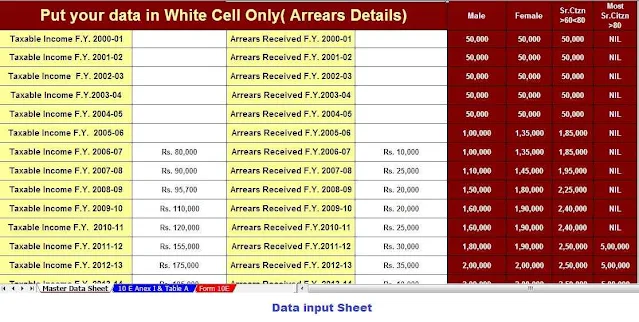

Arrears Salary Relief Calculator A.Y 2023-24 for claiming relief u/s 89(1) in Excel|A.Y 2023-24 (F.Y

2022-23) Calculator of arrears of pay for claiming deduction under section 89(1) of the Income Tax

Act 1961-Download

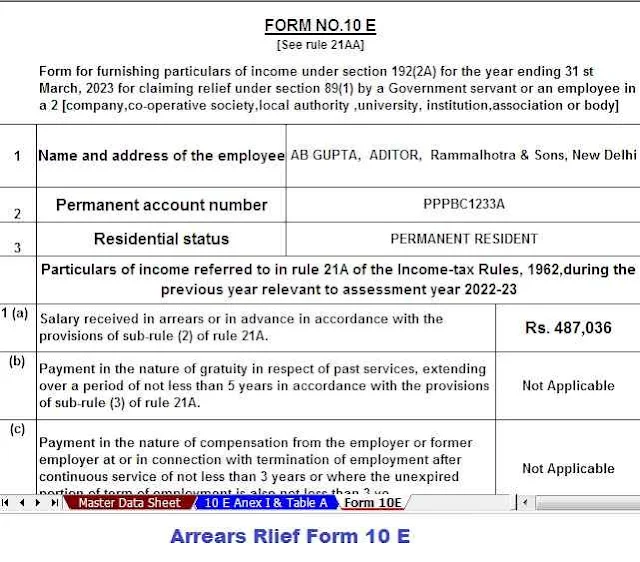

In accordance with Section 89(1) of the Income Tax Act, a reduction in income tax was granted in 1961 when an employee receives an overdue or prepaid salary during the financial year. UnderRule 21AA of the Income Tax Rules, 1962, Form 10-E is filed for claiming the deduction.

According to the Act, if the employee is a government employee or is an employee of a society, cooperative, local government, university, institution, or body association, to claim exemption, the employee can submit his Form 10E her his responsible employer of payment of compensation as provided in Article 192, first paragraph, of the Income Tax Act, 1961

In all other cases, the valuer requesting the exemption requests it on Form 10E from his tax advisor. Relief under Section 89, paragraph 1, is allowed in the assessment year in which the employee receives arrears or advances.

Especially in the public sector, pay revisions have become more common. Since independence, six pay committees have been formed by the government so far. The retroactive recommendations of the committee have all resulted in salary delays. The rationale behind granting this exemption under section 89 is that as a result of payment of arrears or advances received by him in a particular financial year, the income of the employee for that financial year increases due to the amount of arrears or advances . . . . As a result, the employee's income is taxed at a higher rate than the income would have been taxed if no such advances or expenses had been incurred.

The steps involved in calculating the Article 89(1) exemption are essentially as follows:

First, expand the amount of arrears or advances received to the specific relevant financial year and recalculate the income tax for each year if the arrears were incurred in the same relevant financial year.

Then calculate the income tax for each of the fiscal years irrespective of arrears or advances received.

Third - removal of total income tax arrived at the 2nd stage of stage-1.

Fourth, you calculate the income tax for the financial year incurred by the arrears, including arrears/advances.

Fifth: compute the income tax for the financial year in which the arrears were collected, less arrears/advances.

Income tax of the sixth deduction reached stage 5 of income tax reached stage-4

Sixth - deduction of income tax reached stage-3 of income tax reached stage-6

The amount so entered is the amount of the deduction under section 89 (1).