Deductions in the new tax regime as per Union Budget 2023-24 | The Union Budget 2023 scrapped

around 70 deductions in the new tax regime for individual taxpayers. Exclusions include deductions up

to Rs 1.5 lakh under Section 80 C and benefits on health insurance premiums U/ Section 80D.

However, some deductions are only available to taxpayers under the new tax regime. This article will

help you understand some of the exemptions and deductions that are valid under the new tax regime.

What is the new tax regime for the financial year 2023-24 (A.Y 2024-25)?

The Union Government has introduced a new tax Scheme under Section 115BAC in the 2020 Budget with preferential tax slab rates.

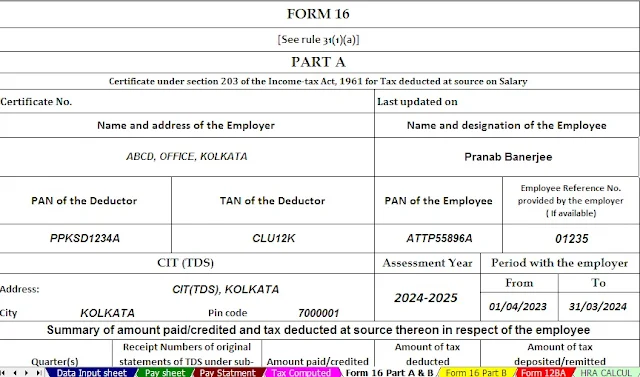

You may also like- Download

and Prepare One by One Form 16 Part

A&B and Part B for the Financial Year

2022-23 and Assessment Year 2023-24

As per the Budget 2023, the government has forecast the following key changes for the financial year (F.Y) 2023-24:

Rationalization of Income Tax Slabs

|

Income Tax Slabs |

Tax Rates (in % p.a.) |

|

Up to Rs. 3 lakhs |

NIL |

|

Rs. 3 lakhs- Rs. 6 lakhs |

5% |

|

Rs. 6 lakhs- Rs. 9 lakhs |

10% |

|

Rs. 9 lakhs- Rs. 12 lakhs |

15% |

|

Rs. 12 lakhs- Rs. 15 lakhs |

20% |

|

Rs. 15 lakhs & Above |

30% |

|

Education Cess |

4% p.a. of Taxable Income |

Increased tax refund limits

Full tax refund on income up to Rs. 7 lakhs is provided under the new tax regime U/Section 87A of the Income Tax Act 1961.

|

Tax Rebate Limit Under Old Tax Regime for F.Y 2023-24 |

Tax Rebate Limit in New Tax Regime for F.Y 2023-24 |

|

Rs. 5 lakhs |

Rs. 7 lakhs |

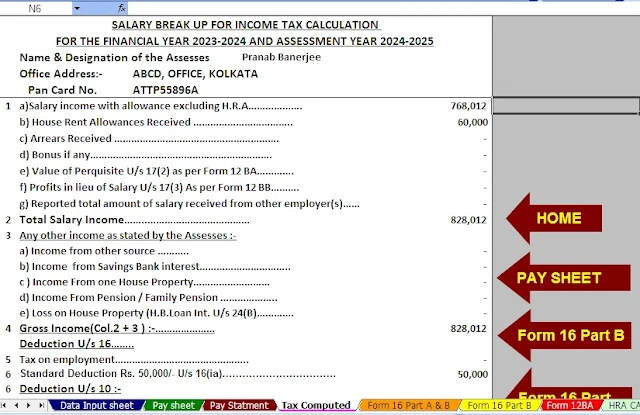

You do not have to pay tax if you claim the standard deduction of Rs. 50,000 with a capital limit of Rs. 7.5 lakhs.

You may also like- Download

and Prepare One by One Form 16 Part B

for the Financial Year 2022-23 and Assessment Year

2023-24

Increase in Basic Tax Exemption Limit

The lower tax exemption limit of Rs. 2.5 lakhs as per the old tax regime increased to Rupees Three lakhs under the new tax regime.

|

Age Categories |

Basic Tax Exemption Limit u/ Old Tax Regime for F.Y 2023-24 |

Basic Tax Exemption Limit u/ New Tax Regime for F.Y 2023-24 |

|

< 60 Years of Age |

Rs. 2.5 lakhs |

Rs. 3 lakhs |

|

60-80 Years of Age |

Rs. 3 lakhs |

|

|

> Years of Age |

Rs. 5 lakhs |

Standard Tax Deductions

Salaried persons are eligible to claim the benefit of standard deductions of Rs. 50,000 under the new tax regime.

