Section 80DDB | Who can claim deductions under Section 80DDB?

Section 80DDB is Income Tax Rules 11DD. Under the Income Tax Act, of 1961, taxpayers can claim

deductions for certain specified benefits for themselves or their dependents.

This type of exemption is covered under Chapter VIA of the Income Tax Act, 1961.

Individuals and HUFs who are residents of

How many deductions can be claimed under section80DDB?

Deductions corresponding to the

following amounts can be claimed under section 80DDB:

For the financial year 2021-22 (the review year

2022-23)

• A person is eligible for a tax of

Rupees 40,000/-(Forty Thousand) or the amount actually paid, whichever is less.

• Senior citizens, above 60 years

of age, are eligible for a tax deduction of Rupees 60,000/-(Sixty Thousand) or

the amount actually paid, whichever is less.

From the fiscal year 2022-23 (the tax year 2023-24)

• A Person is eligible for a tax of

Rupees 40,000/-(Forty Thousand) or the actual medical expenses, whichever is

less.

• Senior citizens between 60 and 80

years of age can claim tax exemption of Rupees 60,000/-(Sixty Thousand) or the

actual amount spent on health care, whichever is less.

• Super seniors, above 80 years of age, are eligible for tax exemption of Rupees 80,000/-(Eighty Thousand) or the actual medical expenses, whichever is less.

From the financial

year 2018-19 (The assessment year 2019-20)

• A Person is eligible for a tax of

Rupees 40,000/-(Forty Thousand) or the amount actually paid, whichever is less.

• Senior citizens, above 60 years

of age, are eligible for a tax deduction of Rupees 100,000/-(One Lakh) or the

amount actually paid, whichever is less.

Diseases or medical conditions specified in section

80DDB

According to the Income Tax

Department, the following diseases or circumstances may require tax exemption

under Section 80DDB:

(1) Neurological disease, whose

disability level is 40% and greater -.

• Dementia

• Dystonia Musculorum Deforms

• Aphasia

• Motor neuron diseases

• Ataxia

• chorée

• Hemiballism

• Parkinson’s disease

(2) Malignant cancers

(3) Entirely acquired

immunodeficiency syndrome (AIDS).

(4) Chronic renal failure

(5) Hematologic disorders

Haemophilia

Thalassemia of the body

Papers are required for claiming deductions under

Section 80DDB

To claim deductions under section 80DDB of the Income Tax Act, 1961, the assessee has to furnish evidence that medical treatment has actually been provided. It is mandatory to obtain a certificate from the prescribed authority, who has benefited from the medical treatment if a person wants to claim a deduction under this section.

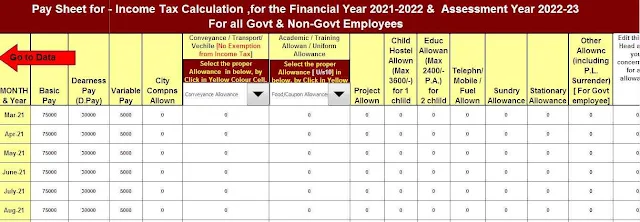

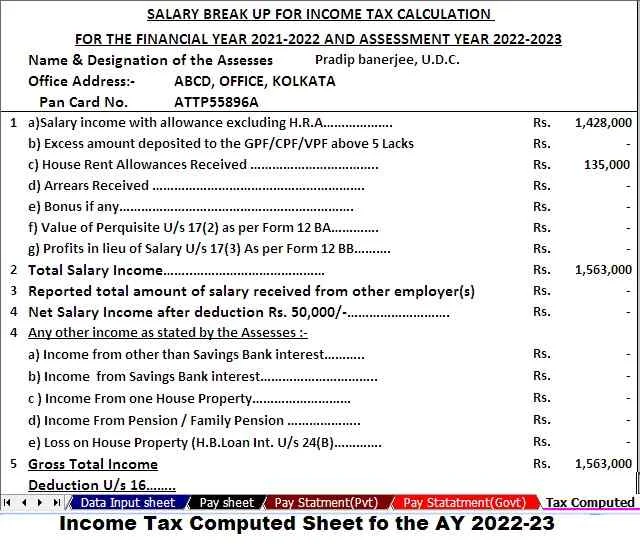

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

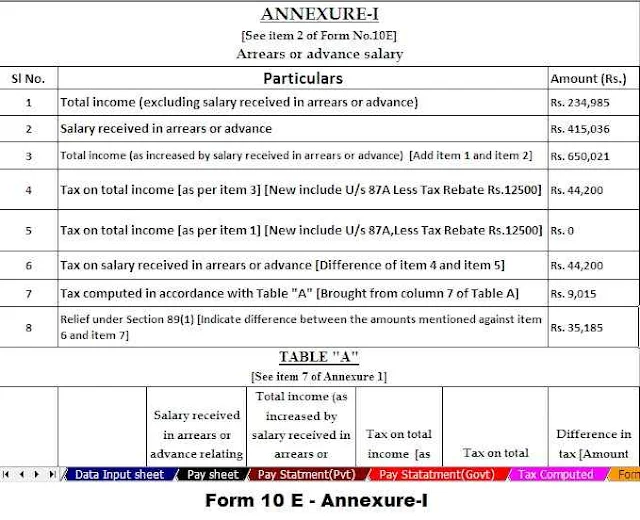

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

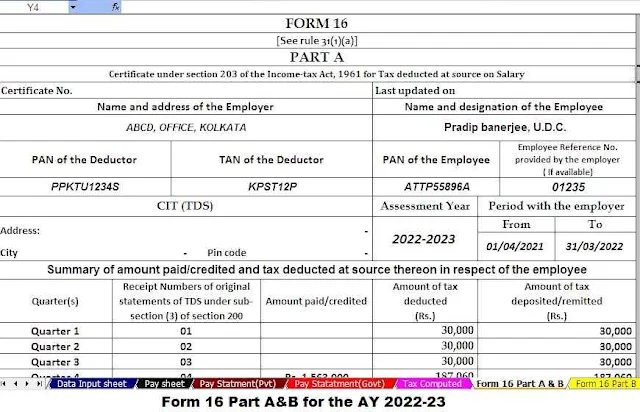

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2022-23