Excel Form 10E - Withholding Salary A.Y 2023-24 Calculator of Benefits for Rebate under Section 89(1) Income Tax Act 1961 - Download

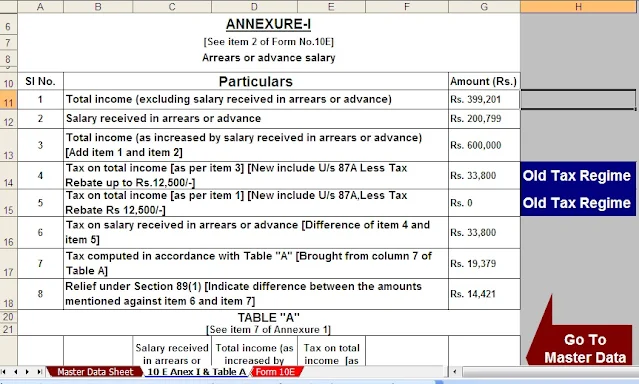

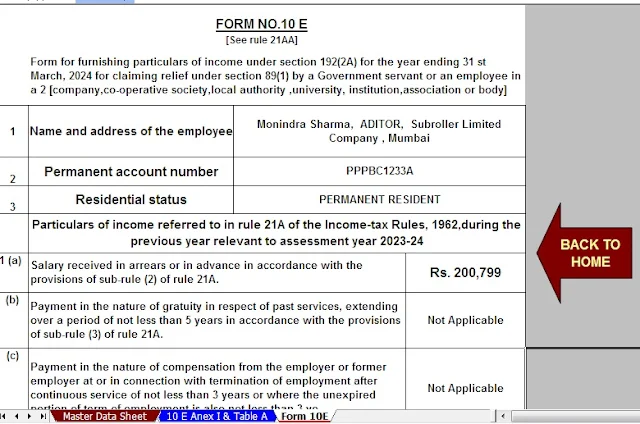

Under section 89(1) of the Income Tax Act 1961, an exemption from income tax was granted when an employee received late or advanced wages during a financial year. Under rule 21AA of the Income Tax Rules of 1962, Form 10-E was prescribed for benefits.

Subject to the above rule, if the worker is a government employee or an employee of a company, cooperative, municipality, university, institution, or association of bodies, he/she may, to claim compensation, file Form 10E with his/her employer, who is responsible for paying wages, as stated in subsection (1) section 192 of the Income Tax Act 1961

In all other cases, a person who is assessed as requiring an exemption must file a Form 10E application with their income tax inspector. An exemption under section 89(1) is permitted in the assessment year in which the employee received the delay or advance.

Wage reviews, especially in the public sector, have become commonplace. Since independence, the government has set up six payment commissions. Retroactive recommendations from each committee led to wage delays.

The reason for this section 89 benefit is that due to the payment of past due or advance wages received in a given fiscal year, the employee's income for that fiscal year is increased by the amount owed or advanced. As a result, the worker's earnings are taxed at a higher rate than the rate at which his earnings would have been taxed were it not for such delays or advances.