Interest deduction u/s 80TTB | Old age is usually accompanied by many questions and problems.

Health is one of the main factors. Dealing with health issues while managing finances can be a little

tricky. The government has recently taken steps to make life easier for the elderly.

The 2018 budget includes several

very important measures that will benefit older people. The introduction of

Section 80TTB is proof of this. This new section allows seniors to claim tax

credits of up to INR 50,000 on specific interest earned during the tax year.

The section applies to persons who

qualify as senior citizens. Most people are over 60. To take advantage of the

benefits, people must be not only senior citizens but also residents of

Taxpayers can deduct any amount up

to INR 50,000 on specified interest earned during the year. The amount will be

deducted from your gross income. Below is a list of the specified percentages

that you can claim in this section.

Any interest you earn on bank

deposits, whether it's term deposits or savings accounts.

Any interest you earn on deposits

made at the post office.

Any interest you earn on your

deposits with a cooperative society affiliated with banking institutions, a

cooperative land development institution or a cooperative land mortgage

institution, etc.

Exceptions under

Section 80TTB

Although Section 80TTB is intended

to help reduce the tax burden on older people, it does not apply in all

scenarios. Here are some situations where a section would not be good.

If any deposits belong to partner

companies.

If any deposits belong to an

association of persons (AOP).

If any deposits are owned by a

group of individuals (BOI).

If an individual belongs to any of

the above organizations, they are exempt from Section 80TTB.

Difference between

80TTA and 80TTB

Section 80TTA deductions are very

similar to Section 80TTB, with some minor differences. Section 80TTA allows

deductions if the interest earned is in savings accounts. You can keep a

savings account at a bank, post office or cooperative bank. The deduction is

then deducted from the gross income of the individual or Hindu undivided family

(HUF). The maximum allowable deduction is INR 10,000.

Here are the main

differences between both sections.

|

Particular |

Section 80TTA |

Section 80TTB |

|

Authenticity |

Applicable to individuals or HUF but not senior citizens. |

Applicable only to senior citizens. |

|

Type of Income |

Interest earned on a savings account. |

Interest is earned on various types of deposits. |

|

Deduction Amount |

INR 10,000 |

INR 50,000 |

One of the main differences between sections 80TTA and 80TTB

is their applicability. Until the 2018-2019 financial year, the Section was

open to all. That is, anyone will qualify for the deduction, individuals, the

elderly, super-elderly people. However, starting in the fiscal year 2018-2019,

seniors will no longer be able to claim deductions under section 80TTA.

Sections 29 and 30 of the 2018 Finance Act

Section 29 of the Finance Act 2018

seeks to amend section 80TTA. The clause applies to any taxpayer, individual,

or HUF whose gross income for one calculation year includes interest earned in

a savings account.

Under the proposed change,

taxpayers using Section 80TTB will no longer be able to enjoy the benefits of Section

80TTA. The change took effect on April 1, 2019, making it applicable for the

2019-2020 assessment year and beyond unless amended.

Clause 3 of the Finance Act 2018

aims to introduce a new section to the Income Tax Act, namely section 80TTB.

This section will focus solely on earned interest and is intended for seniors

only. Under the new section, if a senior citizen taxpayer's gross income

consists of interest earned in any of the following ways, they will be eligible

for a deduction of up to INR 50,000 per tax year.

Interest received through any

banking institution. Mostly institutions to which the Banking Regulation Act of

1949 applies.

Any deposits made with banks or

financial institutions are specified in Section 51 of the Banking Regulations Act

1949.

Deposits are made to cooperatives

that carry out banking activities.

Deposits made to mortgage

cooperatives.

Deposits are made to cooperatives

involved in land management.

Deposits made at a post office or

as defined in Section 2 of the Post Office of India Act 1898.

And it should be noted that deductions are available for use as long as they do not belong to a group of persons, an association of persons or companies. The section is presented exclusively for pensioners. Therefore, they can no longer claim deductions under section 80TTA.

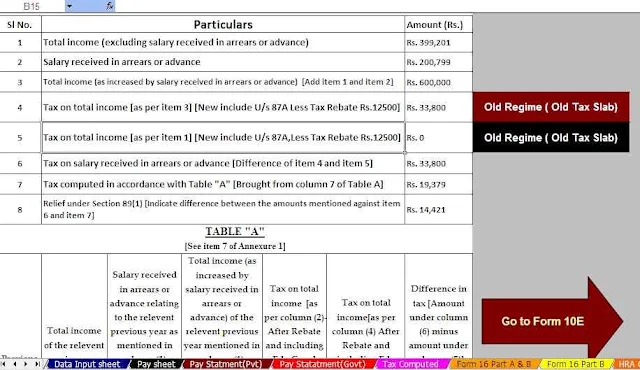

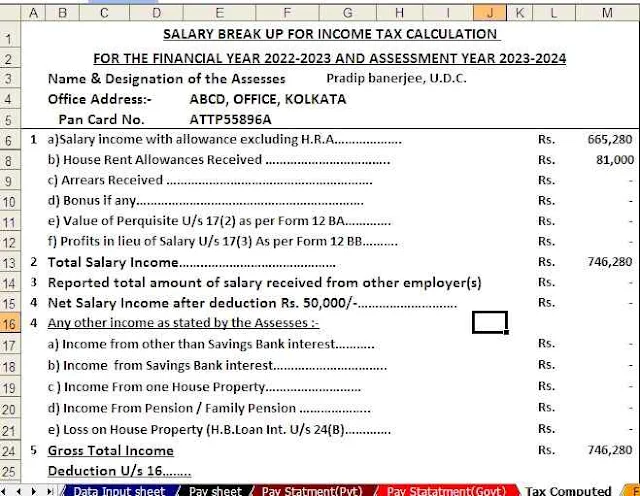

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2021

3)

Automated Income Tax Form 12 BA

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10)

Automatic Convert the amount in to the in-words without any Excel Formula