Family pensioners can claim standard deductions of Rs. 15,000 under the new tax regime.

You may also like- Download

and Prepare at a time 50 Employee’s

Form 16 Part B for the Financial Year 2022-23

and Assessment Year 2023-24

Comparison of Deductions under the Old vs. New Regime. New regime for F.Y 2023-24

The following table shows a comparative analysis of the deductions available under the old and new tax regimes:

|

Available Exemptions/ Deductions |

Old Tax Regime |

New Tax Regime |

|

Standard Deductions of Rs. 50,000 |

YES |

YES |

|

Employment/ Professional Tax u/ Sec 10(5) |

YES |

NO |

|

House Rent Allowance (HRA) u/ Sec 10(13A) |

YES |

NO |

|

Exemptions for Free Food & Beverages through Vouchers/ Food Coupons |

YES |

NO |

|

Deductions of Up to Rs. 1.5 lakhs U/ Chapter VIA towards investments like U/ Sec 80C, 80CCC, 80CCD, 80DD, 80DDB, 80E, 80EE, 80EEA, 80G, etc. |

YES |

NO |

|

Deductions U/ Sec 80CCD(2) for Employer’s Contribution to Employee NPS Accounts |

YES |

YES |

|

Deductions U/Sec 80CCD(1B) of Up to Rs. 50,000 |

YES |

NO |

|

Medical Insurance Premium U/Sec 80D |

YES |

NO |

|

Interest on Home Loan for Self-Occupied/ Vacant Property |

YES |

NO |

People who earn Rs. 50 lakhs and above falls in the higher income category. The Government of India imposes a surcharge on high earners.

|

Income Slabs |

Surcharge Rates in Old Tax Regime |

Surcharge Rates in New Tax Regime (in % p.a.) |

|

Rs. 50 lakhs |

NIL |

NIL |

|

Rs. 50 lakhs- Rs. 1 crores |

10% |

10% |

|

Rs. 1 crores- Rs. 2 crores |

15% |

15% |

|

Rs. 2 crores- Rs. 5 crores |

25% |

25% |

|

Rs. 5 crores & above |

37% |

25% |

You may also like- Download

and Prepare at a time 50 Employee’s

Form 16 Part A&B for the Financial Year

2022-23 and Assessment Year 2023-24

The new tax regime is the default option for an income tax deduction by the employer and the Income Tax Department.

Definition of deductions and exemptions in the new tax Regime

Let’s understand the keywords from the list mentioned below:

Deductions in the New Tax Regime

It refers to expenses or investments made by the taxpayer that can be deducted from their gross income to arrive at gross income.

Deductions can help reduce personal or business taxes

Exemptions in the New Tax Regime

It refers to income or investments made by the taxpayer that are not included in the calculation of their taxable income.

There are no exemptions and deductions under the new tax Regime

In the following table, let us identify the main exemptions and deductions under the new tax regime that are not payable to individuals:

Not-claimable Tax Deductions and exemptions under the new tax Regime

Under Section 80TTA and Section 80TTB as Savings Bank Interest

Deductions u/ Section 80C, 80D, 80E, 80CCC, 80CCD, 80DD, 80DDB, 80EE, 80EEA, 80G, and so on. of Chapter VI-A of the IT Act

Professional lawyer

Entertainment allowance and wages

Housing Rent Assistance (HRA).

Travel Authorization (LTA).

The role of the assistant

Early Childhood Education Assistance

Income allowance for a minor

Interest on Home Loan Personal Property/Vacant

Other special duty U/ Section 10(14).

Employee contributions to the NPS account

Donations to Political Parties/Trusts

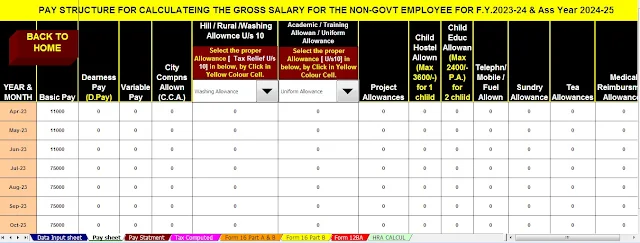

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has all amended Income Tax Sections as per Budget 2023

3)

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Updated Version)

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Govt and Private Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10)

Automatic Convert the amount into the in-words without any Excel Formula