The 2023 Union Budget has proposed several changes to the withholding tax (TDS) tax rules that will

take effect beginning with the new fiscal year beginning April 1, 2023. In the "Budget Highlights"

Finance Act 2023", the Income Tax Department of the TDS rules proposed to be changed in 2023

budget.

1. TDS is suggested to win in online games without any fringe benefits. The tax will be deducted at the time of withdrawal or at the end of the tax year.

2. It is proposed to eliminate the tax exemption available on interest payments on listed bonds.

3. If a withdrawal recipient does not present their EPF PAN, the TDS upon withdrawal will be 20%, instead of the maximum marginal rate.

4. Sections 206AB and 206CCA have been amended to exclude from the scope certain individuals who are not required to file an income return and who are notified by the government.

5. For some income paid to non-residents or foreign companies, the tax payable will be withheld at the rate of 20% or the rate specified in a tax treaty, whichever is lower. This exemption will be available if the beneficiary presents a certificate of tax residence.

6. Section 155 has been amended to resolve the TDS mismatch issue. “When a taxpayer reports income using the accrual method, he can tax before withholding is deducted. It is noted that a TDS mismatch prevents the taxpayer from demanding the withholding credit. The amendment in Section 155 allows the taxpayer to submit to the appraiser within two years of the fiscal year in which the tax was withheld," says the Income Tax Department.

"The evaluation officer will then adjust the assessment to allow the taxpayer to claim the TDS credit. Section 244A is also amended to provide that interest on the refund arising from the prior correction shall be for the period from the date the request is made as of the date the refund is granted.”

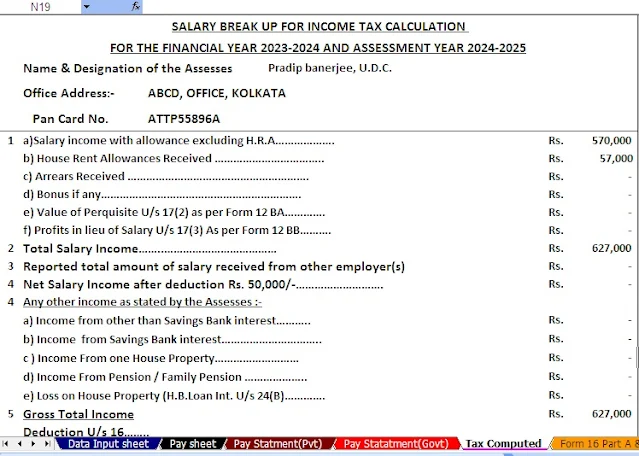

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

4) Auto

Calculate Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

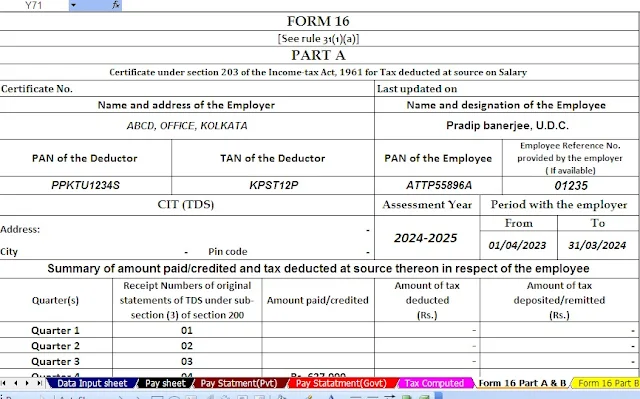

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24