LTA – Tax benefits| Leave Travel Allowance is one of the best tax-saving tools available to an

employee. It’s a tax exemption that employers offer their employees. Leave Travel Allowance, as the

name suggests, is an allowance paid by an employer to an employee when the primary travel with the

family or on their own. The amount paid as Leave Travel Allowance is tax-free.

What is a leave travel allowance?

Leave Travel Allowance or LTA is a form of subsidy provided by employers to an employee to travel. Covers domestic travel expenses while on sick leave.

Section 10(5) of the Income Tax Act 1961 in Rule 2B guarantees tax deduction and also details the items to be deducted from tax. There are certain provisions relating to a tax deduction which are expressly mentioned in Section 10(5) of the Income Tax Act, 1961.

Latest Update:-

The travel license subsidy does not apply

to Taxpayers who elect the New Tax Slab.

Below is a list of expenses excluded from the Leave

Travel Allowance

Air Travel- Economy flight fare will be deducted for the shortest route or cost incurred which is less.

Travel by Rail: First Class A.C. for a shorter route or travel expenses shall be exempt, whichever is less.

The place of origin and destination of the journey is connected by rail but the journey is made by other modes of transport

The place of origin and destination is not connected by rail (partially/fully) but are connected by another approved public transportation system

The place of origin and destination is not connected by rail (partially/wholly) and is not connected to any other recognized public transportation system as well.

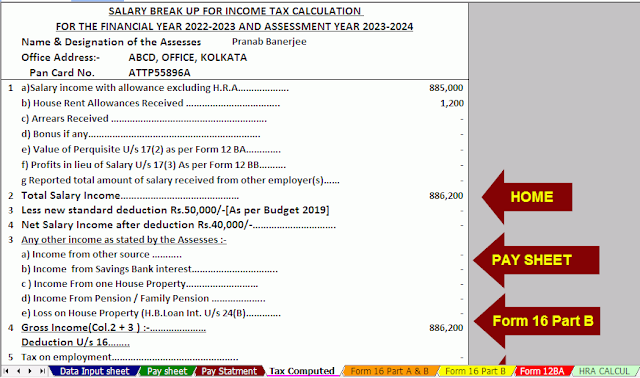

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2022

3)

Automated Income Tax Form 12 BA

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

10)

Automatic Convert the amount into the in-words without any Excel Formula

Calculation of Vacation Travel Allowance

An employee can claim LTA for two trips in a block of four years. These block years are different from financial years and are prepared by the Income Tax Department. Currently, we have a block year from January 1, 2014, to December 31, 2017. In this block year, an employee can claim LTA for two trips made during 2014-17, however, if the employee does not make any claim, then the exemption carries over for the next year and not to the next block. Only travel or ticket expenses are considered for exemption, all expenses incurred for stay, meals, sightseeing, etc. are excluded. is not eligible for LTA.

LTA deductions applied

Depending on the salary structure, you can claim LTA exemption only up to a certain point. LTA can be claimed in the following cases:

Air Travel - When the destination is booked by air, an exemption is allowed for domestic airline economy class ticket rates.

Travel by rail: when the destination is also connected by rail, exemption of AC first class tickets is allowed

Travel by Other Mode of Transportation: If the destination is not covered by air or rail, an amount equivalent to the fare of First Class, Premium or AC 1st Class, whichever is less, may be claimed for the departure of the LTA.

LTA deductions will only be considered for the shortest round trip. If an employee is entitled to an LTA amount of Rs 30,000 but claims only Rs 20,000, the deduction applicable to LTA will be Rs 20,000 and the remaining Rs 10,000 will be added to his income, which will be payable for the obligation. tax.

LTA tax refund

In cases where you are unable to make an LTA claim within the year, you can roll it over to the following year. However, the LTA exemption is not included in the filing of the income tax returns. Your employer will issue an acknowledgement of your LTA claim and attach it to Form 16.

LTA restrictions

There are certain restrictions when it comes to travel allowance by license. Key restrictions applicable to the Holiday Travel Allowance are detailed below.

Vacation Travel Allowance applies only to travel expenses.

The individual can travel as far as

The individual must retain the proof of travel as may be required for tax purposes.

The exemption from the holiday travel allowance is not available for more than two children born after 1st October 1998.

One employee claim LTA only twice in a block of four

years

If no LTA is claimed in a particular block, it can be carried over to the next block and used in the first year of the next block.

The LTA waiver also provides protection for the individual’s family. Family, under the LTA, includes the immediate family consisting of parents, siblings, spouse and children.

limitations of travel

Below are the travel limits applicable under the Holiday Travel Allowance.

The holiday travel allowance only covers domestic travel and does not cover international travel

The type of travel must be travel by air, train or public transport.

Documents required for applying for LTA

To apply for LTA, the employee has to submit the LTA form along with the travel bills. While the IT Department or the service provider is not required to verify tickets or invoices, it is recommended that you retain the tickets, boarding pass and other documents, so that they can be handed over to the LTA Claims Officer if required