New tax regime: Update! Income tax provided excellent information on the TDS of employees. Note

that the new tax section is the default, so if you don't want to choose the new tax section and want to

keep the old one, you can choose the old tax section. Let's find out all about it.

What new or old tax regime do you want to choose for taxation, now your company will ask you this

question. In this regard, the Income Tax Department has recently issued a notification.

The Income Tax Department says that now a company cannot deduct TDS without consulting the

employee. To do this, you must obtain the permission of the employee. The TDS will be deducted

according to the employee's choice of tax regime. And based on that you will be paid.

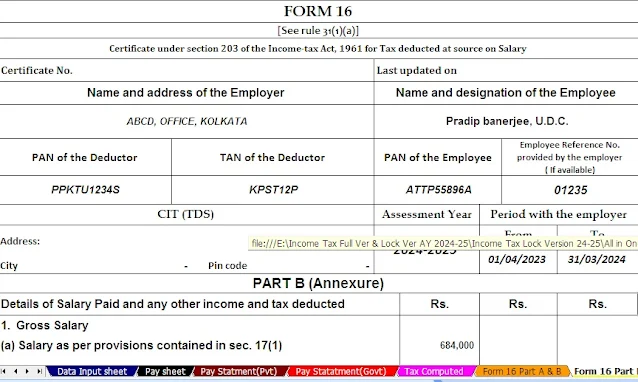

You may also like- Automatic Income Tax Form 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24 [This Excel Utility Can Prepare at a Time 50 Employees Form 16 Part B]

Note that the new tax section is the default, so if you don't want to choose the new tax section and want

to keep the old one, you can choose the old tax section.

If no regime is selected, then

However, if the employee does not want to opt for any regime, then according to the new tax regime

launched in the 2023-24 corporate budget, the employee's TDS will be waived. However, wage earners

have many options for higher deductions and tax breaks. They can get a TDS exemption under any tax

slab. For this reason, the company cannot deduct the TDS of any employee without consulting it.

The tax slab and the tax rate of the new tax regime

0% tax on profit of Rs 0-3 lakh

5% tax on Rs 3-6 lakh

10% tax on Rs 6-9 lakh per year

15% tax on profit of Rs 9-12 lakh

20% tax on annual profit of 12-15 lakhs

30% tax on income of Rs 15 lakh or more

Tax Slab and Tax Rate of the Old Tax Regime

No tax will be paid on profits up to 2.5 lakhs

5% income tax from 2.5 sin to 5 lakh

20% tax on income between Rs 5 lakh and Rs 10 lakh

The tax of 30% on the annual income of 10 missings or more

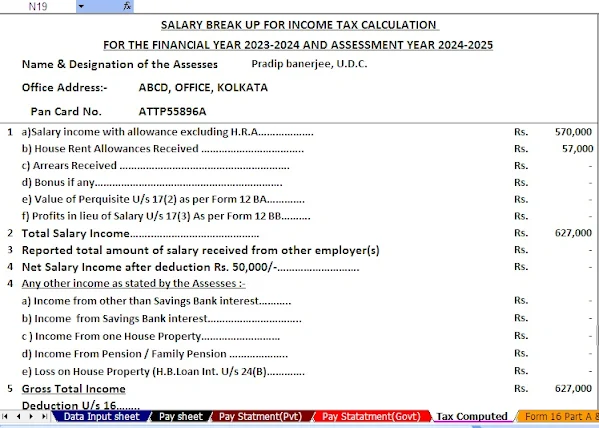

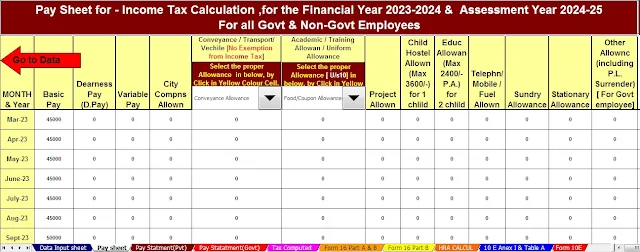

Download Auto Calculate Income Tax Preparation Excel-Based Software All in One for the Government and Non-Government Employees for the Financial Year 2023-24 and Assessment Year 2024-25