What is Section 89?

Download Automatic Arrears Relief Calculator U/s 89(1) with Form 10 E | For the purposes of the Income Tax

Law, income tax is levied on the total income earned or received during the

previous year by the taxable person. There are cases when past debts are paid

to an employee in the current year as salary arrears. In this case, the income

tax payable by the employee will in this case be higher in the current year.

This may be due to a change in the flat rate applicable to the taxpayer, in

connection with which his flat rate will change to a higher tax rate.

The Section 89 tax credit allows us

to deal with this situation. Provides for an exemption if the employee is in a

higher tax bracket at the time of receiving money for previous years.

How to calculate the tax exemption

under section 89(1) for wage arrears?

Below are the detailed steps for

calculating Section 89 assistance:

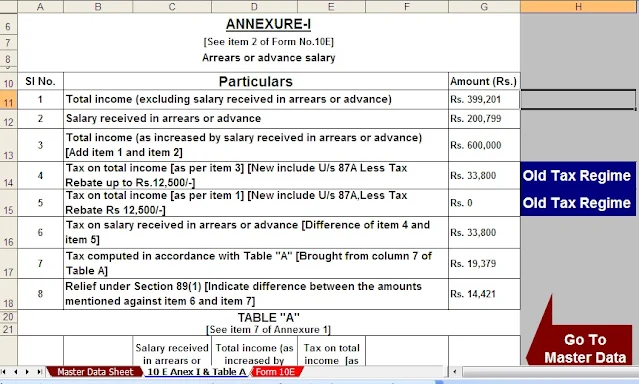

Step 1: We need to calculate the

tax due on all income, including income owed in the year it was received.

Step 2: Calculate the tax payable

on total income, excluding income owed in the year of receipt. As evidence, the

employer provides the employee with an overdue document, which will indicate

the additional amount received. This amount must be deducted from the total

salary as stated on the worker's Form 16. The calculation of the tax would give

us responsibility in case there were no delays.

Step 3: Calculate the difference

between steps 1 and 2. This will be the additional payroll tax included in your

total income.

Step 4: Calculate the tax payable

for each previous year to which additional delays apply:

By total income, including

additional debt

By total income without additional

debt

Step 5: Calculate the sum of the

difference between the amount calculated in step 4. This will calculate the

actual tax liability for any previous years for which arrears were received in

the current year.

Step 6: The amount in excess of step 3 over step 5 will be the amount of the tax exemption allowed by section 89. If there is no excess, no exemption is allowed. If the tax calculated in step 3 is less than the tax calculated in step 5, the employee does not need to apply for an exemption under section 89.