All the West Bengal Government Employees are well known that the Bengal Government has not

paid the D.A.till now from the financial year 2020-21 to on-words. The Govt employees get the

benefits only the Annual Increment in the month of July of each financial year. It is too hard to listen

to the pending D.A. In this regard where the other State Government has already paid the up-to-

date D.A. as same as the Central Govt Employees. The Pending D.A. of the West Bengal Government

is @31% back to the Central Govt Employees.

If paid by the D.A.by the West Bengal Government between March 2024, then the Income Tax may hike for each State Govt Employee. As such the West Bengal Government has already declared the 6th Pay Commission since 1/2/2016. By this 6th Pay Commission hike the Pay of each and every State Govt Employees. And also hike the Tax Liability of the Govt Employees.

However, the Financial Year 2021-22 and Assessment Year 2022-23 have gone and started the New Financial Year 2022 from the 1st April 2022 and which will end on 31/3/2024 means the running financial year 2022-23 and Assessment Year 2023-24.

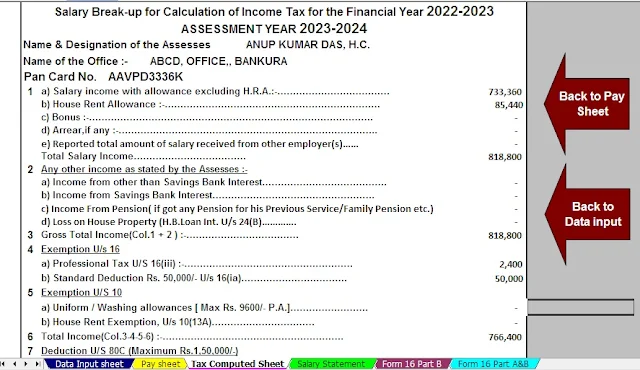

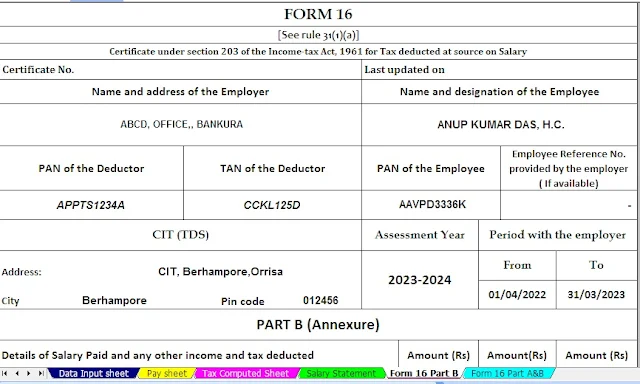

So, you should calculate your Income Tax for the Financial Year 2022-23 and assessment Year 2023-24 and you can plan your Tax Savings Idea. For the easy calculation by this site prepare a Unique Excel Based Software All in One only for the West Bengal State Employees for the Financial Year 2022-23. With this software, you can calculate your actual Income Tax Liability with prepare at a time Income Tax Form 16 Part A&B and Part B and Auto calculate Exemption of House Rent U/s 10(13A) as per the New Finance Budget 2022.

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for

4 Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23

7) Individual Salary Sheet