Old vs. New Income Tax Slab – Everyone's eyes are on the tax slab and the budget. Currently, there are

two income tax slabs in the country. There are different provisions in both cases. If a person's salary is

50 thousand, then how much tax will be deducted from the new or old tax slab? Let us tell you this.

Therefore,

Budget 2023: The general budget will be presented on February 1. The fiscal year 202-23 is about to

end. This time, people are hoping that the income tax exemption offer will come out of Finance

Minister Nirmala Sitharaman's box.

In other words,

Everyone's eye remains on the tax slab and the budget. Currently, there are two income tax slabs in the

country. There are different provisions in both cases. If a person's salary is 50 thousand, then how

much tax will be deducted from the new or old tax slab? Let us tell you this.

However,

Two tax slabs

Speaking of changing tax sheets, in past budget sessions people have been disappointed. Currently,

there are two tax systems in the country. The first system is called the Old Tax Slab. To provide relief

to taxpayers, in 2020, the government introduced a new tax slab to make filing ITR easier. To this end,

they also began to develop a new system. However, despite bringing in a new slab, the government

retained the old tax slab.

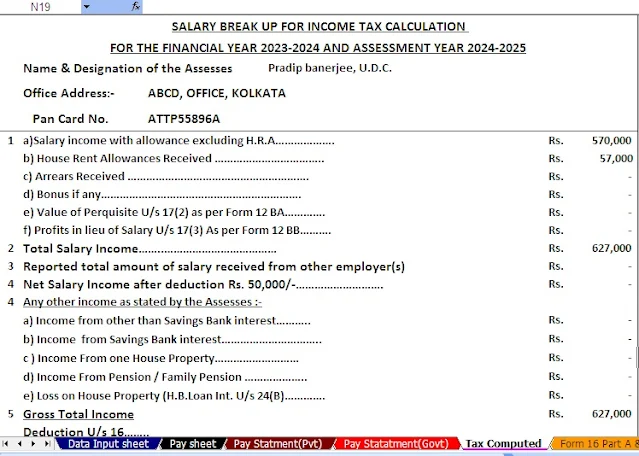

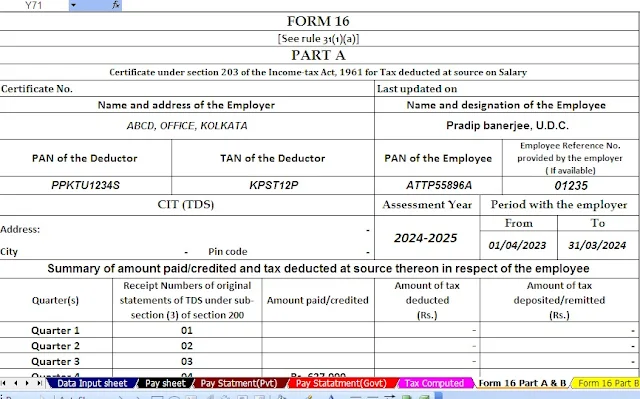

How much tax of the old system on 50 thousand salaries?

For instance, If the monthly salary is Rs 50 lakhs and there is no other source of income, the annual

income will be Rs 6 lakhs. If you opt for the above system, a deduction of up to Rs 1.5 lakh is available

under Section 80C of the Income Tax (IT Act 80C). Employed persons also get the benefit of the

standard deduction of Rs 50,000.

Under the old system, there is no income tax up to 2.5 lakhs. A 5% tax is required on income between

Rs 2.5 lakh and Rs 5 lakh. But after the discount of Rs 12,500, it becomes zero. That is, according to

this slab, no tax will be due on income up to Rs 5 lakh.

5,00,000(Income) – 5,00,000(Net Tax Deduction)= 0 Tax

How will the tax be saved on an income of Rs 6 lakhs in the new tax system?

Under the new tax system, income up to Rs 2.50 lakh is tax-free, but after that, Rs 2.5 lakh will be

taxed at 5%, which is equivalent to Rs 12,500. A tax of Rs 24,400 is applied to wages up to Rs 6 lakhs

. If the income is more than Rs 5 lakh and Rs 1 lakh, then that amount of Rs 1 lakh will fall under the

10% bracket. In this case, a tax of Rs 10,000 will be applied. Likewise, a rate of 4% will be applied to

the liquidated tax. If the tax is Rs 12,500 then the tax will be Rs 900.

How will the income from 6 shortfalls be tax-free?

Below 80C, cashback up to Rs 1.5 lakh is available. For this, you can invest in NSC, ELSS, PPF, and

EPF. Apart from this, if you contribute Rs 50,000 to the National Pension System (NPS), you will get

an additional deduction of Rs 50,000 in 80CCD (1B). Home loan borrowers can save Rs 2 lakh

separately.

• Income 6,00,000-1,50,000 (PPF, EPF) = 4,50,000

• 4,50,000-50,000 rupees (NPS) = 4,00,000 rupees

• 4,00,000-2,00,000 (mortgage loan) = 2,00,000 (tax free) .