Save tax on Income for the A.Y.2023-24|For most people, paying income tax at the end of the tax year

is a difficult task. Much of the fuss revolves around scheduling insurance, rent, and other receipts in

such a way as to result in the lowest tax liability possible.

Income tax planning doesn't have to be a difficult task if you carefully consider every aspect of your income. While some of the tax-saving methods are very common, if you are in a higher tax bracket, you can turn to non-traditional methods to maximize your savings.

Invest more in the National Pension Scheme

If you are an NPS subscriber, you may qualify for tax credits under section 80CCD(1) with a general cap of Rs. 1.5 varnish according to Sec 80 CCE. What you may not know is that you can claim an additional Rs 50,000 deduction under Section 80CCD(1B) Income Tax. So, to save on taxes, increase your contribution to the national pension system.

Download Automated Income Tax Challan 280 for Self or Advance tax

If you are a parent, you can claim a deduction from the amount spent on school, university, college or any other educational institution. During the financial year, the maximum tuition deduction that can be claimed along with deductions for insurance, reserve fund, pension and other investments is Rs 1.5 lakh. This exemption is for a maximum of 2 children.

Wedding gift

A wedding is a big event in

Channel your investments through your parents

Seniors are eligible for special tax credits. You can redirect your investment income if your parents are on a low income. So if you earn Rs 1 Lakh in interest, instead of including it in your taxable income for the year, you can transfer the money to them without paying taxes. You can donate this money to your parents tax-free. They can reinvest in lucrative seniors schemes such as Seniors FD, Seniors Savings Scheme and others.

Money spent on donations/charities

Tax deductions can be claimed for charities/donations and charitable endeavours. Depending on the purpose, some donations are eligible for a 100% deduction while others are eligible for a 50% deduction. However, you should keep in mind that only donations made in cash or donations by check are eligible for deductions.

PS: Cash allowed up to INR 2000

Phone and internet expenses

In accordance with Rule 3(7)(ix), telephone reimbursement provided to employees is not taxable. If your office work requires the use of a mobile/telephone/internet connection, you are entitled to a full exemption from billing.

Paying for parental health and health insurance

Section 80D allows a taxpayer to claim a deduction of up to INR 25,000. You can pay the insurance premium for yourself and your family. If you pay health insurance premiums to your parents, you may qualify for an additional u/s 80D tax credit.

Also, if your parents are not insured by any policy, you can still claim up to Rs.50,000 for medical expenses incurred during the year.

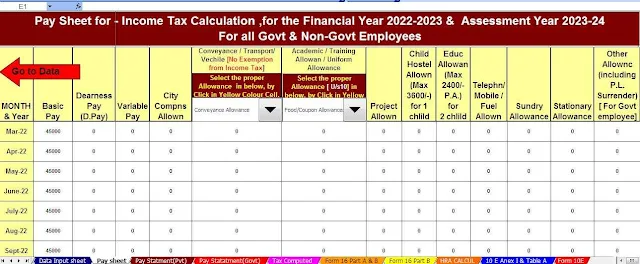

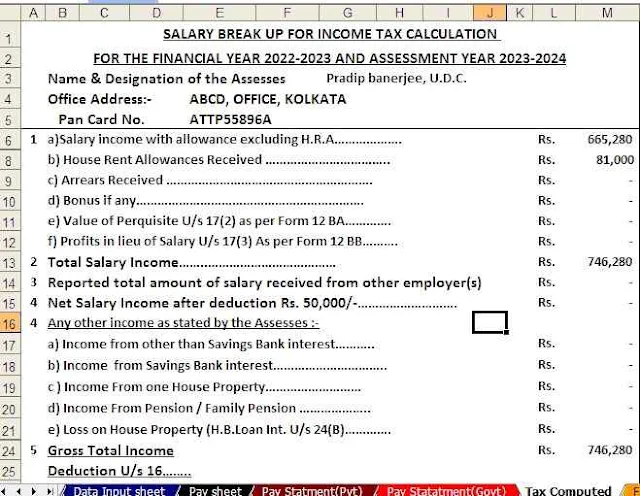

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23

.jpg)