All about Income Tax Form 16| Form 16 has all the details about the TDS deduction from your

paycheck and is submitted to the government by the employer.

Form 16 is a commonly used income

tax-related document in

What is Form 16?

Employers of those earning taxable income are subject to withholding taxes, known as TDS when paying wages. This tax deduction by the employer is documented on Form 16. Form 16 has all the details about deducting TDS from your paycheck and is submitted to the government. Form 16 is a statement of how much you have earned as income in a tax year and how much TDS your employer has withheld from your wages, depending on the tax class you are in.

Download and Prepare at a time 50 Employees Form 16 Part B for the F.Y.2021-22

Issued under Section 203 of the I-T Act, Form 16 states that your employer withholds the TDS and submits it to the I-T Department. Form 16 also provides information about how your tax liability is calculated, based on the investment report you made at the beginning of the year.

If you have changed jobs several times in a fiscal year and all employers have deducted TDS during this period, you must collect Form 16 from each of your employers before submitting your ITR.

Download form 16

Downloading Form 16 is not possible as only your employer can provide Form 16. Most organizations have an internal payroll platform, where an employee can download Form 16 after it has been issued by the employer. However, it is not possible to download Form 16 from any other source.

Download and Prepare at a time 50 Employees Form 16 Part A&B

for the F.Y.2021-22

The company creates and downloads Form 16 through the TRACES portal at https://www.tdscpc.gov.in/app/login.xhtml. The employer must authenticate the contents of Form 16 before providing it to the employee.

Eligibility Form 16

All salaried employees, whose income falls into the taxable category, are entitled to a Form 16 from their employer. Some organizations issue Form 16 even to employees whose salaries are not taxed and therefore TDS is not withheld.

Form 16: Details you can find

On Form 16, you will find the following information:

1. Company TAN and PAN data

2. Employee data

3. Details of tax payment

4. Tax withheld under Section 191A

5. Salary details

6. TDS receipt

7. Refund or balance of taxes to be paid

Download and Prepare at a time 100 Employees Form 16 Part B for the F.Y.2021-22

Make 16 parts

Form 16 consists of two parts: Form 16 A and Form 16 B.

Details of Form 16 Part A

• PAN and TAN entrepreneurs

• Employee PAN

• Employer's name and address

• Taxes are deducted and deposited every three months

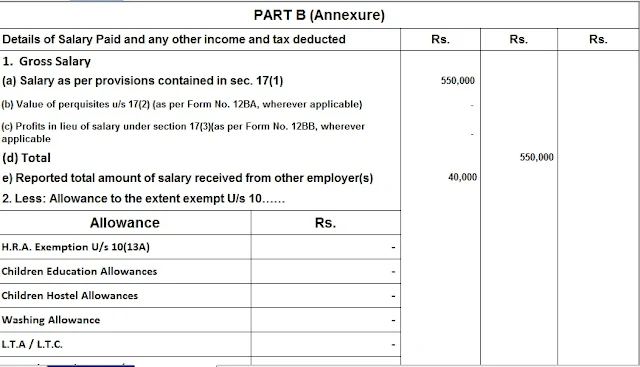

Details of Form 16 Part B

• Detailed salary details

• Details of allocation under Section 10

• Deductions allowed under Chapter VI-A

• Help under Section 89

Form 16, Form 16A and Form 16B

While Form 16 is a TDS certificate of your wages, Form 16A is a TDS certificate of wages for income other than wages. Form 16 B, on the other hand, is a TDS certificate for income earned through the sale of real estate.

If your employer has withheld the TDS and submitted it to the IT Department, you can find these details on Form 26AS. Issued by the IT Department, Form 26AS is a consolidated annual tax credit report, which contains information about taxes withheld from your income by employers and banks, including up-front taxes or self-assessment taxes paid during the year, sales and purchases of property.

Also, know all about UAN login

Form issue date 16

Form 16 is issued by your employer annually on or before June 15. Form 16 is issued immediately after the tax year in which the tax was withheld.

Download and Prepare at a time 100 Employees Form 16 Part A&B for the F.Y.2021-22

Form 16: Uses

A salaried employee may use the information listed on Form 16 in the following situations:

• To file a tax return

• To apply for all types of loans

• To apply for a foreign visa

• When joining a new company

• To show proof of income

• To check the effectiveness of your tax-saving instrument