Worried about paying huge taxes every year? Know these deductions that can reduce your tax payable.

Section 80C - Investment deductions from taxable income

Some of your investments offer more than just expected returns. You can also save on taxes. Section 80C investments are important examples of such investments. This deduction is eligible for the individual and Hindu undivided family (HUF). Deductions are available for some large investments such as:

Investments in the state pension fund (NPF)

Unit Linked Investment Plans (ULIP)

Equity Savings Schemes (ELSS)

Participation of employees in contributions to the Pension Fund

National Savings Certificates (NSCs)

Life insurance premium payment

Child education

Home loan repayment

Senior Savings Scheme (SCSS)

Maximum deduction: `1,50,000*

*The maximum deduction shown here only applies to the specific section. Also note that, in the aggregate, the maximum deduction that can be claimed under Section 80C, Section 80CC and 80CCD(1) is $1,50,000. In addition, an additional 50,000 may be claimed as a tax credit for investments in the National Pension Scheme (NPS) account pursuant to section 80CCD (1B).

Section 80 CCD - Withholding a contribution to a pension fund

It is designed to reduce the tax liability of pension plans offered by various public and private sector insurance companies. It provides a deduction to an individual who has paid or contributed an amount to any insurer's annuity plan to receive a pension (income) from a fund created by the insurer. The deduction of premium paid during the year may be claimed as a deduction from taxable income.

Maximum deduction: `1,50,000*

*The maximum deduction shown here only applies to the specific section. In addition, please note that the cumulative maximum deduction that can be claimed under Section 80C, Section 80CC and 80CCD(1) is $1,50,000.

In addition, an additional Rs.50,000 may be claimed as a tax credit for investing in an NPS account pursuant to section 80CCD (1B).

Section 80CCD. Deduction of contribution to the central government pension system.

A Section 80CCD deduction is permitted for individuals who make deposits into their retirement accounts.

The maximum deduction allowed is 10% of wages (in the case of employees) and 20% of gross income (in the case of self-employed persons) or £150,000, whichever is less. Under subsection 1B, there is an additional deduction of up to $50,000 for individual contributions to the NPS.

Maximum deduction: Rs.2,00,000*

* The maximum deduction shown here only applies to the specific section. Also note that, in the aggregate, the maximum deduction that can be claimed under Section 80C, Section 80CC and 80CCD(1) is Rs.1,50,000.

In addition, an additional Rs.50,000 may be claimed as a tax credit for investing in an NPS account pursuant to section 80CCD (1B).

Both of the sections mentioned above are related to pension plans and annuity plans. But there is a difference between them.

While Section 80CCD covers a deduction from the amount paid into an annuity plan by any insurer, Section 80CCD provides for a deduction from the amount paid into pension plans: NPS and Atal Pension Yojana.

Main

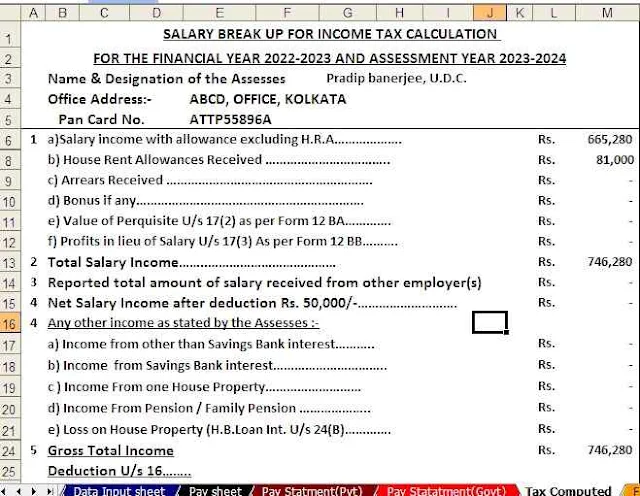

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure as per the

4) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

5) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23

7) Individual Salary Sheet

Section 80D - Deduction of premium paid for health insurance

Section 80D allows a taxpayer to deduct up to $25,000 for insurance for self, spouse, and dependent children. If the insured is aged 60 or over, the deduction is available for up to EUR 30,000. An additional insurance deduction for parents (parent or both) is allowed in the amount of 25,000 (30,000 if the parents are 60 years of age or older). You can also claim a preventive health check-up to Rs.5,000 up to the limit above.

Maximum deduction: Rs.60,000

Section 80E - Deduction of Interest on an Educational Loan Taken for Higher Education

If you took out a student loan for higher education, you can claim a tax credit under Section 80E. It applies even if the loan may be to a spouse, children, or student for whom the taxpayer is legally responsible. A deduction is permitted from the amount of interest on the loan and is available for a maximum period of 8 years or until interest is paid, whichever comes first.

Main

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure as per the

4) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

5) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23

7) Automated Income Tax Form 12 BA

You can even claim a deduction if the loan is made to fund study abroad.

Maximum deduction: no limits. The deduction is granted for 8 years.

Section 80GG - Tax deductions for paid rent for housing.

Under Section 80GG, you may claim a deduction for housing rent you paid if you did not receive Home Rent Assistance (HRA) from your wages. The taxpayer, spouse, or minor child must not have accommodation at the place of work. The taxpayer must live on rent and pay rent. In addition, the taxpayer must not have their own housing anywhere else.

The deduction under this section is available at least:

Rent paid minus 10% of the total rent

5000 per month

25% of total income

Maximum deduction: `60,000

Savings Account Interest Deduction - Section 80TTA

A deduction may be claimed under section 80TTA on interest income received from a bank savings account. Savings bank account interest must first be included in the Miscellaneous Income section when it is calculated, and the deduction may be deducted from the total interest earned or "10,000" whichever is less. Interest income on time deposits, regular deposits or interest income on corporate bonds cannot be reported under this section.

Maximum deduction: Rs.10,000

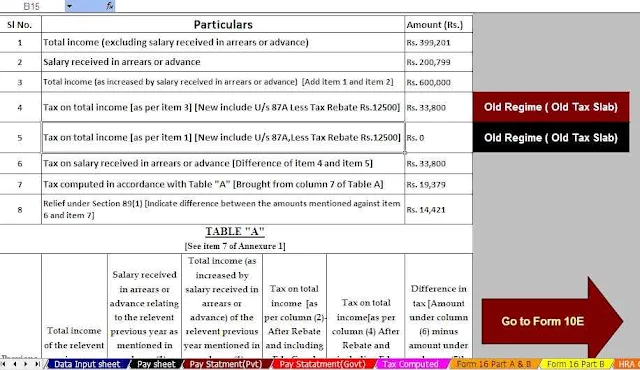

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23