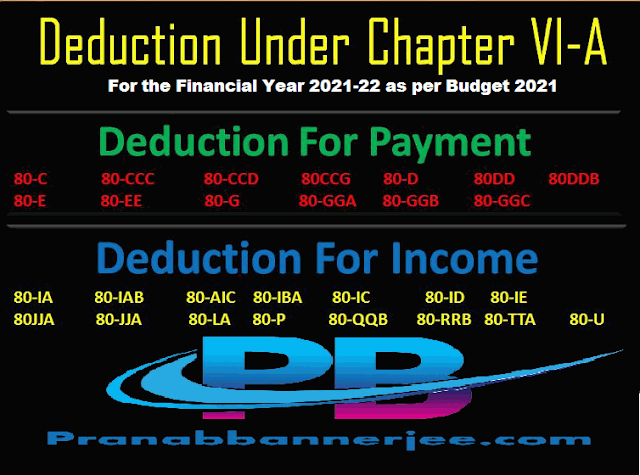

Common Deduction of Income Tax Chapter VIA, At a Glance Chapter VIA Deduction, List of all

income tax deductions from 80C to 80U. Chapter VIA List of all cuts at a glance, cut under Chapter

VI-A. Here we provide a list of all deductions covered under section VIA of the Income Tax Act. In

this article, we provide a complete list of cuts, including the name of the section, a brief description of

the section, a list of evaluators who may receive this discount, the amount of the cut, and so on.

In this article, we provide a list of all deductions available under the Income Tax Chapter VIA. In this article, we provide a list of all the cuts by chapter under section VIA. Now take a look at the table below for a VIA chapter listing all the cuts.

Deduction in case of a maximum contribution of fixed pension fund person and HUF. 1,50,000

Medical insurance premium deduction in case of individual or HUF whether residential or non-resident - in case of a person - maximum Rs. 25,000 & Senior Citizen Rs. 50,000/-

Individual or HUF resident extra in

Rs.50,000 or Rs.1,00,000 in case of severe disability

Extra-person or not. 20,000

Actual payment has been made

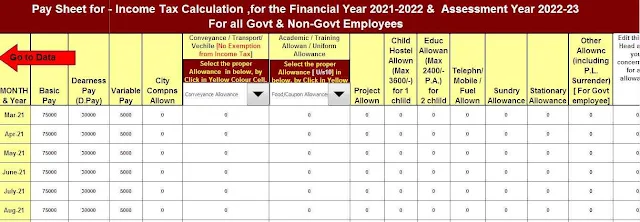

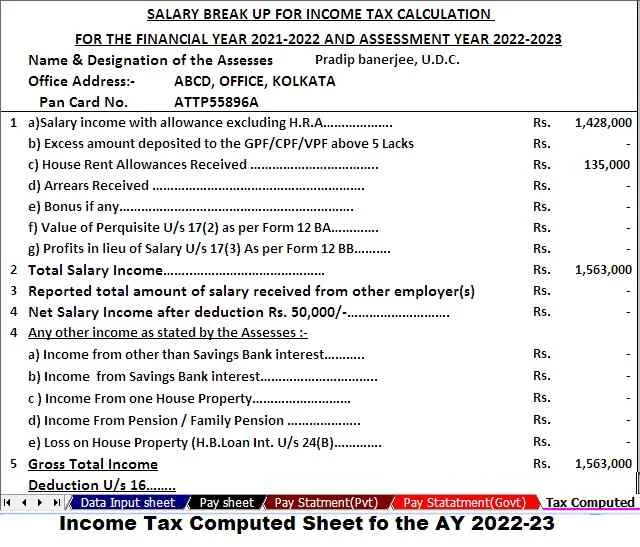

Download Automated Income Tax Preparation Excel Based Software

All in One for the Government & Non-Government (Private) Employees for the

F.Y.2021-22 and A.Y.2022-23

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

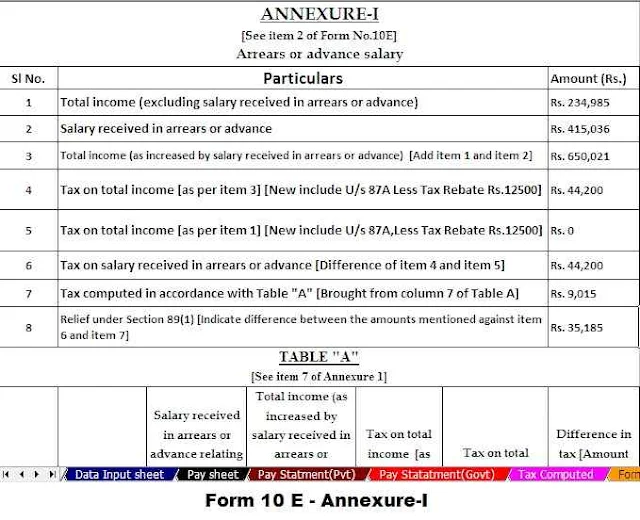

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2021-22 (Update Version)

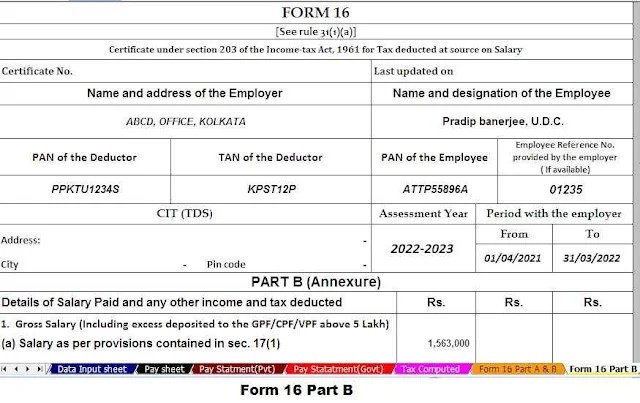

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2021-22