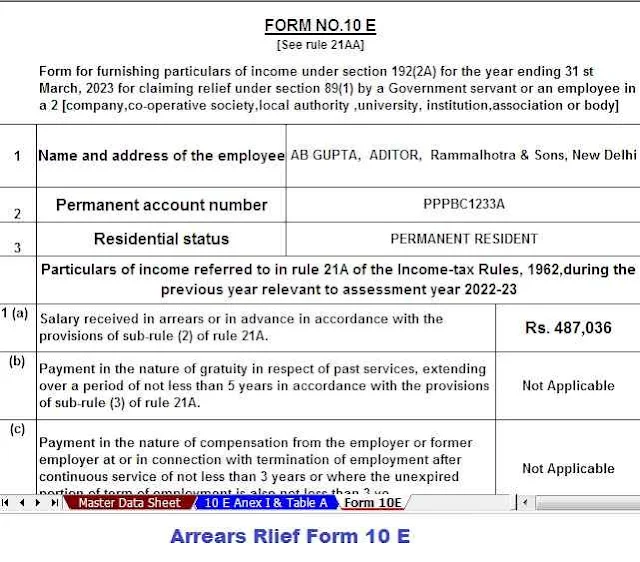

Download Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E for the

F.Y.2021-22 with details of Section 80TTA of the

Income Tax Act

Download Automated Income Tax

Arrears Relief Calculator U/s 89(1) with Form 10 E for the F.Y.2021-22.What is

Section 80TTA?

As per the Income Tax Act Under

Section 80TTA provides for an Exemption

for interest income from Bank/Post Office. Discounts are available with a few

limitations and limitations. In this article, we have covered everything about

claiming a tax deduction because of the interest earned

Tax exemption on interest income

Where the total income of a

taxpayer includes any income through interest on the deposit, such income is

tax-free. The taxpayer must be an individual taxpayer, a member of a Hindu

undivided family, or a member of a Hindu undivided family.

The way to earn interest should be

from a deposit with a savings account:

A banking institution where the

Banking Regulation Act, 1949 (10 of 1949), applies

A cooperative society is involved

in the banking business.

The assessee can claim a tax

deduction when calculating his total income

Tax deduction on the interest

income from the time deposit is not available.

Therefore, the exemption is not

allowed in the following cases:

Interest from fixed deposits

Interest from recurring deposits

No other time deposit

The amount of deduction under

section 80TTA of the Income-tax Act

The maximum discount allowed under

8TTA for a financial year is Rs.

Actual interest is discounted if

the total interest is less than Rs.

If the total interest is excess

than Rupees Ten Thousand, only Rupees Ten Thousand is entitled as tax exemption

The assessee must consider his /

her total interest from all savings bank accounts.

Eligibility to claim an exemption

under 80TTA

Cutting approved under 80TTA

The below-given taxpayers can be

entitled to get the benefits under Section 80TTA of the Income Tax Act:

Private Taxpayer or Hindu Undivided

Family (HUF)

Indian residents

Non-Resident Indians (NRIs) own NRO

Savings Accounts

Deduction under 80TTA is

unauthorized

The following types of taxpayers

are not eligible for deduction:

Interest income is received from

any deposit in a savings account. The account is owned by or on behalf of:

A firm, or

An association of individuals, or

A body of individuals

Then no exemption will be given to

any partner of the firm or any member of the association or any person of the

body. These taxpayers will not be allowed to deduct against interest income

when calculating total income.

Furthermore, even senior citizens cannot

claim a waiver under the 80TTA. They can claim tax benefits under 80TTB.

How to claim Section 80 TTA

exemption while filing an income tax return?

First, you add the interest income

with your total income. You will then have to claim tax benefits under section

80 deduction under section 80TTA.

Income Tax Section 80TTB only for Senior Citizen above 60 years of age.

Where the total income of a

taxpayer includes any income through interest on the deposit, such income is

tax-free.

Ways to earn interest on deposits

with:

A co-operative society is engaged

in conducting banking business.

A post office under the Indian Post

Office Act, 1898

The assessee can claim a tax

deduction when calculating his total income

A maximum of Rs 50,000 was approved

by 8TTB for a financial year.

If the total interest is less than

Rs. 50,000, the actual interest is discounted.

The difference between Section

80TTA and 80TTB

Section 80TTA Section 80TTB

Individual Taxpayer and Hindu

Undivided Family (HUF) only allowed for senior citizens above 60 years of age

Interest earned on deposits with

savings account only: - Deposit with a savings account - Fixed deposit, term

deposit or recurring deposit

Exemption limit under section 80TTA Rs.10,000 per annum Exemption limit under section 80TTB Rs.50,000 per annum

Download Automated Income Tax Arrears Relief Calculator U/s89(1) with Form 10 E for the F.Y.2021-22