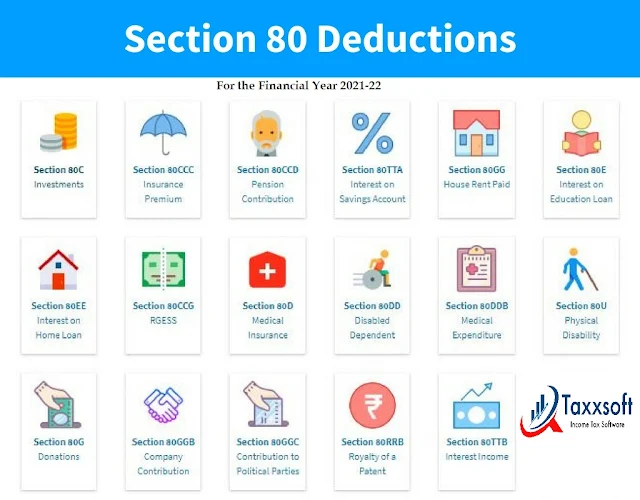

Income Tax Deduction U/s 80 |Section 80 deduction for the fiscal year 2020-21, A.Y 2021-22 (with budget 2021 amendment)

The Income Tax Department has made various deductions from taxable income under Chapter VI A deduction to encourage savings and investment among the taxpayers. As 80C is the most famous, there are other deductions that help taxpayers reduce their tax liability. Let's understand these deductions in detail:

Section 80C - Deduction on investment

Section 80C is one of the most popular and preferred categories among taxpayers because it allows them to reduce taxable income by incurring tax-saving investments or incurring eligible expenses. It allows taxpayers to deduct a maximum of Rs 1.5 lakh per year from the total income.

The benefits of this deduction can be taken by individuals and HUFs. Companies, partners, LLPs will not be able to avail of this discount.

Under Section 80C includes deposition to , 80CCC, 80CCD (1), 80CCD (1b) and 80CCD (2).

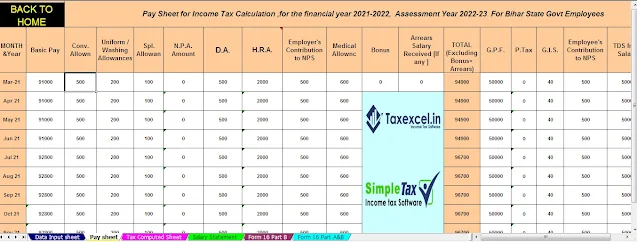

You may also, like- Automatic Income Tax Calculator All in One for the Bihar State Employees for the F.Y.2021-22

It is important to note that the total limit for sub-clause for claiming deduction without additional deduction of Rs. 50,000 allowed under 80CCD (1b) is Rs. 1.5 lakhs.

Eligible investment for a tax deduction

80C PPF, EPF, LIC Premium, Equity-Linked Savings Scheme, Basic Payment for Home Loan, Stamp Duty and Registration Charge for Property Purchase, Sukanya Siddhi Yojana (SSY), allows a deduction for investments made in National Savings Certificate ( NSC), ULIP, tax saving FD for 5 years, etc.

80CCC discount for life insurance annual plan.

80CCC allows a deduction for payments for annual pension plans. The amount received from the annual pension or the amount received after the annual surrender, including the interest or bonus earned on the annual, is taxable in the year of receipt.

80CCD (1) Deduction for the contribution of NPS employee under section 80CCD (1) Minimum approved maximum discount among the following

10 10% of salary (if the taxpayer is an employee)

• Total income 20 & (in case of self-employment)

• 1.5 Lakh (Limit allowed under 80C)

Deduction for 80CCD (1b) NPS is allowed to deduct additional Rs. 50,000 for deposit in NPS account

You may also, like- Automatic Income Tax Calculator All in One for the Assam State Employees for the F.Y.2021-22

Section 80 TTA - Interest on Savings Account

Excluded from total gross income for interest on the savings bank account

If you are an individual or HUF, you can claim a maximum deduction of Rs.10,000 against interest income from your savings account at a bank, co-operative society or post office.

Section 80GG - House rented

The deduction is payable for house rent where HRA is not received

If HRA is not available then a Section 80GG discount is available for the rent paid. Taxpayers, spouses or minors should not have a place of employment

B. The taxpayer should not have self-acquired residential property in any other place

C. The taxpayer must live in the rent and pay the rent

d Discount is available to all persons

The lowest deduction available is:

A consistent minus 10% of the total income is rented

B. 5,000 / - per month

C. 25% of Adjusted Total Income *

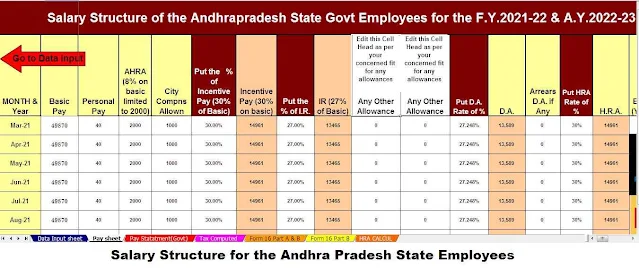

You may also, like- Automatic Income Tax Calculator All in One for the Andhra Pradesh State Employees for the F.Y.2021-22

Section 80E - Interest on education loan

Deduction for interest on education loans for higher education.

