Exemption U/s 16 standard deduction of the Income-tax Act, 1961

Section 16 of the Income-tax Act, 1961 provides for deduction from taxable income under the heading 'Salary'. It gives exemption for standard deductions, entertainment allowances and professional taxes. Through this deduction, a salaried taxpayer can reduce his taxable salary income as taxable.

Further, with the recent revision of the standard deduction, the benefits of this section have been greatly increased. Also, there is no hassle of paying bills for travel and treatment, which makes it much easier to claim.

The exemption of Standard deduction is entitled to under section 16(ia) of the Income-tax Act. The standard deduction against the allowances of transport of Rs 19,200 and the medical allowance of Rs 15,000. This was published by our Finance Minister Jaitley in the 2018 budget.

In the 2018 budget, a provision of Rs 40,000 has been made in lieu of transport allowance and medical compensation. A taxpayer does not have to submit any bill or proof of expenses to deduct this money. 40,000 It offers a flat deduction of Rs. 40,000

Subsequently, the amount cut from Rs 40,000 in the interim budget 2019 was increased to Rs 50,000. So Rs 40,000 was deducted for FY 2018-19 and Rs 50,000 will be deducted from FY 2019-20.

You may also, Like-

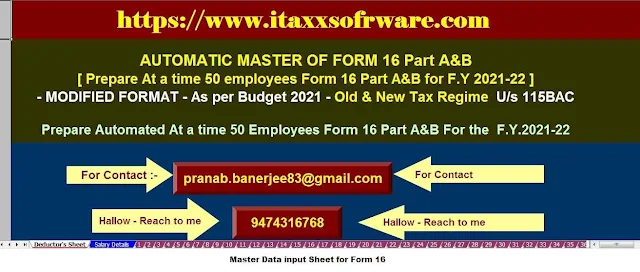

Automatic Income Tax Master of Form 16 Part A&B for the F.Y.2021-22[This Excel Utility can prepare at a

time 50 Employees Form 16 Part A&B as per Old and New Tax Regime]

A taxpayer's pension will be taxed under the heading 'salary' received from his former employer. Since the pension received is taxed under the heading 'Salary', the deduction under section 16 will also be available to the pensioners.

The amount of exemption allowable under section 16(ia) for standard deduction is:

Got paid

Or

50000 rupees

Which is less

Note that the standard deduction is not related to cutting 80C or any other section of section VIA.

Entertainment allowance under section 16 (ii)

An allowance should be an allowance that is specifically paid by an employer to the taxpayer in the form of an entertainment allowance.

Entertainment allowance for government employees

For Central Government and State Government employees, the minimum deduction available is among the following:

20% of basic salary

5000 rupees

Entertainment allowance for a private employee

Unlike recreation allowances, discounts are not available for private employees. Only Central or State Government employees are eligible for deduction. Also, employees of local authorities and statutory corporations are not eligible for the cut.

Deduction of tax on employment is allowed under Section 16iii of the Income Tax Act. The amount that the taxpayer pays for employment tax or occupational tax is approved as deduction under section 16.

The following points should be kept in mind when calculating deductions against professional taxes:

The taxpayer has to claim deduction only in the financial year where professional tax is paid to the government

Taxes paid by the employer on behalf of the employee are also deductible. Here, the amount paid by the employer as professional tax will be included as a condition of the first total salary. Article 16 Later under the same amount of deduction

There is no upper or lower limit on exemption under section 16(ia) as per the Income-tax Act. The exemption deem feet to only on the actual amount of professional tax. However, no state government can levy more than Rs 2,500 per year as professional tax. Only payable tax is eligible for deduction and not interest or delay fee for non-payment of professional tax.

Download Automatic Income Master of Tax Form 16 Part A&B for the

F.Y.2021-22 [This Excel

Utility can prepare at a time 100 Employees Form 16 Part A&B as per Budget

2021 as well as Old and New Tax Regime]