Tax Saving options for A.Y.2022-23.We all want to save as much money as we can within the law.

All of us should always pay our income tax because it builds the nation and strengthens the-

economy. But, wise, planned and strategic investment can help us save some money to pave the

-way for a financially secure future. Here are some top options that every taxpayer should explore-

to save their income tax.

Five tax saving options

under section 80C

To encourage savings,

the Government of India offers tax breaks if you invest in certain financial

instruments each year. The amounts invested in these classified instruments are

deductible from your taxable income.

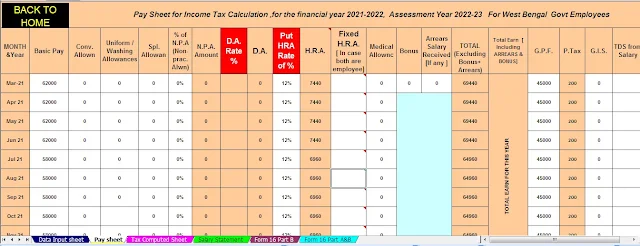

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the West Bengal State Employees for theF.Y.2021-22

Section 80C is one of

the most popular tax-saving options among income taxpayers and offers a variety

of ways to invest money and save tax every year. The annual limit for claiming

tax deduction is currently set at Rs 1.5 lakh. The following devices are widely

popular because of the specific benefits of each:

1. Public Provident Fund

The current interest

rate is 7.1% and this is a safe option if you are looking for a risk-free,

stable return in the long run. The minimum validity of PPF accounts opened at

selected bank branches and post offices is 15 years and can be extended up to 5

years block.

The amount deposited in

the PPF account is deductible from taxable income under section 80C, although

partial withdrawals are only allowed from the 7th year. It is mandatory to

deposit a minimum of Rs.500 per annum to keep the account active.

2. National Pension

Scheme (NPS)

NPS is a voluntary

pension scheme that is tax-exempt at both maturity and annuity (up to 40%).

Contributions to NPS are also deductible from taxable income under section 80C.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Andhra Pradesh State Employees for theF.Y.2021-22

3. Life insurance plan

If you are looking for

a healthy investment then the most powerful and difficult instrument. Use it if

you are looking for inflation-beating returns, wealth creation and financial

security for your family. No material other than the tax benefit under section

80C provides financial protection for your family.

Canara HSBC Oriental

Bank of Commerce Life Insurance offers some savings plans and even guaranteed

returns to give you peace of mind. In the case of premature death, future

premiums are paid by the company (for certain policies) so that the family's

lifestyle and education aspirations are not affected.

In addition to

investing in National Pension Scheme under Section 80C, there is now an extra

opportunity to claim an additional exemption of up to Rupees Fifty Thousand

under Section 80CCD (1B). If you have invested Rs 1.5 lakh in life General

Provident Fund or Public Provident Fune, you can invest another Rupees Fifty

Thousand in National Pension Fund and deduct a total of Rupees Two lakh from

your taxable income.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Assam State Employees for the F.Y.2021-22

4. Mediclaim under

Section 80D

Health insurance not

only protects you from the cost of hospitalization but also saves taxes on

premiums paid. This dual benefit is because the premiums paid can be deducted

under Section 80D of the Indian Income Tax Act. What's more, you can even

include premiums paid for your family and dependent parents.

Up to Rs 25,000 can be deducted from taxable income for health insurance cover for you, your spouse and your dependent children. Also, you are entitled to claim an additional deduction of Rs 25,000 paid for health insurance if your parents are under 60 years of age.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Bihar State Employees for theF.Y.2021-22

There is also an

incentive to do preventive health check-ups. It has cost Rs 5,000 to get a

health check for you, or your family is also eligible to be deducted under

Section 80D though under the overall limit.

5. Home Loan - Section

24B

Buying a home with a

home loan is not just about building your home or fulfilling your family's

dreams. Not only will you save money on constantly rising rents, but you can

also save some money that would otherwise have been paid as taxes.

A) Home Loan Principal:

Home loan EMI has two components- principal and interest. The principal

component that is paid each year is deductible from your taxable income under

section 80C and within the total limit of Rs 1.5 lakh under section 80C.

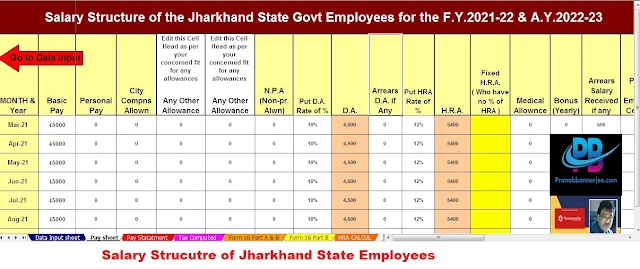

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Jharkhand State Employees for theF.Y.2021-22

b) Interest on home loan:

If the property is self-acquired, interest up to a maximum of Rs. 2 lakhs

is also deductible from the taxable income under section 24B.

C) Registry and other charges:

Whenever you register your property, you are also eligible to claim a

deduction of stamp duty and the amount paid for registration.

With so many ways to

invest and save tax, you must look for the benefits and returns of each before

zeroing in on the right one for you. Even with the above options, you can claim

a discount of up to Rs 5 lakh from your taxable income. If you fall into the

30% tax bracket, you can save a whopping Rs 1.5 lakh with just the above

options!

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has all amended Income Tax Section as per Budget 2021

3)

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Govt and Private Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount in to the in-words without any Excel Formula