A person is allowed to deduct interest on a loan taken for higher education.

.

Section 80EE - Home Loan Interest

Exemption on home loan interest for first-time homeowners

If the loan has been taken in the financial year 2016-17, then this discount will be available from F.Y 2017-18. Deduction under section 80EE is available only to homeowners (individuals) who own only one home on the date of loan approval. The value of the property should be less than Rs 50 lakh and the home loan should be less than Rs 35 lakh. Loans taken from a financial institution must be approved between 1 April 2016 and 31 March 2017. An additional rebate of Rs. Loan EMI) approved under section 24 (B).

Section 80D - Medical Insurance

Deduction for premiums paid for medical insurance

You (as an individual or HUF) can claim a rebate of Rs 25,000 for insurance for yourself, your spouse and dependent children under section 80D. An additional deduction of up to Rs 25,000 is available for parental insurance if they are below 60 years of age. If the parents are over 60 years of age, the discount amount is Rs 50,000, which has been increased from Rs 30,000 in the 2018 budget.

In case, both the taxpayer and the parent are 60 years of age or above, a maximum exemption of up to Rs. 1 lakh will be available under this section.

You may also, like- Automatic Income Tax Calculator All in One for the Jharkhand State Employees for the F.Y.2021-22

Section 80U - Physical Disability

Discount for a person suffering from a physical disability

A discount of Rs.75,000 is available for a resident who is suffering from a physical disability (including blindness) or mental retardation. In case of severe disability, one can claim a rebate of Rs. 1,25,000.

Section 80G - Grants

Cuts for donations to social causes

The various grants specified under 80G are eligible to be deducted with or without limitation up to 100% or 50%.

From FY 2017-18, any cash grant above Rs. 2,000 / - will not be allowed as a deduction. Grants above Rs.2000 / - other than cash to qualify for 80G deduction Should be done in any mode.

Section 80 TTB - Interest income

Exemption of interest on deposits Rs. Fifty Thousand for senior citizens to the Savings Bank or Post Office notes the Senior Citizen can not avail U/s 80TTA

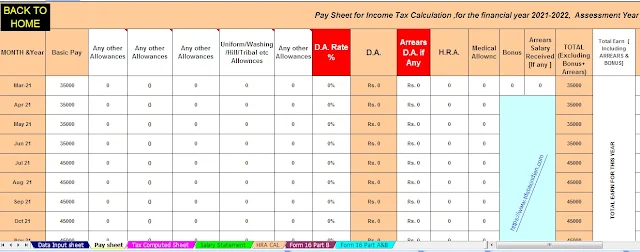

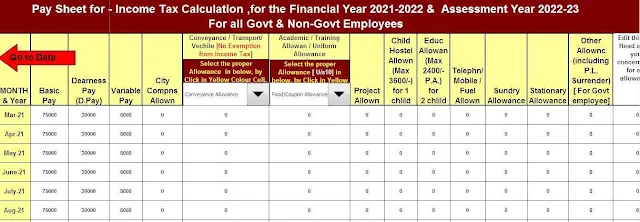

Download Automated Income Tax Preparation Excel Based Software All in One for the Government & Non-Government (Private) Employees for the F.Y.2021-22 and A.Y.2022-23

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old

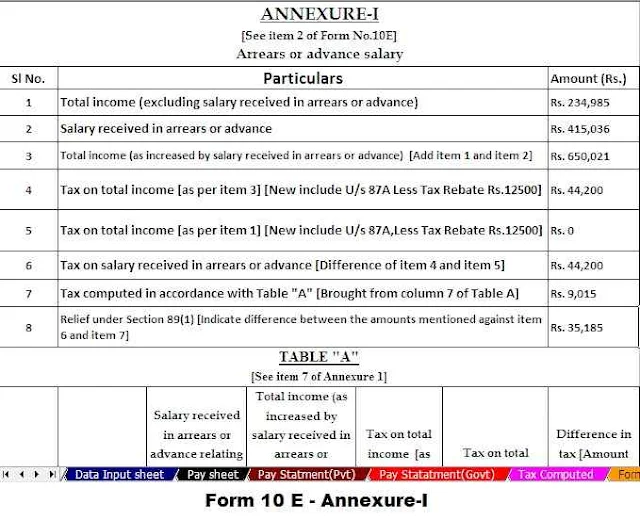

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22