What is Form 16? For a salaried employee, Form 16 is the important document required to file an

Income Tax Return (ITR).

What is Form 16?

Form 16 is a certificate issued under Section 203 of the Income Tax Act, 1961 for withholding tax (TDS) on salary income received during the financial year.

The employer issues it for taxes withheld from the employee’s wages. The withheld tax is credited to the government in the PAN of the employee.

The TDS certificate provides a detailed account of the wages paid to the employee and the tax attached thereto. Also, if the employee opts for the old income tax regime and provides proof of investment, such information will appear in Form 16.

The employer is liable to issue a TDS return to the employee if tax is deducted from the salary.

How many sections are there in Form 16?

Form 16 consists of two parts: Part A and Part B. Both parts must be marked TRACES. This will ensure that both portions were collected from the income tax portal.

What does Part A of Form 16 contain?

Part A of Form 16 details the payroll tax withheld at source in each quarter of the financial year.

Form 16 Part A contains the following information:

Name and address of employer

Name and address of the manufacturer

Employer's PAN and TAN

PAN of the employee

The period in which the employer calculates the payroll tax

Summary of the amount paid or credited as wages and tax withheld (TDS) as reported to the employee

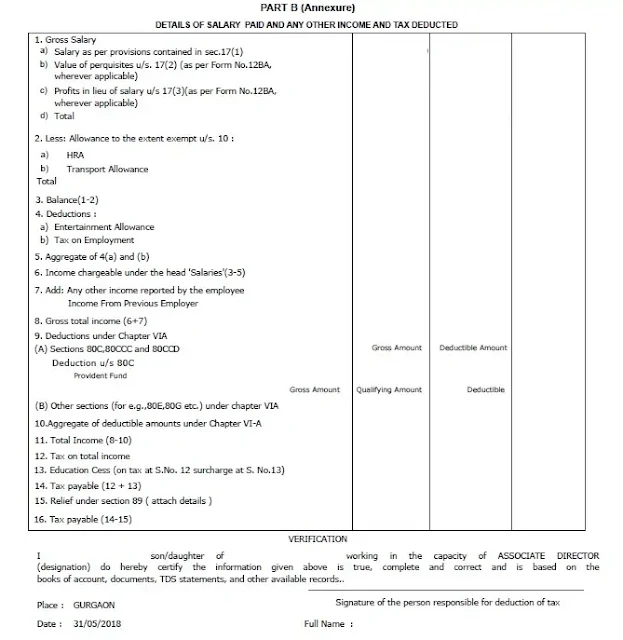

The TDS notice also states whether an employee opted for the old income tax regime or the new income tax regime. Part B of Form 16 contains:

A detailed breakdown of gross remuneration: a) Wages as defined in Article 17 (1), b) Value of benefits in Article 17 (2) and c) Interest in lieu of wages in Article 17 (3).

These costs are exempt from income tax under Act.

• All other deductions like standard deductions etc. consisting of salaried employees.

• Deductions allowed under Chapter VI-A of the Income-tax Act, such as Section 80C, 80D, etc.

• Lighting per Part 89, if

necessary