Download and Prepare Automatic Income Tax Salary Certificate Form 16 for the F.Y.2021-22 | Form

16 is a certificate issued under Section 203 of the Income Tax Act 1961 for tax deducted at the source

(TDS) from income under the head's "salary." It is issued when the tax is deducted by the employer

from the employee's salary and deposited with the government. The certificate provides a detailed

summary of the amount paid or credited to the employee and the TDS for it. This form is issued

annually under the provisions of the Income Tax Act (I-T Act) usually after the end of the fiscal year

for which it was issued. The employer must issue the certificate to the taxpayer if tax has been

deducted from the salary by the employer.

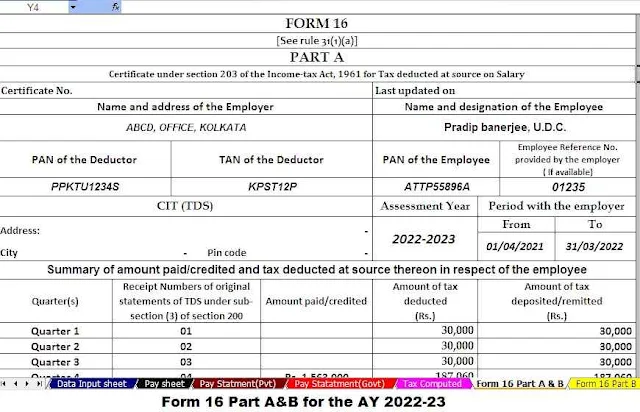

Download and prepare One by One Income Tax Form 16 Part

A&B for the F.Y.2021-22

Form 16 helps an individual to easily register in the International Telecommunication Register as it facilitates access to information regarding salary and tax exemption available to him. A TDS certificate consists of two parts: Part A and Part B. Keep in mind that both parts must have the TRACES logo on them.

What is Part A of Form 16?

Part A of Form 16 consists of the details of the tax deducted at the source on the salary. It is created and downloaded from the TRACES portal by the employer.

1 Part A of Form 16 includes the

following:

2 Name and address of the employer

3 PAN (Permanent Account Number)

and TAN for the employer

4 Pan employee

5 Summary of the amount paid or credited and the tax withheld at source as stated in relation to the employee

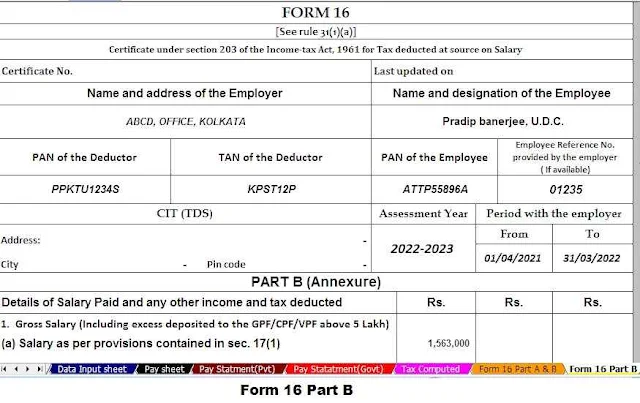

Download and prepare One by One Income Tax Form 16 Part B for the F.Y.2021-22

What is Part B of Form 16?

It is a supplement to Part A of

Form 16 that must be issued by your employer.

Part B of Form 16 includes:

1 Detailed salary distribution

2 Income tax provisions to the

extent that they are exempt from tax under Section 10

3 Allowable deductions under

Chapter VI-A of the Income Tax Act such as Section 80C, 80D, etc.

4 Any other deductions such as the

standard deduction available to salaried employees.

5 Reliefs under Section 89

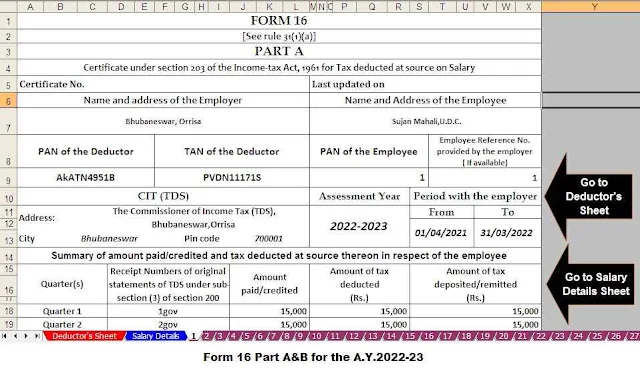

Download and prepare at a time 50 Employees Form 16 Part

A&B for the F.Y.2021-22

What do you do when you work with

one or more employers?

If you have worked with one

employer during the fiscal year, the employer will issue Form 16 for the full

fiscal year. It will include details of tax withheld and deposited for all

quarters of the fiscal year.

If you have worked with more than

one employer during the fiscal year, each of the employers will issue Form 16

for the period in which you worked with each of them. However, Part B of Form

16 may be issued by either the employer or the latter employer at the choice of

the taxpayer.

Under current rules, the deadline

for employers to issue Form 16 is June 15 each year. Provisions in the Income

Tax Act make it mandatory for an employer to issue Form 16 to his employee if

TDS tax is deducted from his or her salary.

You should also know that if the employer is late or does not issue Form 16 by the given date, he will be liable to pay a fine of Rs 100 per day until the date the default continues. However, the fine must not exceed the amount of the withholding tax.

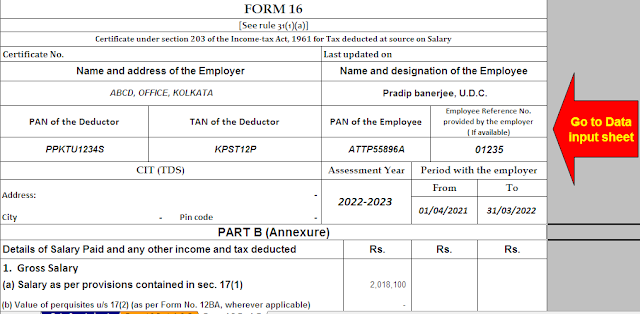

Download and prepare at a time 50 Employees Form 16 Part B for the F.Y.2021-22