Download 89(1) Arrears Relief Calculator From F.Y.2000-01 to F.Y.2022-23|If you are in arrears in the

2022-2023 tax year relating to the previous year(s), then your tax liability will be higher due to the

arrears, but you know that you can split out your delayed income in the relevant years on a national

basis and may avail of an exemption under section 89(1) of the Income Tax Act 1961.

The reason for providing this

benefit under section 89 is that due to the payment of past due or advance

wages received in a given fiscal year, the employee's income for that financial

year is hiked by the amount advanced. In fact that a result, the employee's

earnings are taxed at a higher rate than the rate at which his earnings would

have been taxed were it not for such delays or advances.

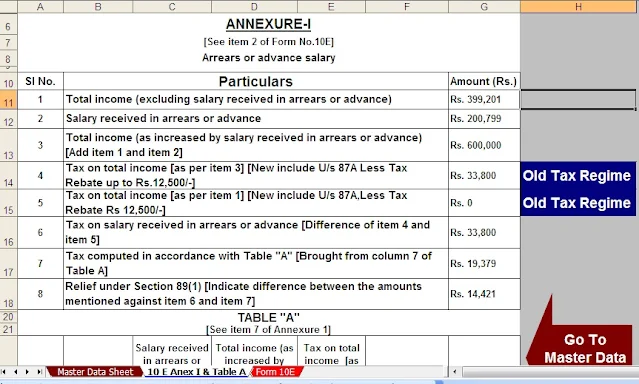

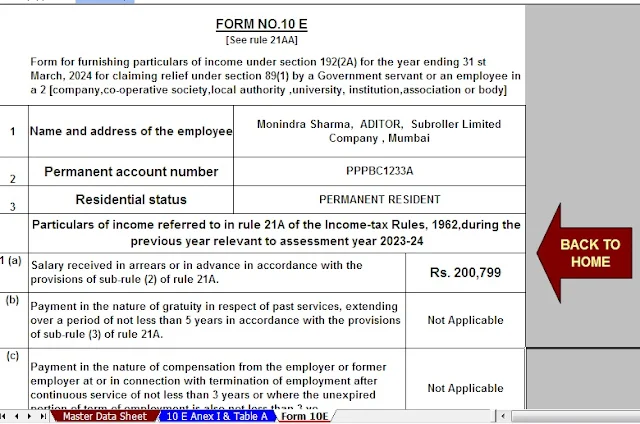

We have prepared a small Excel calculator that will be useful to calculate the write-off under section 89(1) of arrears received in the financial year 2022-23 and the debt is related to the maximum before the financial year 2000-01 through the financial year 2022-23.

How it works

This calculator shows two income

tax calculations, one is a tax based on wages/debts received and the other is a

tax based on qualifying years, if the tax based on the receipt is greater than the

tax due based on qualifying years then section 89 exemption (1) will be

available, otherwise, nothing will be available, which means there is no

benefit from debt allocation in the respective years.

How to use. Note/Frequently Asked

Questions on Using the Calculator

You must complete only the white

column. If the arrears are in years other than those listed on the sheet, put

zeros in the remaining optional years.

All white cells are optional, fill

in only those that are required. Insert a zero where numbers are not needed

Fill in M for men and F for women

and S for Mr Citizen and N for the new article 115 tax regime (calculator does

not work for very old retirees). You must choose a status each year. Make sure

the status is correct

Complete total income excluding

debt, including all other income and after all deductions such as section 80C,

80CC, 80D, 80G ...........80U, etc.

Complete the annual breakdown of

the arrears received for the fiscal year 2022-2023 in the respective years. The

total will automatically be shown in the fiscal year 2022-23.

The debt column (C-11 of the spreadsheet) in FY 2022-23 is protected and cannot be edited, if you received debt related to FY 2020-21 in FY 2022-23 itself, then you are not covered by the definition of debt and should be included in total income for 2022-2023 (Spreadsheet C-10).

The result is disregarded, if total A > total B, then relief will be taken in accordance with section 89(1), otherwise 0 will be shown. An additional form 10E will also be automatically completed with the appropriate annexe, including table-1.