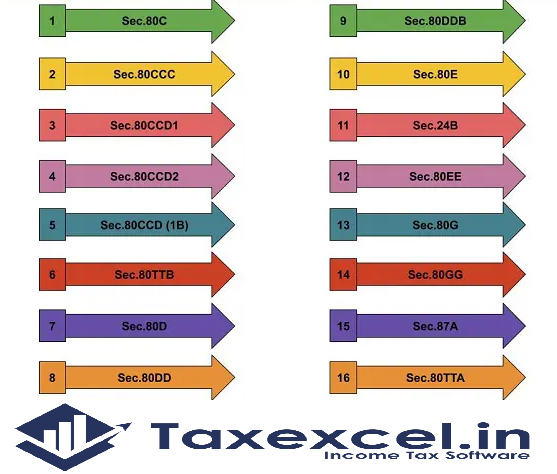

Section wise income tax deductions list | The deduction for the taxable

amount is available in various sections of the Income Tax Act, 1961. The

deduction must be mentioned on the relevant ITR form when filing the tax

return.

Section 80C

The deduction in this section is only available for individuals and HUF. This section allows certain investments such as NSC, etc. to be exempt from taxation. and charges up to Rs.1,5 lakh.

The deduction in this section applies to payments made to LIC or any other approved insurance company under an approved retirement plan. The pension policy should be up to Rs 1.5 lakh and should be deducted from the taxable income for the individual himself.

The deduction under this section is for the contribution to the New Pension Scheme by the assessor and the employer. The deduction is equal to the contribution, not exceeding 10% of his salary.

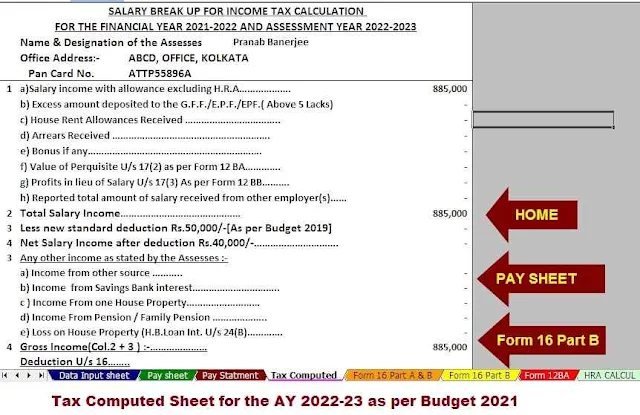

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2021

3) Automated Income Tax Form 12 BA

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount in to the in-words without any Excel Formula

The total deduction available under Sections 80C, 80CCC and 80CCD is Rs 1.5 lakh. However, the contribution to the pension scheme notified under section 80CCD is not counted in the limit of Rs 1,5 lakh.

Section 80D

This is the section that deals with the income tax deduction of insurance premiums paid. In the case of individuals, the insurance policy can be taken out for oneself, spouse, dependent children - up to Rs 15,000 and for parents (dependent or not) - up to Rs 15,000.

If the insured is a senior, an additional deduction of Rs 5,000 is applicable. In the case of HUF, any member can be insured and the normal deduction will be up to Rs 15,000 and there will be an additional deduction of Rs 5,000.

Total Rs. 2.0 lakhs can be claimed if the valuer is an individual or a HUF.

Section 80DDB

This section is for the deduction of medical expenses resulting from the treatment of diseases or illnesses specified in the rules (11DD) for the assessor, a family member or any member of the HUF.

Section 80E

This section deals with the deductions that apply to interest paid on education loans for education in India.

Section 80EE

This section deals with the tax savings applicable to first homeowners. Applicable for people whose first home value is less than Rs 40 lakh and the loan is taken for which is Rs 25 lakh or less.

Section 80 TTA

This section deals with the tax savings that are applied to interest accrued in savings bank accounts, post offices or cooperatives. Individuals and HUFs can apply for the interest income deduction of up to Rs 10,000.

Section 80U

This section deals with the flat-rate deduction of income tax that applies to the handicapped, upon presentation of the certificate of disability. Up to Rs, 1.0 lakh may be non-taxable depending on the severity of the disability.

Section 24

This section deals with the interest paid on those real estate loans that are exempt from taxation. You can request a deduction of up to Rs 2,0 lakh per year and this is in addition to u / s deduction 80C, 80CCF and 80D. This is for self-occupied properties only. For the properties that have been leased, 30% of the rent received and the municipal taxes paid can benefit from the tax exemption.