Download Automatic Income Tax Form 16 Preparation Software In Excel which can prepare at a time

50 and 100 Employees form 16 for F.Y.2021-22 |An income tax deduction is a reduction in taxable

income that reduces a person's tax liability. It is also important to note that a significant portion of a

person's income falls into the tax bracket. Section 80 deduction is divided into several categories

according to the type of investment.

What is Section 80C Deduction?

We all expect good returns when we

invest, but did you know that some of your investments pay you more than that

and help you save on taxes?

One such investment is Section 80C.

It is considered as one of the most preferred categories of taxpayers as it

reduces taxable income through tax-exempt investments.

We all as Indian taxpayers look for

different ways to save money and reduce our tax deductions. A taxpayer who uses

a tax-saving investment and claims a deduction under section 80C is entitled to

a rebate of up to Rs. 1,50,000 on their taxable income. The following different

investment possibilities are available:

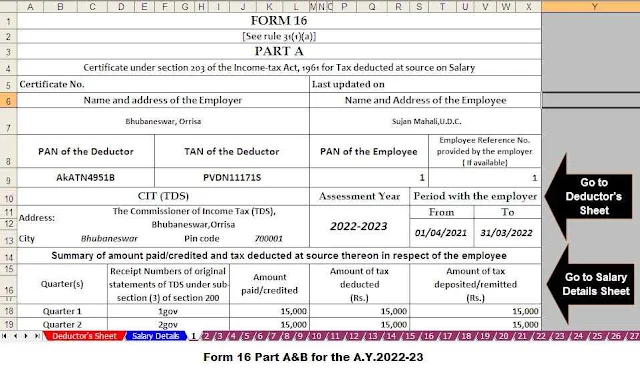

Download Automatic Income Tax Form 16 Preparation Excel Based Software for the Financial Year 2021-22 [This Excel Utility can prepare At a time 50 Employees Form 16 Part A&B as per Budget 2021

1. Employee provident fund: Under

this investment, both the employer and the employee can contribute equally (12%

of the basic salary).

2. Premium for health insurance: If

you pay a premium for health insurance, you may be eligible for tax benefits.

3. Public Provident Fund (PPF): The

government of

4. Premium for life insurance: If

you pay the life insurance premium, you are eligible for tax benefits.

5. Sukanya Samrudhi Account

Investment: For a girl child in

6. National Savings Certificate: It

is a safe way to save. Also, even if the NSC has a 5-year term, you can claim a

discount for interest in the year you bought them. Because it is a government-sponsored

program, it protects the security of your money.

7. Children's tuition fees: It

covers the cost of tuition at a university in

8. Housing Loan: The principal

repayment of a home loan, as well as the cost of registration, may be eligible

for tax relief under section 80C.

9. Post Office Fixed Deposit: Fixed

deposit at the post office is like a bank fixed deposit, however, only a 5-year

deposit is eligible for a tax deduction.

Download Automatic Income Tax Form 16 Preparation Excel Based Software for the Financial Year 2021-22 [This

Excel Utility can prepare One by One Form 16 Part A&B and Part B as per

Budget 2021

What is Section 80CCC?

Single contributions to pension plans are eligible for an income tax credit under section 80CCC. Payment in annual pension schemes may be deducted under section 80CCC. Tax benefits on expenses for purchasing or continuing a retirement plan are defined under section 80CCC.

What is Section 80CCD?

It relates to the individual's

contribution to the following schemes:

National Pension System (NPS)

Section 80CCD (1): It deals with

tax deduction for self-employed / central government / other employers. Salary

employees are entitled to a maximum deduction of 10% of their salary, whereas

self-employed taxpayers can deduct 10% of their total income.

Section 80CCD (2): This section

discusses the NPS contribution of the employer. Individuals who deposit in their

pension account are eligible for deductions under section 80CCD. If an employer

contributes to an employee's NPS account, the employee can claim a tax

deduction. The threshold is 10% of an employee's salary.

Section 80CCD (1B): For the capital

invested in NPS, the total tax savings can be up to Rs. 2,00,000, an additional

tax benefit of Rs.50,000/-

What is 80D?

A tax deduction under section 80D

is available for premiums paid for health insurance coverage. A taxpayer can

deduct up to Rs 25,000 for insurance for themselves, their spouses, and their

dependent children under section 80D. If your parents are under 60, you can get

an additional discount of up to Rs 25,000 for their insurance. However, if they

are over 60 years of age, they can deduct Rs 50,000 under this section.

What is Section 80DD?

Rehabilitation of disabled

dependent relatives is included in section 80DD. An individual or a HUF

department can take advantage of the 80DD discount:

খরচ

Cost of medical services, training, and rehabilitation of a disabled dependent

relative.

Payment or contribution to a

designated scheme to assist disabled dependent relatives. If the disability is

40% or more but less than 80% then there is a set deduction of Rs. 75,000.

There is a set deduction of Rs. 1,25,000 for 80% or more severe disability.

Conclusion

As an investor, having the right information can help you save a lot of tax money. Now that you are aware of all the tax-saving options like 80C, 80D, 80CCD, and others, you need to make sure that you use them properly to save money.

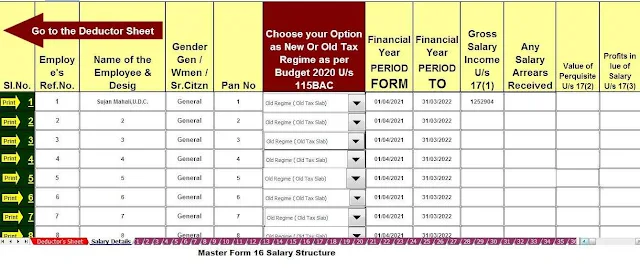

Download Automatic Income Tax Form 16 Preparation Excel Based Software for the Financial Year 2021-22 [This

Excel Utility can prepare At a time 100 Employees Form 16 Part A&B as per

Budget 2021