What is a joint home loan?

A home loan where there is more

than one borrower is called a joint home loan. Two friends cannot be

co-borrowers. In fact, banks sometimes refrain from lending to siblings unless

they co-own the property. This also happens in the case where the loan is made

with the parents as co-borrowers. It is only in the case of spouses that banks

do not require co-ownership of the said property from the co-borrowers.

Having a joint home loan is

advantageous when both co-borrowers are taxpayers. But keep in mind that to

claim income tax benefits on joint home loans, all co-borrowers must be the

co-owners. Tax benefits can be claimed in the same proportion as the loan taken

by the co-owners.

A co-owner who is not a co-borrower

is not entitled to income tax benefits. Likewise, a co-borrower who is not a

co-owner cannot claim tax benefits. Below are some examples that will make this

concept clear.

Fixed amount - Rs 75 lakhs

Loan amount - Rs 60 lakh

EMI for 20 years @ 10% p.a. (reducing) – Rs 57,901/- p.m

Case 1 – Husband (H) and Wife (W), both workers and taxpayers. H buys an apartment in his own name and to manage the EMI burden takes out a home loan with W as co-borrower. In this case, even though W is the co-borrower and contributes to the EMI, she would still not be eligible to claim any u/s 80C or section 24 tax benefit. i.e. in all years, only H can claim up to Rs 1 .50 lakh interest and 100% principal or Rs 1 lakh, whichever is less.

Case 2 – H and W both purchased a

house with 50:50 co-ownership and also jointly took out home loans in the same

proportion. In that case, H and W can claim Section 80C and Section 24

income tax benefits in equal proportion. i.e. the full payment of interest and

principal will be split evenly on H&W and both can separately claim Rs 1.50

lakh u/s 24 and Rs 1 lakh or 50% of principal, whichever is less

Case 3 – H and W acquire a house with a co-ownership of 75:25 and also take out a joint home loan at the ratio of 50:50. In that case, both H and W can claim Section 80C and Section 24 income tax benefits in proportion to loans. that is, the interest and principal payment will be split 50:50 and both H&W can claim income tax benefit only in that proportion, up to the maximum allowable limit.

Please note that in all of the above cases the tax benefits that have been discussed are for the self-occupied house. In the case of a lease or lease on the house, no principal payment, but 100% of interest payment, may be claimed under section 24 by both co-owners in proportion to their loans.

Advantages of having a common home

loan

1. A big advantage is the income tax benefit that is shared between the co-owners.

2. The second advantage is the increased chances of getting the loan and also the increased eligibility of the loan.

Disadvantages of having a regular

home loan

1. The autonomous property is one that is occupied by the owner for his own housing, and if there is any other property acquired, it will be treated as “Considered leased” and taxed accordingly. Thus, in the case of a condominium, if any of the condominium owners acquire some other property in the same city, they will be treated as “considered to leave”.

2. If any of the co-borrowers has bad credit behaviour due to which the home loan repayment is erratic, this will affect the other co-borrower's credit score as well.

3. If, due to any dispute, any of the co-borrowers refuses to repay the loan, please be advised that, in accordance with the loan schedule, the liability to repay the loan rests with each co-borrower. borrower. This means that all co-borrowers are required to pay as much as all repayments. A creditor can also sue both co-applicants to recover the debts.

4. We are all emotional beings.

Under the lure of gaining access to high credit eligibility that can help with

the purchase of a large home, we tend to forget how the EMI load will affect

other goals.

Although banks grant loans to spouses without the obligation of co-ownership, it is advisable for both spouses to have some property. Before becoming a co-applicant, make sure you own some percentage of ownership of the property. Also, if you are a co-borrower, you may be able to draw up and sign an agreement with your spouse about the division of responsibility. This is to avoid any dispute in the future.

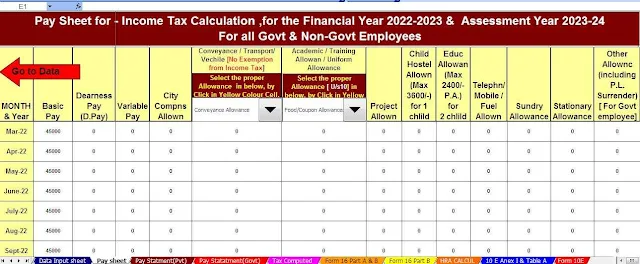

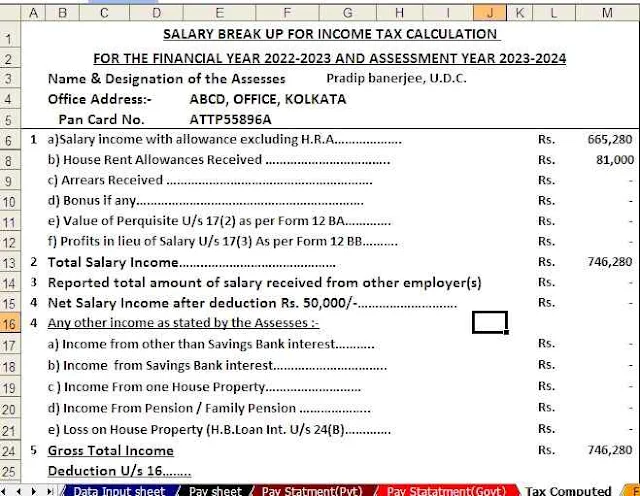

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23