Know you’re Tax Burden for the F.Y.2022-23 and A.Y.2023-24 | As the Financial Year 2021-22 has already gone and the New Financial Year 2022-23 has started from the 1st April 2022 which will end on the month of 31st March 2023. So we called the Financial Year 2022-23 and Assessment Year 2023-24.

Now it is indispensable as well as necessary to calculate your Income Tax liability for the Financial Year 2022-23 as per the Finance Budget 2022. The New and Old Tax Regime U/s 115 has continued for this present financial year. You can change your opinion from Old to New or New to Old Tax Regime this year. Hope all of the Tax Payers are well known about this New and Old Tax Regime U/s 115 BAC.

However, we prepare an Excel Based Software for calculating your Income Tax liability for the Financial Year 2022-23 and Assessment Year 2023-24 as per the Finance Budget 2022. This Excel Based software can use by both Government and Private Employees or Concerned also. This Excel Utility is easy to generate just like an Excel File. No need for any calculation of tax which will calculate automatically as per the Income Tax Law. No need to calculate for House Rent Exemption U/s 10(13A as the software can calculate it automatically.

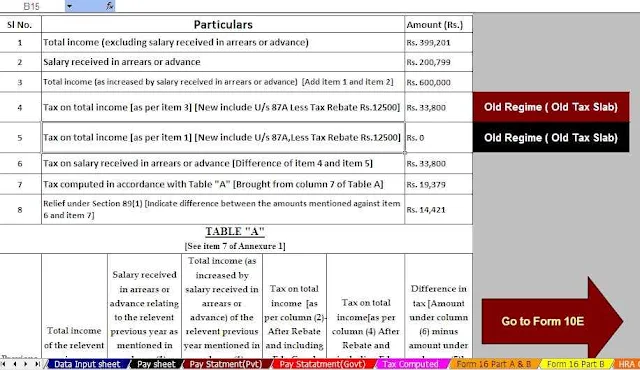

Most of the advantage of this Excel Software All in One is that the Salary Arrears Received from the previous years, you can calculate the Arrears Relief by this software as the Automated Income Tax Arrears Relief Calculator has built in this software U/s 89(1) along with Form 10 E.

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23