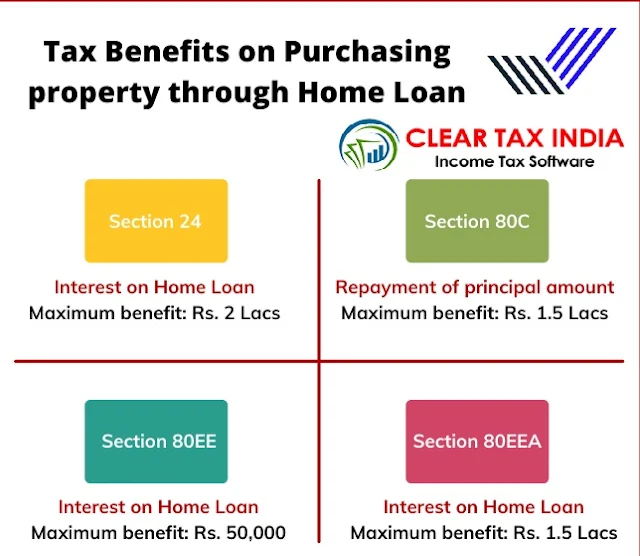

Tax Benefits on Home Loan| While purchasing a property through a home loan, one can save tax under Section 24, Section 80C, Section 80EE, and Section 80EEA of the Income Tax Act.

We are regularly asked how we can save tax on purchasing a home with a home loan. That’s why we’ve created this blog in which we focus on tax saving schemes when buying a property through a home loan.

While purchasing homes through a home loan, tax savings are available under Section 24, Section 80C, Section 80EE, and Section 80EEA of the Income Tax Act for the assessment year 2022-23. Claiming deductions under these sections can be either in the amount of principal or interest.

Who can claim a mortgage loan waiver?

The provision of the Income Tax Act makes it clear that only that person can claim the deduction of the mortgage loan against whom he owns the property and also obtains a loan in his name. In other words, the person should:

– The landlord, too

– The borrower of the loan

Announcement:

Deduction on housing loans is available only to private individuals or members of HUFs and not to others. Therefore, corporations, joint ventures, legal entities, or trusts cannot apply for mortgage loans.

Now let us get to know the whole arrangement in detail

Section 24: Exemption from mortgage income

According to the provisions of Article 24, if a person obtains a mortgage for purchase or construction, the interest paid on the principal amount of the loan is exempt from tax.

You may also like - Automated All-in-One Income Tax Preparation Software in Excel for Non-Government Employees for Financial Year 2022-23

The sub-clauses in this category are:

1. If the loan is made for a house owned by the owner, he can claim a deduction up to Rupees Two lakh or the loan amount, whichever is less.

2. If the loan is for the purchase or construction (not renovation) of the property prior to the actual purchase or completion of the property, the person may also claim the interest.

3. And claiming deduction may include payment of interest before completion of construction or purchase, in 5 equal installments, from the year of purchase of the property or completion of construction.

To take advantage of this deduction, the individual must calculate the interest payable to the bank or financial institution that lent the loan and divide it by the principal repayment. Also, it does not matter if there is an actual payment of a certain amount to the investor - one can get a deduction for the full annual amount of interest.

You may also like- Automatic Income Tax Salary Arrears Relief Calculator U/s 89(1) in Form 10E from F.Y 2000-01 to F.Y 2022-23 (Updated Version)

Conditions for claiming deduction under section 24

• First, the individual must have purchased or completed the construction of the property within 5 years (3 years to F.Y 2015-2016) from taking out the loan in order to claim the higher interest deduction on the loan.

• Second, the mortgage loan date is April 1, 1999, or later

• Finally, the individual must have proof of creditworthiness.

Certain exceptions to section 24

• If a person is not domiciled because he lives in another city for work or business and lives in another residential or rental property in the city where he works, he can still claim a tax deduction on the interest paid up to Rs. 2 million.

• There is no deduction for agency fees or commission for loan modification or tenant.

Section 80C: Exemption of household expenses in favor of the Chief

Section 80C provides for deduction from the payment of the principal of the relevant financial year. Further, the amount of deduction under Section 80C is principal or Rs. 1 50,000, whichever is lower.

You may also like- All-In Automatic Income Tax Preparation Software for Government and Non-Government Employees for Financial Year 2022-23

Section 80C Deductions

There is only one condition under section 80C for claiming deductions from the home loan - which the property must not be sold within 5 years of ownership.