Tax Saving Tips |

1. Sukanya Samridhi Yojana (SSY)

Has become one of the most

important tax-saving schemes is Sukanya Samriddhi Yojana. It was launched in

2015 by the Government of India as part of the Beti Bachao Beti Padhao

campaign. This had a great impact on the general public. The scheme allows

fixed-income investments, through which the taxpayer can invest regular

deposits and at the same time earn interest on them. An investment in Sukanya

Samriddhi Yojana is also considered an eligible deduction under section 80C of

the Income Tax Act.

The Government of India sets the interest rate on the scheme quarterly, which must be paid at the end of the term. The scheme has a fixed period of 21 years and expires after 21 years. Minimum deposit Rs. 250 is required to be done per year for 15 years. Failure to pay the minimum amount within one year will result in account termination. To reactivate your account, you must pay a fine of 50,000 rubles. 50 along with the original Rs. deposit 250 rubs.

You may also like- Automated Income TaxForm 16 Part B for the F.Y.2021-22[This Excel

Utility can prepare at a time 50 Employees Form 16 Part B]

To open a Sukanya Samriddhi

account, below are the eligibility criteria for this tax savings option:

Only girls can claim the benefits

of this scheme.

The girl was less than 10 years

old. There is a grace period of one year that allows a father to invest 1 year

of a 10-year-old daughter.

The investor must provide proof of the

daughter's age.

2. National Savings Certificate

An initiative of the Government of

India, the National Savings Certificate is a fixed-income investment scheme

designed for small and medium-sized investors to invest and earn significant

returns. It is considered a low-risk investment and is as safe as the Reserve

Fund.

Investments in NSC are deductible under section 80C of the Income Tax Act up to Rs. 1.50k. In addition to the tax exemption, it provides the investor with full capital protection and interest guarantee. The following are some of the features of the NSC tax savings option:

The interest rate of 6.8% per annum

is a guaranteed income.

You can claim tax credits under

section 80C up to Rs. 1.5 l

You can invest from Rs. 1000 (or a multiple of 100 rupees). You can increase the investment amount as you see fit.

At the end of the term, the entire

repayment amount will be received by the investor and will be taxed in the

hands of the taxpayer.

Early check-out is not possible.

You can use the same as collateral in case of bank or NBFC loans.

3. Savings deposit with a fixed tax

Term deposits are considered one of the safest tax-saving schemes. It is safer than investing in stocks in terms of risk and return. Banks decide on interest rates, and this depends on several factors. The following are some of the features of a term deposit to save taxes:

An investment in a flat tax savings

deposit that is deductible under Section 80C in calculating taxable income.

Minimum blocking period 5 years

Older people can get a higher

interest rate on investments

In the case of a joint account, the main owner can take advantage of a tax deduction when calculating taxable income.

Savings deposits with a flat tax do

not allow early withdrawal. However, after the 5-year lock-up period, investors

have access to early withdrawals. Early withdrawal conditions vary from bank to

bank.

4. Savings scheme for the elderly

The Senior Citizens Savings Scheme

is an income tax savings scheme available to seniors residing in

Contributors can make investments

with a minimum amount of Rs. 1000 and its multiples. The scheme also offers the

possibility of cash investment if the investment amount is less than Rs. 1

million. Deposits made under the scheme are payable after 5 years. Depositors also

have the option to extend the repayment period for another 3 years.

Investment in the Seniors Savings Program qualifies as a deduction under section 80C up to Rs. 1.5 lakh of taxable income. The interest on these deposits is fully tax-deductible and is tax-deductible if the interest exceeds Rs. 50,000. Deposits made to the Senior Savings Account are cumulative and paid annually.

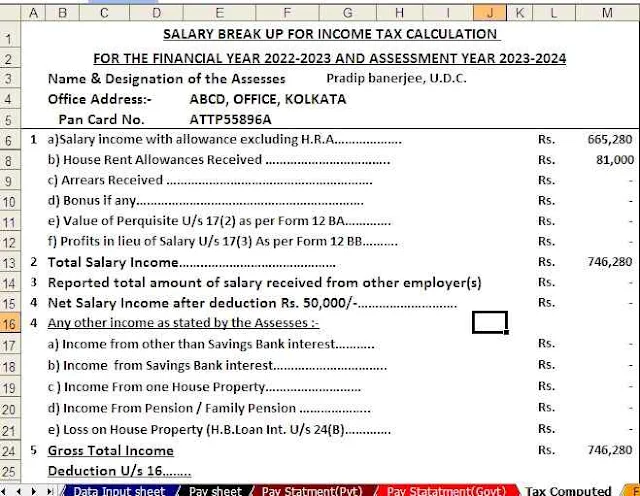

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

employees Salary Structure.

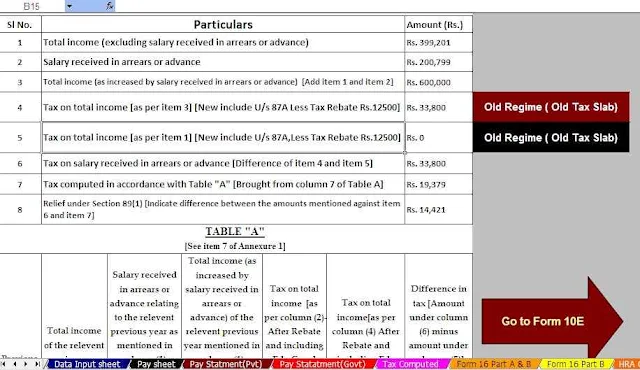

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23

.jpg)