Income tax salary deduction | An income tax deduction helps you reduce your taxable income by

reducing your overall tax liability and thereby helping them save on taxes. Those who qualify for

withholding depend on several factors, with different limits being set for different purposes.

What is

a tax deduction?

Income tax deductions help reduce taxable income. This reduces your overall tax liability and helps you save on taxes. However, the amount of the withholding varies depending on the type of tax deduction you request. You can apply for income tax deductions for amounts spent on medical bills, university fees, and charitable contributions. Also, you can invest in different schemes like retirement savings schemes, life insurance plans and national savings schemes etc. The Government of India provides tax exemptions for various expenses incurred in various activities to stimulate commercial institutions and individuals to participate in activities that have social benefits.

Many of our day-to-day expenses qualify for income tax deductions, along with information about them that is critical in helping us save money. You can claim a tax deduction on money spent on medical bills, education, retirement plans, insurance investments, charitable contributions, etc. This reduction is done to stimulate community members to take part in some useful activities, helping everyone who has been involved in the process.

Download and Prepare at a time 50 Employees Form 16 Part B for the F.Y.2021-22

Income

Tax Deductions Under Section 80C:

Section 80C of the Income Tax Act offers provisions for income tax returns on some payments, with undivided Hindu households and individuals eligible for the deduction. People who can afford to pay taxes can apply for a tax deduction of up to Rs. 1.5 lakhs per year under the 80C section, with this amount being a combination of the applicable deductions under the 80C, 80CCC and 80CCD sections.

Some of the important investments that qualify for a tax return are:

Life insurance policy payments (for spouse, car or children)

Payment of pension/pension funds

Payment of tuition fees to educate a maximum of two children

Payments for the construction or purchase of residential property

Payments are made to fixed deposits with a minimum term of 5 years

Section 80C of the IT Act 1961 offers some additional deductions such as mutual fund investments, NABARD bond purchases, senior savings schemes, etc.

Download and Prepare at a time 50 Employees Form 16 Part A&B

for the F.Y.2021-22

Subsections

of Section 80C:

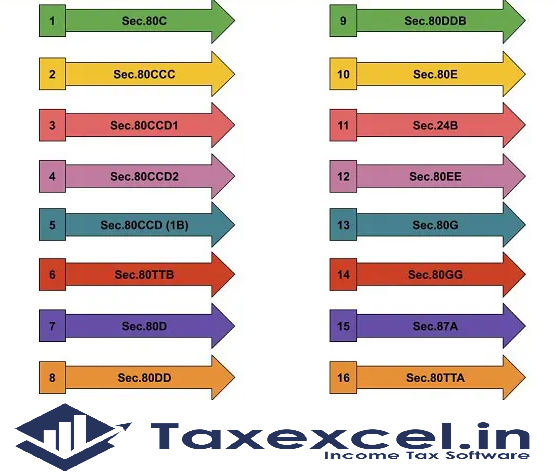

There is a complete list of withholdings under Section 80C of the Income Tax Act, 1961.

Section

80 CCC:

This part of the IT Act, 1961 offers jurisdiction for tax breaks on investments made in pension funds. Any insurance company can offer this pension and can ask for a maximum deduction of Rs. 1.5 lakhs below. Only individual taxpayers can request this deduction.

Section

80 CCD:

Section 80 CCD of the Income Tax

Act intends to strengthen the habit of saving among people by offering them

incentives to invest in pension plans promulgated by the central government of

Part 80

of the GCC:

This section of the Income Tax Act allows for a maximum deduction of Rs. 25,000 per year with certain residents who can benefit from this deduction. Investments made in government-proclaimed equity savings schemes are eligible for income tax deductions, subject to a cap of 50% of the investment amount.

