The Income Tax Act of 1961 offers a number of home loan tax deductions and encourages

residents to invest in real estate. Home loan borrowers should be aware of all available home loan

tax deductions because doing so can allow you to significantly reduce your tax liability.

These are

the tax benefits or income tax deductions on home loans that every home loan

borrower should be aware of.

Discount

when paying the principal of the home loan

The EMI you

pay consists of two parts: the principal repayment and the interest paid. The

principal component of EMI is deductible under Section 80C of the Income Tax

Act of 1961 for self-occupied property. Section 80C deductions can also be

claimed for stamp duty and filing fees paid when you purchased a home.

You may also like:- Automated Income TaxForm 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24(This Excel Utility can

prepare at a time 50 Employees Form 16 Part B)

Discount on interest paid on a mortgage loan

The taxpayer

can deduct both the interest paid on a mortgage loan and the principal amount

paid on the loan. For the case of a self-occupied property, section 24(b)

allows the deduction of interest paid on the mortgage loan up to a maximum of

Rs 2 lakhs in any given financial year.

If you own

two houses and one of them is vacant or occupied by your parents, Section 24

also covers interest on any loans to buy another house. The total tax deduction

for home loans for two houses cannot exceed Rs. 2 lakhs in the fiscal year.

Additional

discount on the purchase of an affordable home

An

additional discount on the interest paid on the mortgage loan used to purchase

the home is available if you purchase it in the affordable housing category. Rs

1.5 lakh may deduct under section 80EEA in the financial year. A maximum of Rs

2 lakh plus deduction is allowed under section 24. Thus, a taxpayer can claim

up to Rs 3.5 lakh deduction in a tax year in case of buying a reasonable house.

Please note

that you cannot claim the same amount twice in two different tranches like as

claim U/s 24 B and 80EEA

You may also like:- Automated Income Tax

Form 16 Part A&B for the Financial Year 2022-23 and Assessment Year 2023-24(This Excel Utility can

prepare at a time 50 Employees Form 16 Part A&B)

Deduction

under Section 80EE

For the

1st-time home purchases taking out mortgage loans, this deduction was reinstated

in the 2016-17 tax year. Taxpayers who got a home loan in the 2016-2017 tax

year he is eligible to claim an extra tax deduction U/s 80EE of up to Rupees

Fifty Thousand. Recently, under section 24(B), a home loan borrower who paid

interest on the loan can deduct that interest from his total annual income up

to a maximum of Rs 2 lakh.

To be

eligible for this discount, you must meet the following requirements:

a) Only

residential properties will be eligible for the increased loan interest

deduction.

It is only

available to first-time homebuyers.

c) The

annual maximum fringe benefit is limited to Rs. 50,000.

d) The value

of the house cannot exceed Rs. 50 lakh when applying for a loan.

e) The loan

cannot be for more than Rs 35,000.

f) The home

loan may be sanctioned between April 1, 2016, and March 31, 2017.

You may also like:- Automated Income TaxForm 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24(This Excel Utility can

prepare at a time 100 Employees Form 16 Part B)

If you

already obtained a home loan in the 2016-2017 tax year, you can still claim

this discount until the loan is paid off in full. This tax benefit is not

available for new home loans obtained after April 1, 2017.

How do I claim tax benefits under Section 80EEA?

To qualify

for benefits under Section 80EEA, a person must meet a number of requirements.

These requirements are the following:

a) The home

loan entitled from 1st April 2019, and 31 March 2022;

b) Stamp

duty on house property cannot exceed Rs. 45 deficiencies;

c) a

taxpayer may not own any residential property as of the date the loan is

sanctioned, and d) an individual taxpayer may not be eligible for a deduction

under current Section 80EE of the Act.

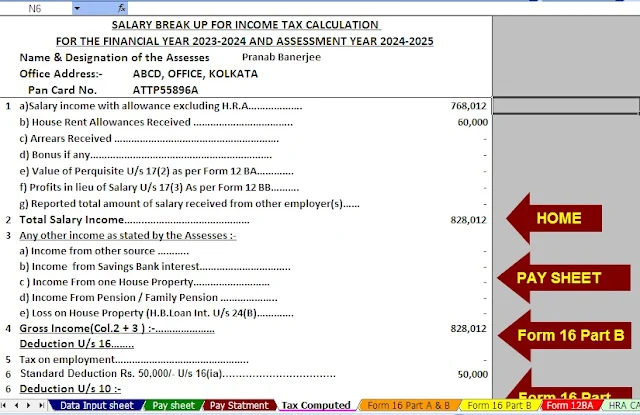

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This Excel

Utility has an option where you can choose your option as a New or Old Tax Regime

3) This

Excel Utility has a unique Salary Structure for Non-Government Employees Salary Structure.

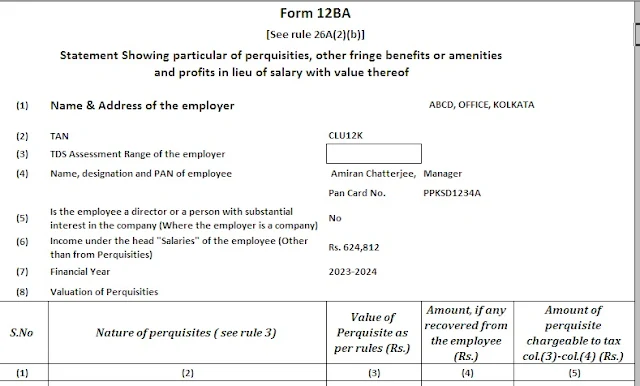

4) Automated

Income Tax Form 12 BA

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24