You cannot claim tax reduction for these below-given deductions under the new regime for the financial

the year 2023-24| New tax regime vs. old tax regime: two people on the same salary may have different

amounts of deductions, and therefore their tax regime may be different

Choosing the right tax regime at the beginning of the financial year is crucial in considering tax planning for self-employed taxpayers. An IT circular issued earlier this month said companies should consult employees about their preferred tax regime for the current financial year.

Since employers have to withhold TDS from paying wages, and if employees do not disclose their preferred tax regime, this can lead to higher TDS on wage income, which will affect their take-home pay.

You may also like- Download and Prepare at a time 50 Employees Form 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24

The choice between the new and the old tax regime depends essentially on the individual's pay scale and investment and other decisions that may be subject to an exemption. He added that two people on the same salary may have different amounts of deductions, and therefore their choice of tax regime may be different.

However, he says the main factors to consider before choosing a new or old tax regime focus on qualifying deductions.

If you opt for the new tax regime, you are not entitled to the following 7 key deductions:

1. Section 80C Investment in PPF, NSC, ULIP, LIC, Old Age Scheme, etc., and payment of tuition fees, registration fee on the purchase of a new house, etc., and depreciation of home loan, the total deductible amount is Rs 1, 5 lacks.

You may also like- Download and Prepare at a time 100 Employees Form 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24

2. Section 80D Payment of Health Insurance Premiums: A person can claim a deduction of up to Rs.25,000 for insurance of self, spouse, and dependent children. A further deduction of Rs 25,000 is allowed for parents under 60 years of age. Also, you can claim up to Rs. 75,000 for you and your parents above 60 years of age.

3. Section 80E Interest on student loans: A person may demand payments for interest on student loans. For higher education loans, a deduction on the interest on the loan is allowed with no upper limit on the deduction.

4. Section 80TTA and 80TTB Interest from Savings Bank Account and Fixed Deposits: Under Section 80TTA, a person can claim a maximum deduction of Rs.10,000 for savings account interest with any bank, post, or cooperative society. Under Section 80TTB, seniors can claim a maximum deduction of Rs 50,000 for savings account interest with any bank, post office or cooperative society and interest on fixed deposits.

You may also like- Download and Prepare

at a time 50 Employees Form 16 Part A&B for the Financial Year 2022-23 and

Assessment Year 2023-24

5. Section 10(5) LTA: The amount deducted under Article 10(5) in respect of the amount of travel expenses or assistance received by a person or from his employer or former employer for himself and his family.

6. Section 10(13A) HRA: An employer may provide a high rent allowance (HRA) to its employees to help them meet their rent. Such gain is taxable for the employee. However, Section 10(13A) of the Income Tax Act provides for the deduction of HRA within specific parameters.

7. Section 24b owner-occupied property interest: Subject to Article 24b, interest paid on the owner-occupied property is deductible from gross income. The landlord alone is allowed to deduct the interest paid up to the total amount of Rs 2 lakh.

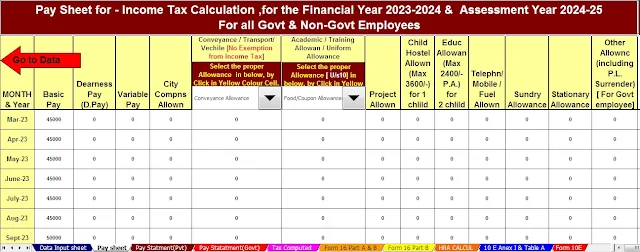

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

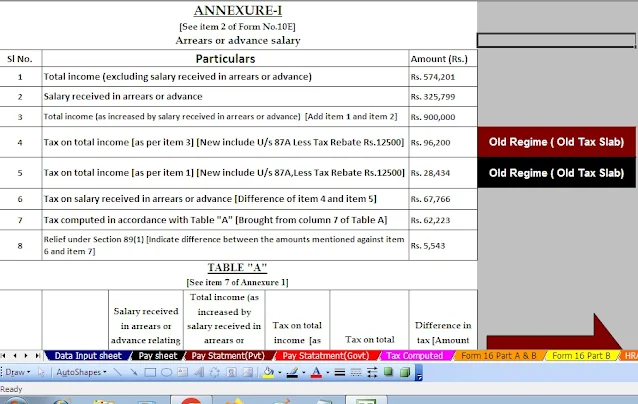

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

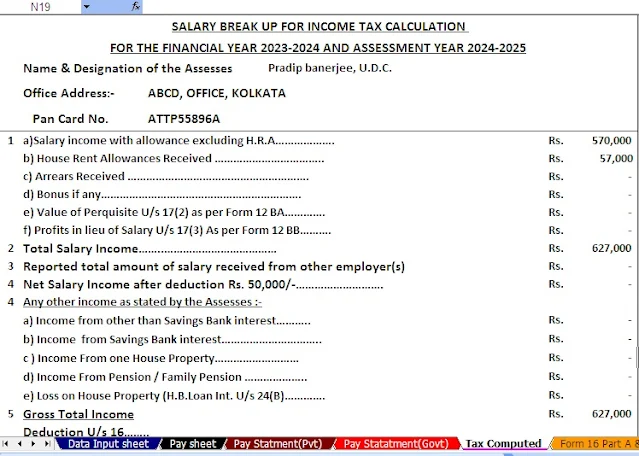

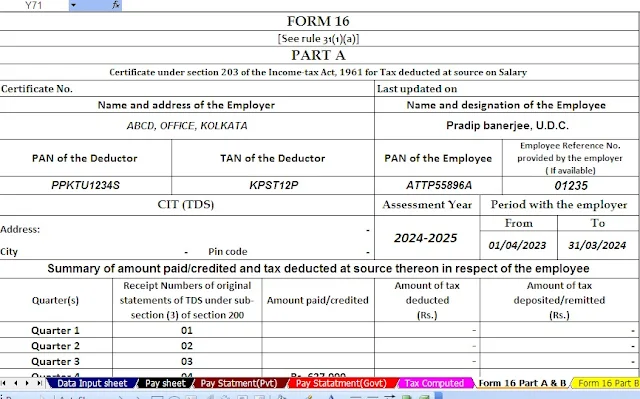

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24