How to save your income tax for the F.Y.2023-24 and A.Y.2023-24 as per Budget 2023. Provision of

Income Tax: In a few days a new budget will be presented. Apart from this, the fiscal year is about to

end. In such a situation, the employees should consider saving every rupee, so today we are telling you

the main formula for the alliance. As a result, you will not have to pay any tax even on an income of

INR 10,000 or INR 50,000.

You may also like; - Automatic Income Tax Form 16 Part A and B for the Financial Year 2022-23(This Excel Utility can prepare at a time 50 Employees Form 16 Part A and B)

Income Tax Savings: Even if your income is Rs 10 lakh, you do not need to pay a single tax of Rs.

Yes, if till now you have been paying income tax of Rs 10 lakh to the Department of Income Tax, now

be careful because today we will tell you about the rules of the Department of Income Tax, according

to which you can pay tax on the rent of Rs 10 lakh can be obtained for free. There are easy ways to

save on taxes. Many people avoid taxes in the wrong way, but today we will tell you how to save taxes

legally. If your yearly package is also Rs 10,000 and Rs 50,000 then you need not worry.

If your annual income is Rs 10,000 and Rs 50,000, you are on the 30 percent tax plate because those with annual incomes above Rs 10,000 must pay 30 percent income tax.

Taxes will not be collected from this formula.

If your annual income is Rs 10,000 and Rs 50,000, the government will give you a standard deduction,

under which you deduct Rs 50,000. Now your taxable income is still Rs 10 lakh.

You may also like; - Automatic Income Tax Form 16 Part B for the Financial Year 2022-23(This Excel Utility can prepare at a time 50 Employees Form 16 Part B)

So, you can use Section 80c of the Income Tax Code. In this, you can claim Rs 50,000. You can claim

PPF (PPF), LIC (LIC), Education Fee for Children, EPF (EPF), and Mutual Funds (ELSS). If there is a

mortgage loan in progress, you can also claim it. In this way, you will now have to pay tax on an

income of Rs 8 lakh 50 lacks.

If you don't want income tax of Rs 10,000 and Rs 50,000 then you have to invest in the National

Pension Scheme (NPS) under 80CCD(1B). Here you have to invest Fifty Thousand rupees. Now you

will have to pay tax only on an income of Rupees Eight lakh. Let's see how it can also be reduced.

You may also like; - Automatic Income Tax Form 16 Part A and B and Part B for the Financial Year 2022-23(This Excel Utility can prepare One by One Form 16 Part A&B and Part B )

Now you have to use Section 24B of the Income Tax Code. Under this, you can claim Rs. However,

you will only get this relief if you have spent that amount on your home loan interest payments. Now

you have to pay an income tax of Rs.6 lakh. Now let's see how this amount can be further reduced.

You are now using Section 80D of your tax return. You hereby purchase medical health insurance for

your family. Your premium can be claimed here. Apart from this, you can claim a health insurance

premium of Rs 50,000 for the elderly (parents). In this way, you can claim a total of Rs 75,000 on

behalf of health insurance premiums. After that, his taxable income has been reduced to just Rs 25,000.

Now if you don't want a tax on your income then you will have to donate Rs 25,000 to any foundation

or trust fund. You can claim this donation under Section 80G of the income tax. In this guide, your

taxable tax liability reduces to Rs 5 lakh.

After claiming all these things, you do not need to pay any tax because income from Rs 2 lakh to Rs 50

lakh to Rs 5 lakh is taxed at a rate of 5 %. In this way, a tax of Rs 12,500 has to be deposited, but the

government has given an exemption to deposit this amount. In this way, you do not need to pay any tax

even on an income of INR 10,000.

Download the Income Tax Preparation Excel Based Software All in one for the Government and Non-Government Employees for the Financial Year 2023-24 and Assessment Year 2024-25 as per Budget 2023

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC

(New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as a New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government

Employees' Salary Structure.

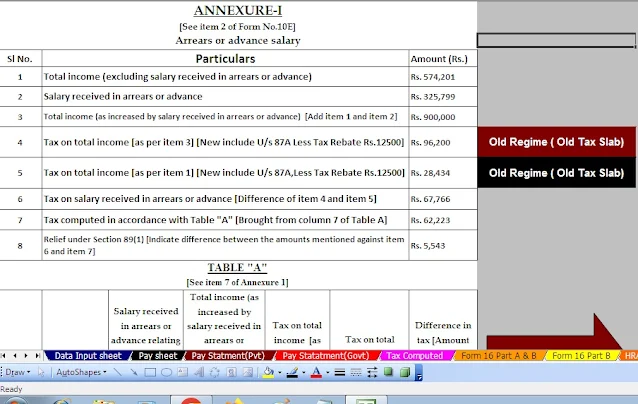

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-

01 to F.Y.2023-24 (Update Version)

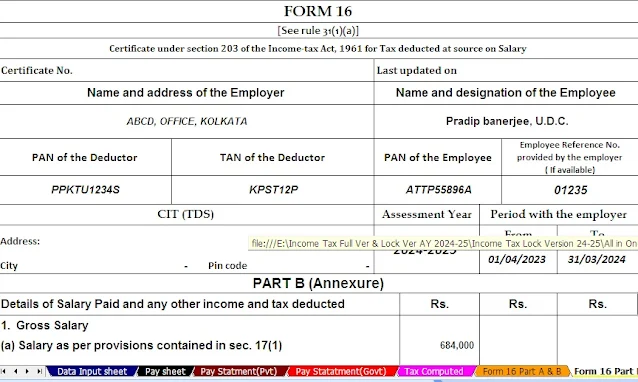

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2023-24