Download and Prepare 16 Forms Part B or Part A, Part A and Part B or Part B for Financial Year 2022-

23 for 50 employees or 100 employees at a time | In the financial year 2022-23, the CBDT (Board of

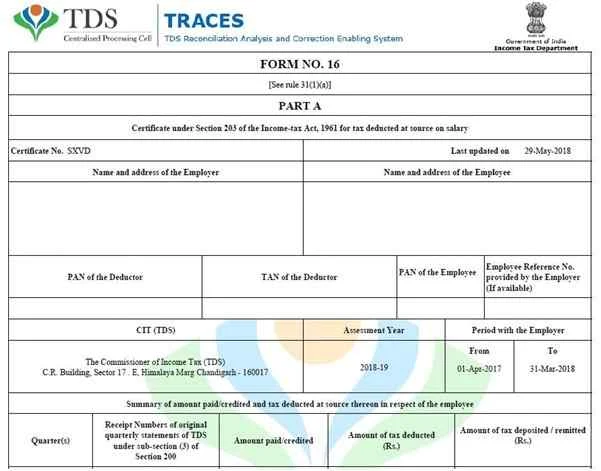

Direct Taxes) has made an amendment in the rule 16 form "Payment of TDS authentication". A

separately paid department to a representative terminates the tax advantage of the district department

declared by the taxpayer.

Payment TDS time is displayed and processed instantly. The CBDT has announced that the reform of 16 modules will have a long-term effect from April 2023.

Is the main proposal included in the new statement organization?

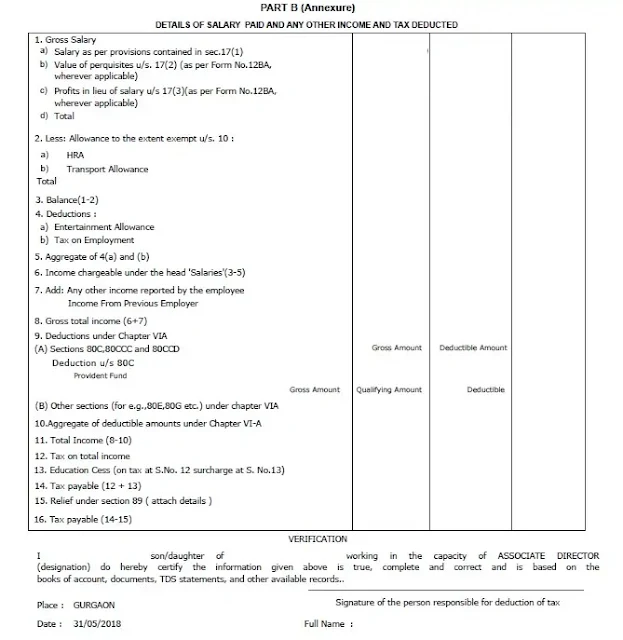

The new Form 16 regime provides full settlement details such as house rent allowance under section 10(13A), traveling allowance, or assistance under section 10(5).

It is reported that the new tax plan for 2020 introduced Section 115 BAC, and this section introduced the annual tax assessment system based on the new and old tax regimes. At this point, it is important to know what is the new and old tax regime.

1) Under the new tax regime, you are not entitled to any annual industrial tax deductions other than NPR deductions. Besides, there was a profit in the new tax regime just before the new tax regime.

2) Under the old tax system, you enjoy all the benefits of the tax component, but from the tax year 2019-2020, the tax component will be the old tax component. In this spending plan, it is clear that you have to make a choice based on your decision, i.e. Structure 1 supports both the new and old tax regimes. 10-IE.

Download the Auto

Calculate and Automatic Income Tax Salary Certificate Form 16 Part B or Form 16

Part A&B for the F.Y. 2022-23

Or

Or

Or

Or

Or