What is Form 16? Form 16 Parts, Types, Eligibility, and Benefits | Form 16 is a type of document

issued by an employer to its salaried employees when they file their income tax return for a particular

financial year. Form 16 Part B must be filled by the deductor U/s 203 of the Income-tax Act, 1961 if

the tax is deducted at source.

Every employer or organization is responsible for deducting TDS before the salary if the salary is not taxable as per the income tax rates for that tax year.

You may also like- Download and Prepare

at a time 50 Employees Form 16 Part A&B for the Financial Year 2022-23 and

Assessment Year 2023-24 in Excel

Income Tax Form 16 is also known as 'salary certificate' as it contains all the financial details of the employee including annual salary and investment details with PAN number.

In short, Form 16 is proof that tax has been paid and submitted by the employer to the government on behalf of its employees.

Parts of Form 16

Now let us understand what is Form 16 as it is one of the most important income tax forms for salaried people. 16, the income tax form is divided into 2 parts.

Part A

Part B

Here we will explain not only what these parts are but also how to fill out Form 16.

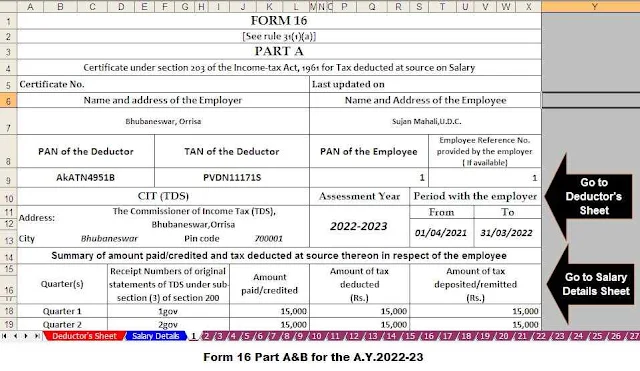

Form 16 - Part A

You may also like- Download and Prepare

at a time 100 Employees Form 16 Part A&B for the Financial Year 2022-23 and

Assessment Year 2023-24 in Excel

Form Part 16

Part A asks you to answer the following details correctly. This section contains all the details of your salary income and tax withholding.

Name and address of employer and employee

TAN details of the deductor or employer

PAN details of the employee’s

Employee PAN

Employee Reference Number (if applicable)

Quarterly data, withheld and deposited by the employer

assessment year

The length of time a given employee has been with the employer

Billing and transfer time

TDS Payment Confirmation Number

You may also like- Download and Prepare at a time 50 Employees Form 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24 in Excel

Form 16

- Part B

In Part B:

1. Total wages earned by the employee up to this period

2. Chapter 10 benefits, if any, such as rent, tuition, medical bills, etc.

3. Gross income (wages and other employer income)

4. Deductions from salary before tax paid (life insurance, PPF, etc.)

5. Net taxable salary

6. Education Fees and Additional Fees

7. Exemption and relief under sections 87 and 89, if any

8. Tax payable on income

9. Withholding tax

You may also like- Download and Prepare at a time 100 Employees Form 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24 in Excel

What are the benefits of Form 16?

16 Income tax forms are useful for several reasons:

Form 16 is your employer's proof of taxes paid to the IRS and certified by your employer for a certain period of time.

This is an important and necessary document while filing income tax as it contains all the TDS details.

Form 16 is very important for getting loans from banks and other financial institutions

Can be used as proof of visa issuance

It also represents a steady and continuous source of income.

Only Form 16 can disclose a person's salary, tax calculations, and returns.