Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E for the F.Y.2021-22|

a pay structure that can help you reduce your tax burden. Although some of these components are fully

or partially taxable, some may be completely tax-exempt. Therefore, how your salary is structured is

crucial; As such you will always try to maximize the salary taken in your house by reducing the tax

Note that from 1st April 2021, a salaried person has the option to opt for a new income tax regime that comes with tax deductions and exemptions such as house rent allowance, deducted under sections 80C, 80D, etc. If an individual opts for the new tax system, the individual will not be able to claim any of the following components from the salary to reduce the tax burden.

Here are Ten deductions an employee can use to reduce their tax burden and plan their pay structure accordingly.

1. Employees Provident Fund (EPF)

Under the EPF Act, an employee is required to invest 12% of the basic salary and allowance in the EPF and the employer is required to invest an equal amount. Contributions deducted from the employee's account up to Rs 1.5 lakh are exempt from tax. This exemption has been granted under Section 80C of the Income Tax Act. Interest earned on EPF is also tax-free subject to certain conditions

You may also, like- AutomatedIncome Tax Preparation Excel Based Software All in One for the West Bengal GovtEmployees for the F.Y. 2021-22 as per Budget 2021

2.

An employer provides LTA to

employees to help them pay for travel with their families anywhere in

3. Home Rent Allowance (HRA)

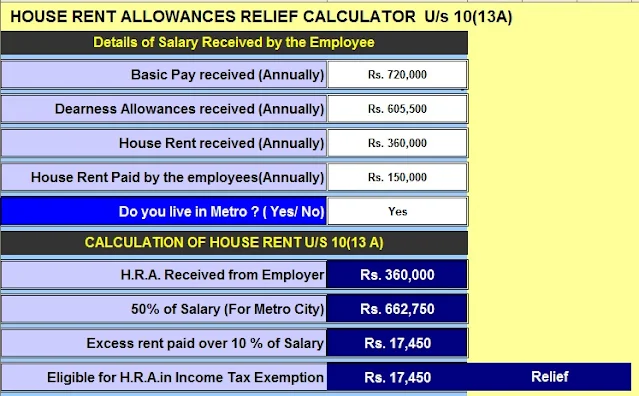

This component of pay helps an employee take care of the rent paid for the premises. In order to be able to claim this deduction, it is essential that it constitutes a portion of one's salary. The amount paid as HRA can be claimed as tax-free subject to certain limits, conditions.

The minimum amount will be tax-free in the following amounts:

More than 10% of salary is rented

Download automatic H.R.A. Calculator U/s 10(13A) in Excel Format

4. Children's education allowance

Rs.100 / - per month as education allowance or Rs.1,200 / - per annum paid by an employer to an employee is allowed as a deduction for child employees from taxable income. This discount is granted to employees up to a maximum of 2 children. In addition, you can claim deductions for tuition fees paid to your children under Section 80C of the Income Tax Act.

5. Hostel cost allowance

Hostel Expenditure Allowance of Rs. 300 per month or Rs. This discount is granted to employees up to a maximum of 2 children.

6. Uniform allowance

It covers the allowance paid by the employer to the employer to cover the cost of purchase and/or maintenance of uniforms worn during employment duties.