Form 16 is a tax or payroll certificate for employees

issued by the Department of Income Tax of the Government of India. This

certificate contains comprehensive information about the employee's wages,

including tax deductions made by the payer or employer in a given financial

year.

What is Form 16?

Form 16 is essentially a tax certificate or document issued

to resident employees of India

Download and Prepare at a time 50 Employees for the Form 16 Part B for the Financial Year 2021-22

Form 16 is commonly referred to as a "salary

certificate". This certificate contains comprehensive information about

the employee's wages, including tax deductions made by the payer or employer in

a given financial year.

Form 16 Income Tax Components

For an employee, Income Tax Form 16 is the most important

tax document. Document Form 16 consists of two parts.

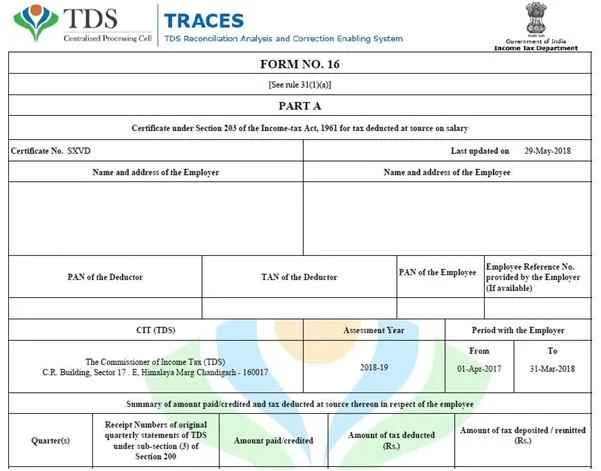

Part A

Part A contains a summary of tax deducted by an employer or

organization from an employee's paycheck and deposited on behalf of the

employee with the IT department. This certificate is signed by the organization

or employer and serves as proof that the employer or organization withheld

income tax at source, that is, from the employee's salary, and transferred this

amount to the IT department.

Download and Prepare at a time 50 Employees Form 16 Part A&B for the Financial Year 2021-22

Details mentioned in Part A include:

Personal information about the employer and employee. This

includes employer and employee names, addresses, PAN data, and employer TAN data.

The TAN or tax account number is the number assigned to the account that is

used to collect and withhold taxes. These details allow income tax authorities

to analyze cash flows from an employer's account to an employee's account.

Note. An organization is not eligible to collect TDS if it

does not have a TAN. In such cases, Form 16 is not issued.

The assessment Year is the specific year in which the taxpayer's income will be assessed. Simply put, this is the specific year that the taxpayer applies for an income tax return. For example, income or wages received between April 1, 2019, and March 31, 2020, are subject to assessment in 2020-2021. The estimated year is therefore 2020-21.

The period of employment of

an individual in the organization during a given financial year

Summary of paid salary

Date of collection or withholding

of tax

Details of quarterly tax

credits and tax deposits at the Department of Income Tax

The date the tax was credited

to the TAN account

Confirmation number

associated with the payment of the TDS amount

The BSR Code of the bank from

which the payments were made and the following Challan numbers.

Part B

This section, in essence, is a summary sheet of information about the total wages paid for a given year, other sources of income declared by an individual to the organization, taxes due and amounts of taxes paid. The information is provided in an orderly and comprehensive manner in the prescribed form. Part B of Form 16 lists the employee's total income and related deductions and benefits. All names and contact details of employees and employers are also listed in this section.

Download and Prepare at a time 100 Employees Form 16 Part B for the Financial Year2021-22

Total Wage Received: The salary

structure is divided into different components, which include bonus, vacation

pay, vacation pay, rental housing allowance, and others.

Eligible Benefits: Pursuant to

section 10 of the Income Tax Act of 1961, employee benefits such as HRA or

rental housing, transportation costs, housing and school expenses with

children, medical care, etc. are mentioned in Part B of Form sixteen.

Gross Income:

The total annual salary received by the employee and other sources of income (eg property/household income, etc.) is reported by the individual employee to the employer. Details of the additional source of income must be provided to the employer when employees submit their proof of investment for deductions.

Salary Deduction: Deductions under section 80C/80CCC/80CCD of the Income Tax Law include contributions to tax saving schemes or instruments such as Sukanya Samriddhi, pension, life insurance policy, tax saving mutual funds and government pension funds. The maximum exemption limit is INR 1.5 lakh.

Download

and Prepare at a time 100 Employees Form 16 Part A&B for the Financial Year

2021-22

Net taxable income: Total tax

credits are summarized in "Chapter IV-A" and the amount is subtracted

from gross annual income to determine total taxable income. The individual's

tax liability is calculated on this taxable amount.

Co-payments and educational fees,

if any

Assistance under section 89, if

applicable

Section 87 rebate if eligible.

Tax decision and refund of tax or

tax balance payable

Benefits of Form 16

Form 16 can be useful in many ways.

Here are some of the uses and benefits of Form 16.

File a tax return

Form 16 contains a detailed

breakdown of the components of your salary. The income information on Form 1

will help you file your tax return. You can refer to it when submitting

declarations.

Check deposited TDS

Employers or a tax officer can only

issue a Form 16 after filing a TDS with the government. Therefore, Form 16 can

be used as evidence that your employer or tax officer has filed a TDS with the

government.

Loan and credit card applications

Download

and Prepare One by One Form 16 Part A&B and Part B for the Financial Year

2021-22

Form 16 is of two types, depending

on the person's source of income:

Form 16A

When tax or TDS is deducted from an

employee's wages by an employer, the employer issues Form 16. Form 16A is

issued when tax is deducted from income in addition to wages.

This form details your total income from additional sources and the resulting tax deducted from that income and deposited in your PAN. It also contains name details, deductor/deductor contact details, deductor's TAN details, PAN details, and Challan details of the deductor's deposited TDS.

Download and Prepare One by One Form 16 Part B for the Financial Year 2021-22

This TDS certificate is issued for deductions made on the sale of real estate. Form 16B reflects the amount of TDS deducted from the total sale amount and is paid by the buyer to the IT department. The buyer is required to deduct 1% as TDS from the total sale price of the property at the time of sale. The buyer must then deposit the amount received under the TDS with the Income Tax Department and provide the seller with Form 16B as proof of the tax deposit.