Deduction u/s 80TTA vs . 80TTB|Currently section 80TTA provides Rs 10,000/- deduction to all

individual/HUF taxpayers.

Section 80TTA of the Income Tax Act, 1961 states:

Deduction of interest on deposits and savings accounts.

80TTA.

(a) As per the Banking Regulation Act, 1949 (10 of 1949) a banking company covered by the Banking Regulation

Act, (including any bank or banking

organization referred to in section 51 of that Act);

(b) A cooperative society engaged

in banking (including a cooperative land mortgage bank or cooperative land

development bank); either

(c) A post office as defined in

clause (k) of section 2 of the Indian Postal Act, 1898 (6 of 1898),

The deduction shall be allowed, in accordance with and in accordance with the provisions of this section, upon the computation of the total income of the assessee as set forth below, viz.

(i) If the amount of such

expenditure does not exceed ten thousand rupees in the aggregate, the whole

amount; and

(ii) Rs.10, 000/- in any other case.

(2) Where an income referred to in

this section arises from a deposit in a savings account held by or on behalf of

a company, association, or group of persons, no deduction is allowed under this

section for such income when computing the total income of a corporate partner

or member of an association or person of a body.

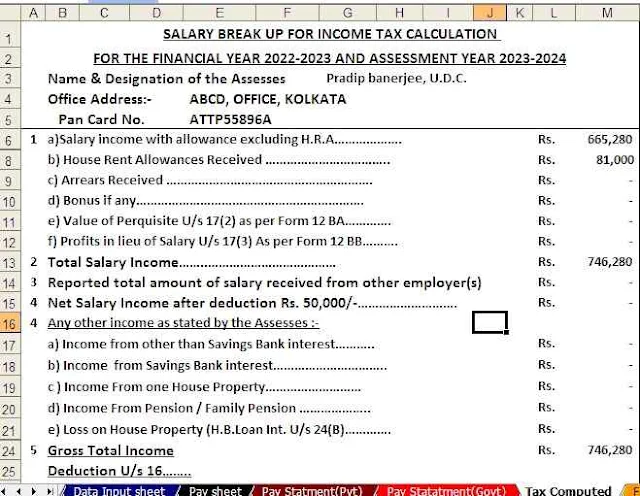

You may also like- Automated Income Tax Preparation Software All in One in Excel for the West Bengal Govt Employees for the F.Y.2022-23

Description. For purposes of this section, "long-term deposits" means deposits due at the expiration of specified periods.

It is now proposed to add a new

section 80TTB to the Income Tax Act 1961 which will fix the age deduction for

interest up to Rs. 50,000/- in cash.

The proposed 80TTB section reads as follows:

80TTB, (1) Where is the collector's

total income? Being old includes any income you earn in the form of interest on

deposits with:

(a) As per the Banking Regulation

Act, 1949 applies (including any bank or banking institution referred to in

section 51 of that Act);

(b) A cooperative society carrying

on the business of banking (including a cooperative land mortgage bank or

cooperative land development bank); either

(c) A post office as defined in

clause (k) of section 2 of the Indian Postal Act, 1898,

Shall, in accordance with and in

accordance with the provisions of this section. It is permissible, in computing

the total income of the assessee, to deduct—

(i) If the amount is not excessive. The total sum of fifty thousand rupees, the whole of such amount; and

(ii) In any other case, Rs.50,000/-.

(2) Where the income referred to in

subsection (1) comes from income held by or on behalf of a company,

association, or private association, no deduction shall be allowed under this

Article in respect of the income when calculating the total income of a

business partner or an association member or a person of a body.

Description. For the purposes of

this section, "older person" means a person resident in

The question arises whether Rs,

50,000/- deduction. It is even an interest allowance in FDR Bank which was not

available under Section 80TTA. Another question arises whether senior citizens

can claim deductions under Section 80TTA and 80TTB.

Let’s try to understand.

Section 80TTA provides for the

deduction of interest excluding interest on term deposits. FDR is a term

deposit. This means that there is no deduction of 80TTA in the bank’s FDR

interest.

However, there is no restriction in

u/s 80TTB. That is, Rs. 50,000/- for a senior citizen deduction is also

available on the Bank’s FDR interest.

Also, Finance Bill 2018 does not propose repealing 80TTA. It is available for senior citizens from F.Y 2018-19 as a deduction is suggested under section 80TTB. Seniors can claim an 80TTB deduction. Only when other persons / HUF taxpayers would be eligible for deduction u/s 80TTA.

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

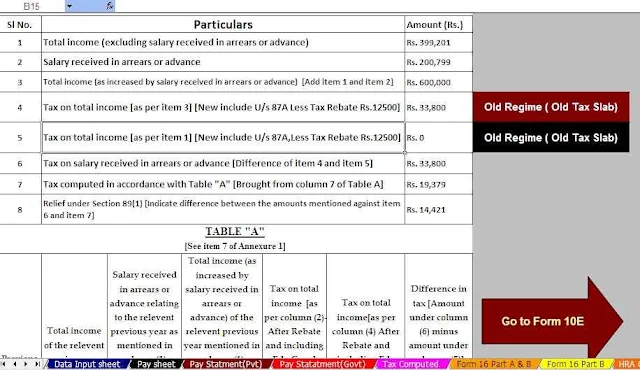

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23