Download and Prepare at a time 100 Employees Form 16 Part B for the F.Y.2021-22

Section

80D Income Tax Refund:

Section 80D of the Income Tax Act allows income tax to be deducted from amounts spent by an individual on health insurance premiums. This includes payments made by the central government on behalf of parents, spouses, children, or yourself for a health plan. You can request an amount of 1,000,000 rubles. 15,000 as insurance deduction for your spouse, own children or dependents if this amount is Rs. 20,000 if the person is over 60.

Both undivided Hindu families and individuals are eligible for a deduction under this section subject to a payment method other than cash.

Subdivisions

of Section 80D

Section 80D of the Income Tax Act contains subsections that explain the benefits available to taxpayers.

Section 80DD:

Section 80DD of the Income Tax Act makes provision for income tax deductions in two cases: deduction of Rupees One Lakh and Fifty Thousand in case of major disability and Rs. 75,000 in case of normal disability. You may claim a deduction under this section for the following expenses:

About payment for treatment of dependents with disabilities

Payment of an amount as a premium to maintain or purchase an insurance policy for these dependents.

Deduct Rs. 1.25 lakh for critical deficit and Rs. Allowed 75,000 for normal disability. Both resident individuals and undivided Hindu families are eligible for this deduction. In this case, the dependents may be parents, spouses, children, or siblings.

Download and Prepare at a time 100 Employees Form 16 Part A&B

for the F.Y.2021-22

Tax

deductions under Section 80 E:

Section 80 E of the Information Technology Act of 1961 is intended to ensure that an individual's education does not become an additional tax burden. Taxpayers are entitled to tax deductions for higher education when paying interest on a loan. You can use this taxpayer loan to fund your child's education. Only individuals who have borrowed from approved financial institutions and charitable organizations are eligible for tax credits.

Subsections of Section 80 E:

Section

80EE:

Only individual taxpayers are eligible for income tax deductions under this section, and interest payments on a loan taken by an individual to purchase residential property are eligible for deductions. In this section, you can take advantage of the maximum deduction of Rs. 3 thousand.

Tax deductions under section 80G:

Section 80G of the Income Tax Law allows taxpayers to contribute to charities by giving them tax credits on tax donations. This deduction is available to all taxable persons as long as they provide proof of payment, and the deduction limit is determined according to certain factors.

100% deductions without limits:

100% of the royalties are provided for donations to funds such as the Prime Minister's Relief Fund, the National Defense Fund, the National Sickness Relief Fund, etc.

100% deduction with qualifying limit:

Download and Prepare One by One Form 16 Part A&B and Part

B for F.Y.2021-22

Contributions made to local associations, authorities or institutions to support the development of sports and family planning are 100% deductible subject to a certain eligibility threshold.

50% deduction without qualification restrictions:

Monetary contributions made to funds such as the Rajiv Gandhi Foundation, the Prime Ministers Drought Relief Fund, etc. are subject to a 50% deduction.

50% deduction with qualifying limits:

Donations made to a faith-based organization and local government for reasons other than family planning institutions and other charities are eligible for a 50% deduction, subject to a certain eligibility threshold.

The eligibility threshold refers to 10% of a taxpayer's total gross income.

Subsections of Section 80G:

Section 80G of the Income Tax Act of 1961 has been divided into the following four categories for ease of understanding:

Section

80GG:

Those individual taxpayers who do not receive rental housing allowance are entitled to this deduction from the rent they pay, subject to a higher deduction equal to 25% of total income received or Rs. 2000 per month. You may claim the lesser of these options as a deduction.

Download and Prepare One by One Form 16 Part B for F.Y.2021-22

Local individual taxpayers with disabilities may claim tax deductions under Section 80 U. Maximum deduction of Rs. 75,000 per year is eligible for persons with a Person with a Disability (PwD) certificate from an appropriate medical institution. Persons with severe disabilities are eligible for a maximum deduction of Rs. 1.25 lakh depending on certain criteria they meet. Some examples of disabilities that qualify for tax credits include cerebral palsy, mental retardation, autism, etc.