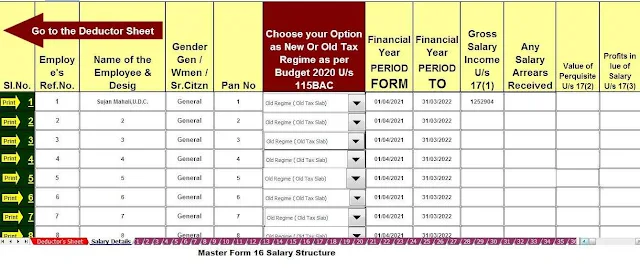

Download and generate Form 16 Part B and Form 16 Part A and Part B for the fiscal year 2021-22

Form 16 components

Form 16 is one of the most

important forms for employees; it contains all the information on wages paid

and withholding taxes.

Form 16 is divided into 2 parts,

both equally important, which are listed below:

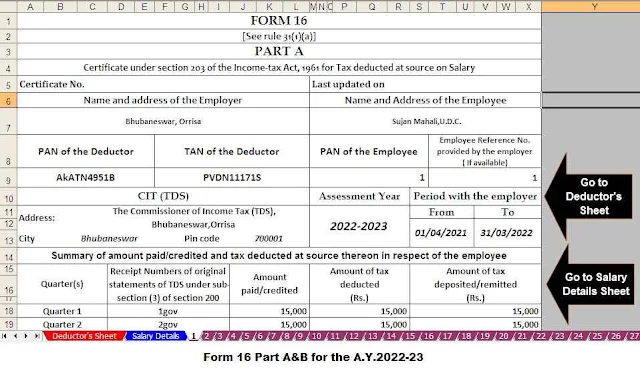

Part A Form 16

Part A of Form 16 provides a

summary of the taxes collected by an employer on the pay of an employee on his

behalf and paid to the government. This is a guarantee certificate signed by

the employer, certifying that he has already filed the TDS deducted from the

employee's salary.

Details to be completed on Form 16,

Part A

Part A of Form 16 contains the

following data, which must be completed:

Personal Information: The personal

information of the employee and employer, including the employer's name,

address, permanent account number (PAN) and TAN (TAN is the number assigned to

the account responsible for deducting and collecting taxes). This data helps

the IT department track money movements from employee and employer accounts.

Year of assessment: Indicates the

year of assessment, or more simply the year in which the taxpayer is required

to submit the tax return. For example, for the income generated between April

2020 and March 2021, the valuation year would be 2021-2022.

Time Period: The length of time the

employee worked for the employer in a given fiscal year.

Summary of wages paid

Tax filing date with the government

Summary of the tax that has been

deducted and also filed with the Income Tax Department

This part of Form 16 is generated

through the Department's Income Tax Track Portal. In addition to the above, it

also provides the BSR code of the bank from which payments are made, challan

numbers and other specific data for further use.

Part A must be signed manually or

digitally by the detractor.

Part B of Form16

Part B of Form 16 covers

declarations of wages paid, any other income disclosed by the employee to the

employer, and things like the amount of tax paid and tax payable. In this part

of Form16, the above information is presented in a comprehensive and

streamlined manner, showing the income earned by the worker, with various

benefits and allowances applicable in a specific format as indicated.

Details to be completed in part B

Part B of Form 16 contains the

following information, which must be completed:

Total salary: The salary structure

is further broken down into various components such as house rent, travel

allowance, vacation receipts, tips, etc.

Exceptions: All applicable

exceptions allowed under section 10 of the Income Tax Act of 1961 are listed in

this part of the form.

Gross Income: This is the sum of

the regular salary plus any other income generated or received by the worker

through various means such as housing and rent.

Details of other sources of income

must be provided by the employee to their employer when submitting the

investment confirmation.

Miscellaneous Paycheck Deductions:

Miscellaneous paycheck deductions under section 80C / 80CCC / 80CCD, including

contributions to instruments or schemes such as Public Provident Fund (PPF), life

insurance, mutual funds, pensions, college tuition, deductions tax for

children. for a total amount up to Rs 1,5 lakh.

Net Taxable Wage: Various tax

deductions are added together in Chapter IV-A and then subtracted from gross

income to calculate net taxable income.

Tuition and additional fees, if

applicable

Section 87 Discount if and when

applicable

Section 89 discount, if any

The total income tax payable on an

employee

Tax deduction and tax balance payable or refundable, as applicable