Download Form 16

1.

Fundamentals of Form-16

As we discussed above, Form-16 is a certificate that

is issued by the employer until June 15, after the end of the financial year.

Form-16 has two parts: part A and part B.

Note. If an employee loses the Form-16, he may request

a duplicate of the Form-16.

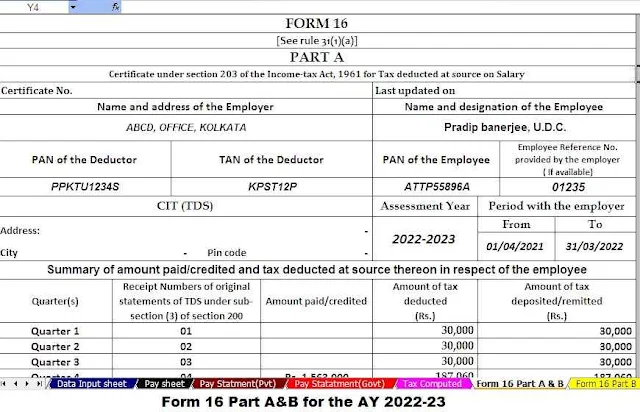

2. Part A of form 16

Using the TRACES Portal

(https://www.tdscpc.gov.in/app/login.xhtml), an employer can create and upload

a TRACES Form-16. Before issuing a certificate, the employer must cross-check

the contents of Form-16. Please note that if you change jobs during the

financial year, your employer will issue a separate Form-16 Part A for the

period of employment. The main components of Part A of Form16 are:

Name and address of the employer

TAN of the employer

TAN of the employer

PAN of the employee

Confirmed tax amount deducted and filed quarterly by

an employee

Download Automated Income Tax Form 16 Part B for the Financial Year 2021-22(This Excel Utility can

prepare One by One Form 16 Part B)

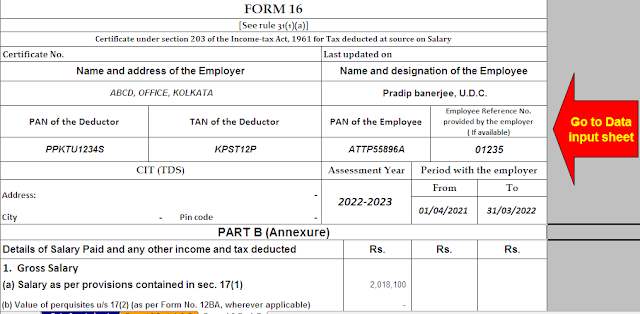

3. Part

B of form 16

Form 16 Part B is an attachment to Part A. Also note

that if you change jobs between fiscal years, you can request Form 16 Part B

from both your employer and former employer. The main components of Module 6,

Part B are:

Detailed pay break

Detailed break in exempt allowances u/s 10

An income tax deduction is permitted under the chapter VI-A of the Income Tax Act.

Here are the fields that are notified about

deductions:

A life insurance premium paid, PPF contribution, etc., U/S 80C

Contribution to PF U/S 80C

Employee's contribution to pension fund Under Section

80CCD (1)

Taxpayer's Contribution to a U/S 80CCD Claimed

Retirement Scheme (1B)

Employer's contribution to a pension fund U/s 80CCD(2)

A medical insurance premium is paid in the amount of

Rs.25000/-.

Interest on a loan taken for higher education U / S80E

Total donations to specific foundations or charities

U/S 80G

Savings account interest U/S 80TTA

Download Automated Income Tax Form 16 Part A&B for the

Financial Year 2021-22(This Excel Utility can

prepare One by One Form 16 Part A&B)

4. Form

16 data required for tax filing.

Here is a list of details that you need to take from

form-16 to file a tax return:

Benefits exempted under Section 10

Violation of U/S deductions 16

Income from the boss's salary

Eligible income/loss from employee homeownership

offered for TDS

Input from other sources offered for TDS

Section 80C Breach of Deductions

Section 80C Cumulative Deductions

Due refund or tax payable

Other information that can also be used when filing an

ITR

Amount of TDS withheld by the employer

Employer's TAN data

Name and address of the employer

Employer PAN data

Current assessment year

Name and address of the taxpayer

TIN of the taxpayer

Download Automated Income Tax Form 16 Part B for the Financial Year 2021-22(This Excel Utility can

prepare at a time 50 Employees Form 16 Part B)

Enter your name (taxpayer), address and TIN. You can

also find additional information about your employer on Form 16 when filing

your annual return, such as:

TDS is held by the employer

TIN of the employer

TIN of the employer

Name and address of the employer

Current assessment year

Your personal number

Download Automated Income Tax Form 16 Part A&B for the

Financial Year 2021-22(This Excel Utility can

prepare at a time 50 Employees Form 16 Part A&B)

What is

the eligibility criterion for Form 16?

Under the rules issued by the Ministry of Finance of

the Government of India, any employee whose income falls under the tax bracket

can apply for a Form 16.

If the employee's income is outside the established

tax limits, the tax does not need to be deducted at source (TDS). Therefore, in

these cases, the company is not required to provide Form 16 to the employee.

However, these days, as a good work practice, many

organizations issue this certificate to an employee because it contains a

summary picture of a person's income and has other additional features.

What to

Look for When Testing Form 16

Once a person receives a Form 16 from their employer,

it is their responsibility to ensure that all details are correct.

You must check the details on Form 16, such as the

amount of income, TDS deducted, etc.

If any of the details are incorrect, you should

contact your organization's HR/Payroll/Finance department immediately and have

the same corrected.

The employer will then correct their termination by

filing a revised TDS application to credit the TDS amount against the corrected

PAN. After processing the revised TDS return, the employer issues an updated

Form 16 to their employee.

Download Automated Income Tax Form 16 Part B for the Financial Year 2021-22(This Excel Utility can

prepare at a time 100 Employees Form 16 Part B)

FAQ

How to

get from 16?

Your employer gives you Form 16 | Even if you quit

your job, your employer will provide you with Form 16.

I don't

have a form 16. How do I file a declaration?

While this is one of the most important forms of

income tax, don't worry if you don't have one. You can file a tax return.

If TDS

is not deductible, should the employer issue a Form 16?

A Form 16 TDS certificate is issued when the TDS has

been issued. If your employer has not deducted TDS, they may not provide you

with Form 16.

Can the

employer write off the TDS and does not issue a certificate?

Any person responsible for paying wages must deduct

TDS before making payment. The Income Tax Law states that any person who

deducts TDS from a payment must provide a certificate with the TDS data

deducted and recorded. In particular, the employer is required to provide a certificate

in form 16.

Download Automated Income Tax Form 16 Part A&B for the

Financial Year 2021-22(This Excel Utility can

prepare at a time 100 Employees Form 16 Part A&B)