Where the tax payable by a person exceeds Rs 10,000 after deducting the original TDS it comes into

play. Challan280 has been cleared by the IT department for early payment of taxes. It can be paid

online using the link https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp and click on

Challan no./ITNS 280 tab.

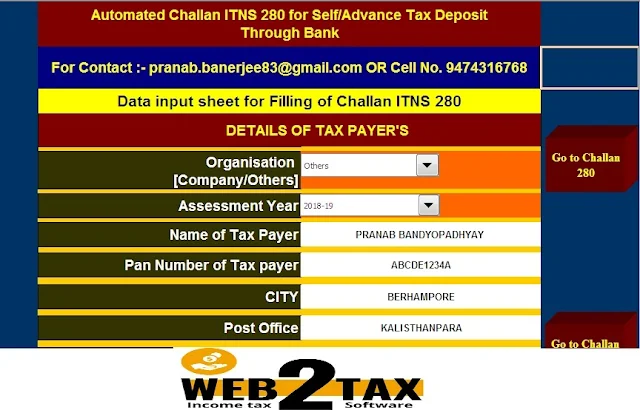

Download the Automated Income Tax Challan 280 in Excel

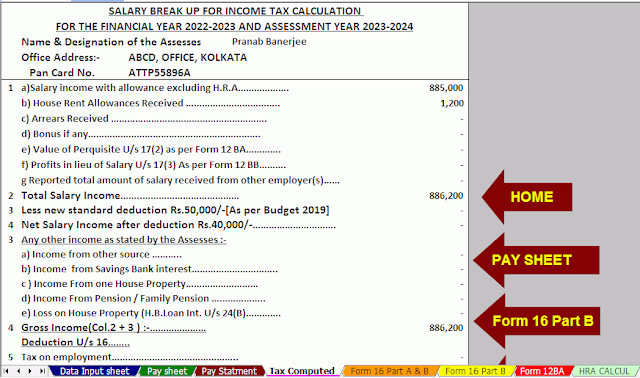

Advance taxes are paid by those who have a source of income other than their salary. Individuals who earn from rentals, capital gains from shares, fixed income, lottery winnings, etc., can pay taxes early. Advance taxes are also known as ‘Pay as you earn schemes and can be paid online or through certain banks. Tax is payable if your taxable turnover exceeds Rs 10,000 in a single financial year. As per law, taxes must be paid in the same year the money is received.

Expiration date:

- 15% of the prepaid tax must be paid on or before June 15 of the financial year.

- 45% of the prepaid tax (minus prepaid taxes) is due on or before September 15th.

- 75% of prepaid taxes (less prepaid taxes) are due on or before December 15th.

- 100% of prepaid taxes (minus prepaid taxes) are due on or before March 15th.

In the case of taxpayers who opted for the presumptive tax scheme, 100% of the advance tax is due on or before March 15 of the financial year.

Where the tax payable by a person exceeds Rs 10,000 after deducting the original TDS it comes into play. If the advance tax is not paid within the due date, interest is chargeable to tax in accordance with the provisions of the IT Act.

How do you pay?

Challan 280 has been cleared by the IT department for early payment of taxes. It can be paid online using the link https://onlineservices. tin.egov-nsdl.com/etaxnew/tdsnontds.jsp and click on Challan tab no./ITNS 280. Next, select the “advance tax” option and pay through net banking or debit card. After the payment, the tax receipt is displayed on the screen. Download and save it with you for future reference.

Who should pay taxes early?

The eligibility criteria for paying taxes early are:

• Your tax credit must be Rs 10,000 and above.

• Income generated through capital gains on shares.

• Interest earned on deposits.

• A victory gained from a lottery.

• Rent or income received on household goods