Section 80U - Tax Deduction for Persons with Disabilities| There are certain sections of the income tax

laws of India which offer tax benefits to individuals if they or any member of their family suffers from

certain disabilities.

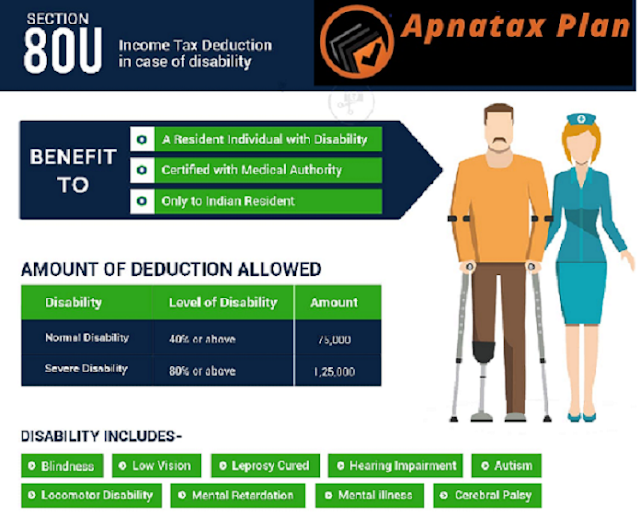

Section 80U provides tax benefits if an individual has a disability, while Section 80DD provides tax benefits if a dependent family member of an individual taxpayer has a disability. This article about on discussing the tax benefits in section 80U.

Who can claim the deduction under section 80U

A resident person who has been certified as a person with a disability by a medical authority can claim tax benefits under section 80U. A disabled person is defined as having at least 40% of the disability ascertained by the health authorities.

Given below the purposes of this section,

blindness

low vision

freedom from leprosy

hearing problems

locomotor disability

mental delay

mental disease

This section also provides a definition of major disability which refers to a condition in which the disability is 80% or more. Major disabilities along with multiple disabilities, autism, and cerebral palsy.

Amount of deduction less than 80U

Deduction of Rs. 75,000 is allowed for the disabled and Rs. Deduction of 1.25.000 for people with severe disabilities.

Section 80U. Requirements for requesting the deduction pursuant to art

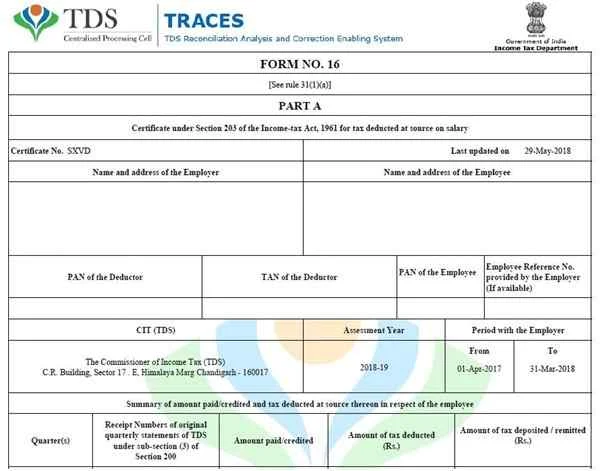

No documents are required in Form 10-IA other than a certificate of disability issued by a recognized medical authority. There is no need to submit an invoice for the cost of continued treatment or other similar expenses.

To submit the application referred to in this section, it is necessary to submit a medical certificate certifying the disability together with the tax return referred to in Article 139 of the relevant AA. In the event that the certificate of assessment of invalidity has expired, it is still possible to request this deduction in the year of the expiry of the certificate. However, a new certificate will be required from next year to apply for Section 80U benefits.

Certificates can be obtained from official physicians who may be neurologists with a Doctor of Medicine (MD) degree in neurology (in the case of children, a pediatric neurologist with an equivalent degree) or civil surgeons in a government hospital or medical executive. ,

Note: If the invalidity is temporary and requires re-evaluation after a certain period, the validity of the certificate starts from the year of assessment relating to the year in which it was issued and during the assessment year relating to the financial year. in which the certificate expires.

Difference between section 80U and section 80DD

Section 80DD provides for the tax deduction for family members and relatives of the disabled taxpayer, while section 80U provides for the tax deduction for the disabled person.

Article 80DD is applicable when a taxpayer deposits a specific amount as an insurance premium for the assistance of their disabled employee. Under section 80DD, the deduction limit is the same as section 80U. Here, an employee refers to the assessor's siblings, parents, spouse, children, or a member of an integrated Hindu family.